- Ethereum reserves on Binance fell by 300K ETH, decreasing centralized promote strain and boosting bullish sentiment.

- 81% of holders sit in revenue, with key pockets clusters close to $2,665, rising the chances of profit-taking or breakout.

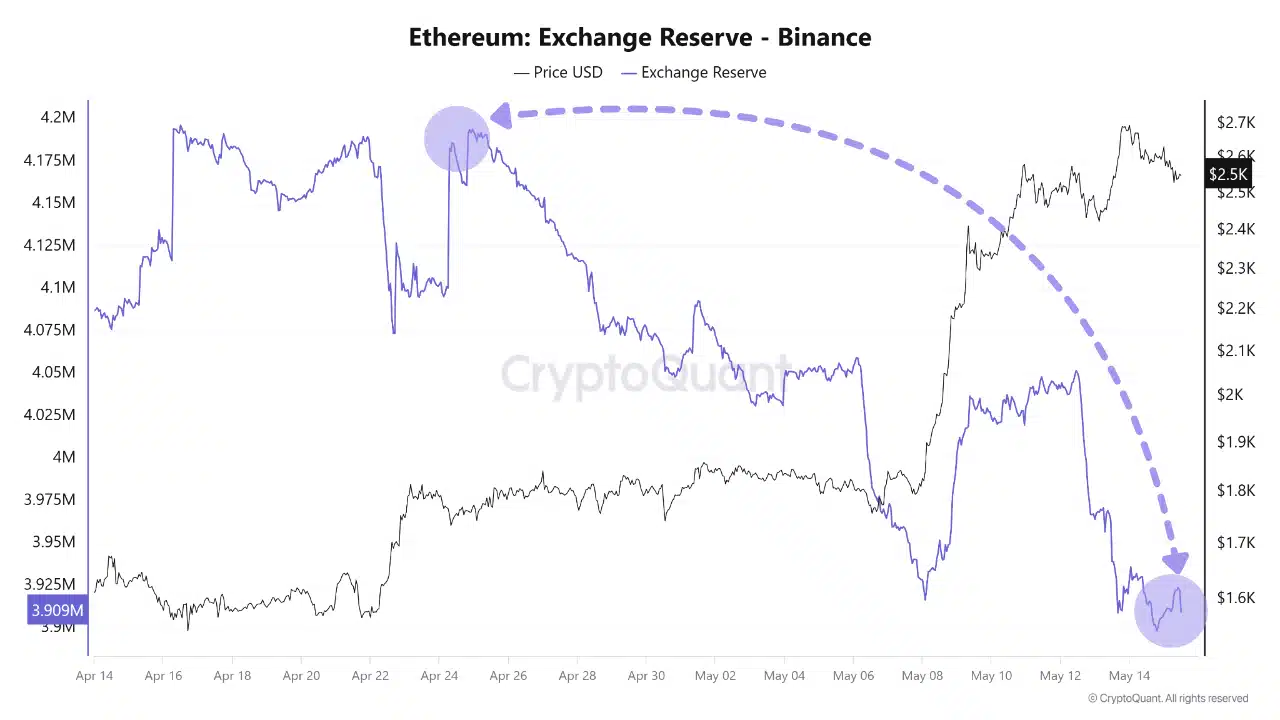

Ethereum [ETH] reserves on Binance have dropped sharply, falling from 4.1 million ETH to three.9 million ETH since mid-April.

This 300,000 ETH reduction alerts elevated investor confidence in long-term holding and decentralized protocols.

Because of this, centralized sell-side strain continues weakening. At press time, ETH modified arms at $2,605.85, up 2.77% in 24 hours.

With fewer cash accessible for instant sale, bulls might achieve management. After all, this provide dynamic may tilt the scales in favor of bulls, particularly if withdrawals persist.

ETH’s complete Trade Reserves stood at $18.9 million, marking a 0.78% every day dip. Although the drop seems minimal, it highlights a cautious stance amongst buyers.

Many desire holding ETH off centralized platforms. This aligns with broader accumulation tendencies seen throughout main wallets. Due to this fact, the lower in reserve worth suggests decreased promoting urge for food.

Can ETH clear $2,665 amid rising liquidations?

The Liquidation Heatmap revealed thick liquidation zones between $2,600 and $2,665, forming a robust resistance cluster. This space may spark volatility as leveraged positions get examined.

Nevertheless, Ethereum’s regular advance towards these zones exhibits rising purchaser confidence. If ETH breaks above $2,665, cascading brief liquidations may increase the rally additional.

Even so, merchants ought to watch intently—value might stall or briefly consolidate earlier than persevering with its climb.

Ethereum fuel utilization dropped to 14.09 billion, marking a big decline from earlier highs. This discount might replicate improved payment effectivity or a brief dip in high-volume exercise.

Having stated that, it doesn’t suggest weakening fundamentals.

Decrease fuel prices usually allow extra inexpensive person participation throughout DeFi and NFT platforms. Due to this fact, this drop might help broader community engagement relatively than hinder it.

Elements nonetheless supporting ETH’s energy

On the time of writing, Ethereum registered 555,880 Every day Energetic Addresses and 1.42 million transactions.

These metrics spotlight sturdy person engagement regardless of altering payment dynamics. Due to this fact, Ethereum’s underlying utility stays intact.

Constant exercise displays continued belief within the community’s capabilities throughout completely different use instances. This user-driven energy, mixed with declining trade reserves, presents structural help for value progress.

Moreover, 81.07% of holders had been in revenue. The biggest focus sat between $2,460 and $2,665—proper the place ETH faces resistance.

Nevertheless, ETH stays above key help, and on-chain alerts stay bullish. If value breaks above $2,665 with quantity, brief positions might unwind.

This might set off a pointy rally.

Due to this fact, merchants ought to monitor this zone intently. A confirmed breakout may mark the start of Ethereum’s subsequent impulsive transfer towards increased ranges not seen in current months.

Is a breakout imminent?

Ethereum’s fundamentals stay sturdy, supported by decreased reserves, rising person exercise, and excessive profitability amongst holders.

Resistance round $2,665 stays the important thing barrier.

Nevertheless, if bulls push previous this stage with conviction, a breakout may comply with. On-chain information favors upside continuation, however momentum should maintain. Merchants ought to watch this essential zone intently.

A profitable breakout may verify the beginning of Ethereum’s subsequent rally part.