Regardless of Bitcoin (BTC) and Ethereum (ETH) nonetheless struggling to reclaim their all-time highs, there seems to be a definite reality amongst each property now, as proven within the newest data.

Significantly, in accordance with Matrixport’s current report, Ethereum is now displaying greater price fluctuations in comparison with Bitcoin previously weeks.

Ethereum’s Risky Outpacing Bitcoin’s

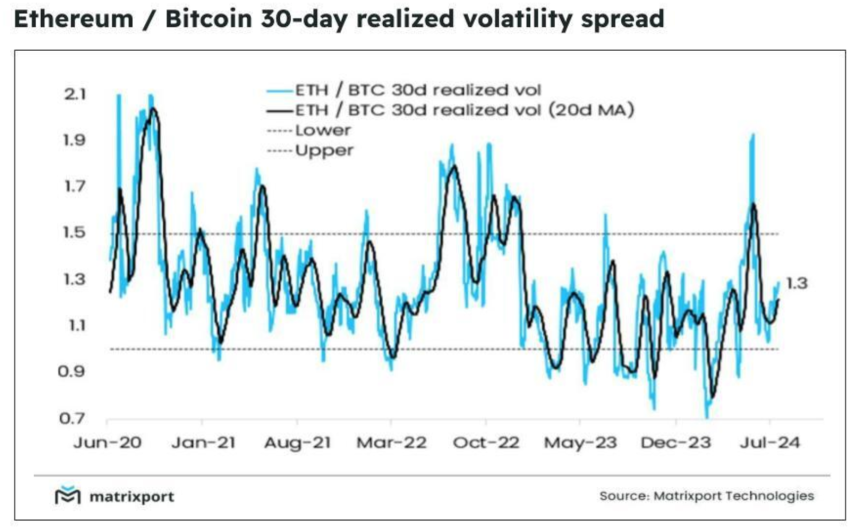

Volatility measures the worth variations of an asset over time, with increased volatility indicating extra important worth adjustments. Based on knowledge from Matrixport, the 30-day realized volatility unfold between ETH and Bitcoin sometimes ranges from 1.0 to 1.5.

#Matrixport

At present-Aug 13: #Ethereum’s Volatility Surpasses #Bitcoin’s#Cryptoassets #cryptomarket #BTC #ETH pic.twitter.com/QoKsuLUrAH

— Matrixport Official English (the one official X) (@Matrixport_EN) August 13, 2024

Which means that Ethereum’s price movements have been as much as 50% extra erratic than that of Bitcoin, suggesting that Ethereum might supply a riskier marketplace for buyers.

This elevated volatility is obvious in the way in which Ethereum reacts to market stimuli. Over current weeks, Ethereum has proven volatility ranges increased than Bitcoin.

This distinction has turn into notably notable for the reason that onset of the most recent bull market, with Ethereum’s worth experiencing extra drastic shifts.

These fast adjustments can considerably impression funding methods, as Ethereum’s larger peaks and troughs current totally different danger and reward situations in comparison with the comparatively extra steady Bitcoin. Matrixport famous within the report:

Resulting from Ethereum’s underperformance for the reason that begin of this bull market, this increased volatility has made it a much less interesting asset. Nevertheless, so long as the volatility ratio stays inside this vary, shopping for Ethereum volatility on the decrease finish may current a horny alternative.

Bitcoin And Ethereum Efficiency

In the meantime, over the week, each property look like virtually mirroring one another in price performance, with BTC rising by 7.5% and ETH by 7.9%.

Nevertheless, there was a noticeable distinction within the efficiency of the previous 24 hours. Over this era, Bitcoin has surged by 2.8% to reclaim its $61,000 worth mark. However, Ethereum has elevated by only one.2%, reclaiming its worth mark above $2,700.

The technical outlook on Bitcoin shows that the asset has now validated the setup of a potential rebound to higher levels.

Bitcoin has efficiently retested the Channel Backside as help (inexperienced circle) to substantiate a reclaim of the Channel general$BTC #Crypto #Bitcoin https://t.co/CKXDAAOA9v pic.twitter.com/ZCTQtKw580

— Rekt Capital (@rektcapital) August 13, 2024

In the meantime, the technical outlook means that ETH may nonetheless be caught. Crypto evaluation platform often called Extra Crypto On-line on X noted:

Clearly, Bitcoin is main as we speak. Ethereum remains to be caught within the vary however may strive an upside breakout from right here.

Featured picture created with DALL-E, Chart from TradingView

At present-Aug 13:

At present-Aug 13: