- 5 crypto wallets doubtless belonging to Justin Solar withdrew 9,018 ETH value $29.2 million

- Ethereum (ETH) may soar by 17% to hit the $4,100-level sooner or later

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has maintained its place above a vital value stage. By doing so, it has continued to draw curiosity from buyers and long-term holders.

On the time of writing, ETH was buying and selling close to $3,380, following a hike of over 4.80% in simply 24 hours.

Donald Trump and Justin Solar on a shopping for spree

On 24 January, SpotOnChain, shared that crypto whales, together with President Donald Trump and Justin Solar, bought important quantities of ETH throughout its newest dip.

In response to the identical, Trump’s World Liberty lately bought 3,079 ETH value $10 million, considerably growing its ETH holdings. The information additional revealed that they’ve amassed practically 32,994 ETH value $109.9 million within the final 4 days alone, bringing their whole holdings to 74,228 ETH.

In the meantime, 5 crypto wallets doubtless belonging to Justin Sun deposited a major 29.2 million USDT to HTX and withdrew 9,018 ETH at a mean value of $3,237.5. The put up on X additionally highlighted,

“Justin Solar appears targeted on reforming the Ethereum Basis, aiming to push ETH to $10k.”

$51.80 million ETH outflows

Along with these business giants, buyers and long-term holders additionally appear to be accumulating the token. This was highlighted by Coinglass’s newest discovering.

Knowledge from the spot influx/outflow metric revealed that exchanges have seen outflows of ETH value $51.78 million within the final 24 hours. This hinted at potential accumulation and a super shopping for alternative going ahead.

Value declaring, nonetheless, that this rising curiosity from crypto whales and buyers emerged throughout a interval when ETH seems to be consolidating inside a good vary.

Technical evaluation and value motion

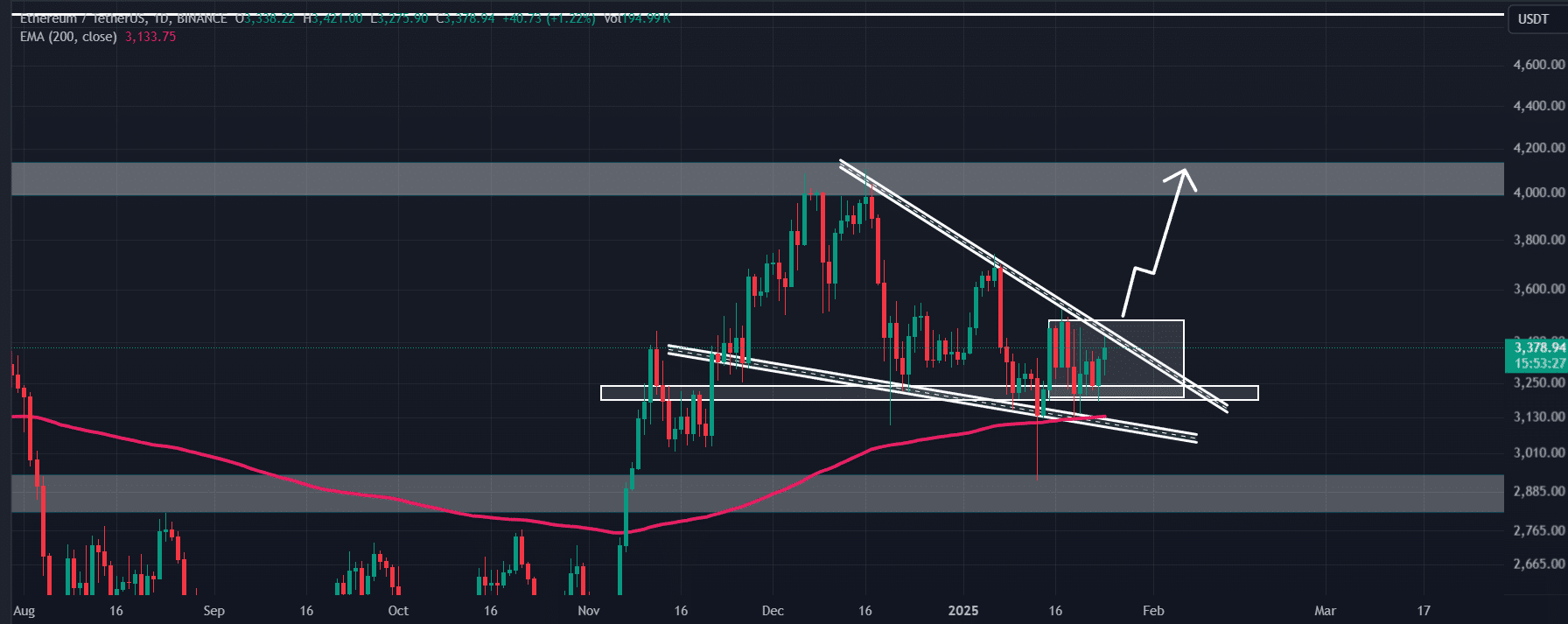

In response to AMBCrypto’s evaluation, ETH shaped a bullish falling wedge value motion sample. Nonetheless, it gave the impression to be consolidating inside a good vary between $3,200 and $3,500, probably resulting from current revenue reserving.

Nonetheless, at press time, ETH nonetheless appeared poised for a breakout. And, if the value breaks out of the consolidation vary, it’s going to have efficiently breached the falling wedge value motion sample. If ETH closes a each day candle above the $3,510-level, it may soar by 17% to hit the $4,100-level sooner or later.

The altcoin’s Relative Energy Index (RSI) stood at 50 too, indicating the asset has the potential to rally and present a value reversal from this stage.