- Practically 73% of the entire earnings accrued to Ethereum holders.

- ARB was nonetheless witnessing appreciable demand from the market.

One of many greatest success tales to have come out of final 12 months’s bear market was the outstanding development of layer-2 (L2) blockchains.

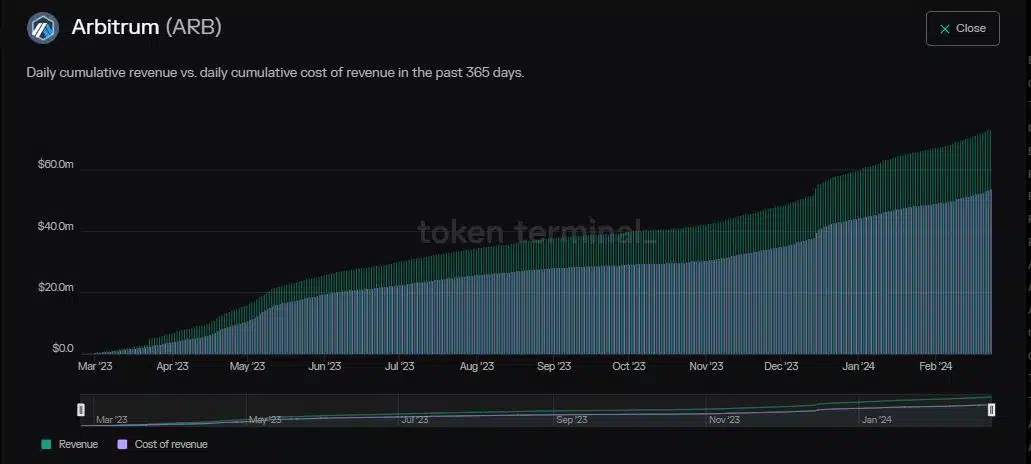

Arbitrum [ARB], arguably a barometer of the business’s efficiency, mopped revenues of over $72 million over the previous 12 months, based on AMBCrypto’s scrutiny of Token Terminal knowledge.

This marked an almost fourfold enhance.

Nonetheless, about $53 million, or 73% of the entire earnings had been accrued to Ethereum [ETH] holders, elevating questions in regards to the incentives supplied to native ARB holders.

ARB holders at an obstacle

Constructed on prime of Ethereum, L2 blockchains course of transactions off the primary chain, thereby serving to the latter to scale.

As a part of the ultimate settlement, the transactions are batched collectively and despatched over to the primary chain together with safety proofs.

It’s this very course of that takes up a considerable quantity of income earned on L2s.

A more in-depth examination of the aforementioned knowledge confirmed that Ethereum validators constantly acquired greater than 70% of the each day transaction charges paid on Arbitrum.

Whereas the upcoming Dencun improve was anticipated to cut back L1 storage prices drastically, the tokenomics leaves little or no for ARB holders to have a good time.

Notice that ARB doesn’t accrue any worth from Arbitrum’s on-chain exercise, and features simply as a governance token.

These components might disincentivize ARB possession in the long term.

Whales present curiosity in ARB

As of this writing, ARB was exchanging fingers at $1.86, rising by 9% within the final month, based on CoinMarketCap.

This was considerably decrease than features made by different L2s like Optimism [OP] and Polygon [MATIC]. Nonetheless, rich traders exhibited an affinity for L2 tokens in current months.

Sensible or not, right here’s ARB’s market cap in BTC’s terms

As per AMBCrypto’s examination of Santiment’s knowledge, addresses holding between 1,000–10 million cash have swelled since December.

On a broader scale, round 140,000 new ARB holders had been added within the aforementioned interval, implying appreciable demand from the market.