- A distinguished crypto analyst steered that ETH might get away of a bullish sample, doubtlessly triggering a major value surge.

- On-chain metrics inform a special story, with rising investor warning and elevated promoting exercise casting doubt on a rally.

Over the previous month, Ethereum [ETH] delivered a notable 18.66% acquire, however its upward trajectory has since slowed. Weekly efficiency confirmed a marginal 0.02% improve, whereas each day features stay modest at 0.20%.

AMBCrypto’s evaluation steered that ETH is extra more likely to face a downturn than obtain the bullish breakout many have hoped for, as market indicators stay largely bearish.

Is Ethereum bullish sufficient to hit $3,400?

In response to Carl Runefelt’s chart analysis, ETH is buying and selling under a descending resistance sample—a formation that usually indicators an impending value rally.

Based mostly on this sample, ETH might doubtlessly climb to $3,420, the height of the formation, representing an 8.55% acquire from its present place.

Runefelt remarked,

“Ethereum wants to interrupt above this descending resistance to regain bullish momentum.”

Nonetheless, additional evaluation means that market sentiment stays divided in favor of the bears, with no clear consensus supporting a breakout above the resistance stage simply but.

Traders offload ETH, including downward strain on value

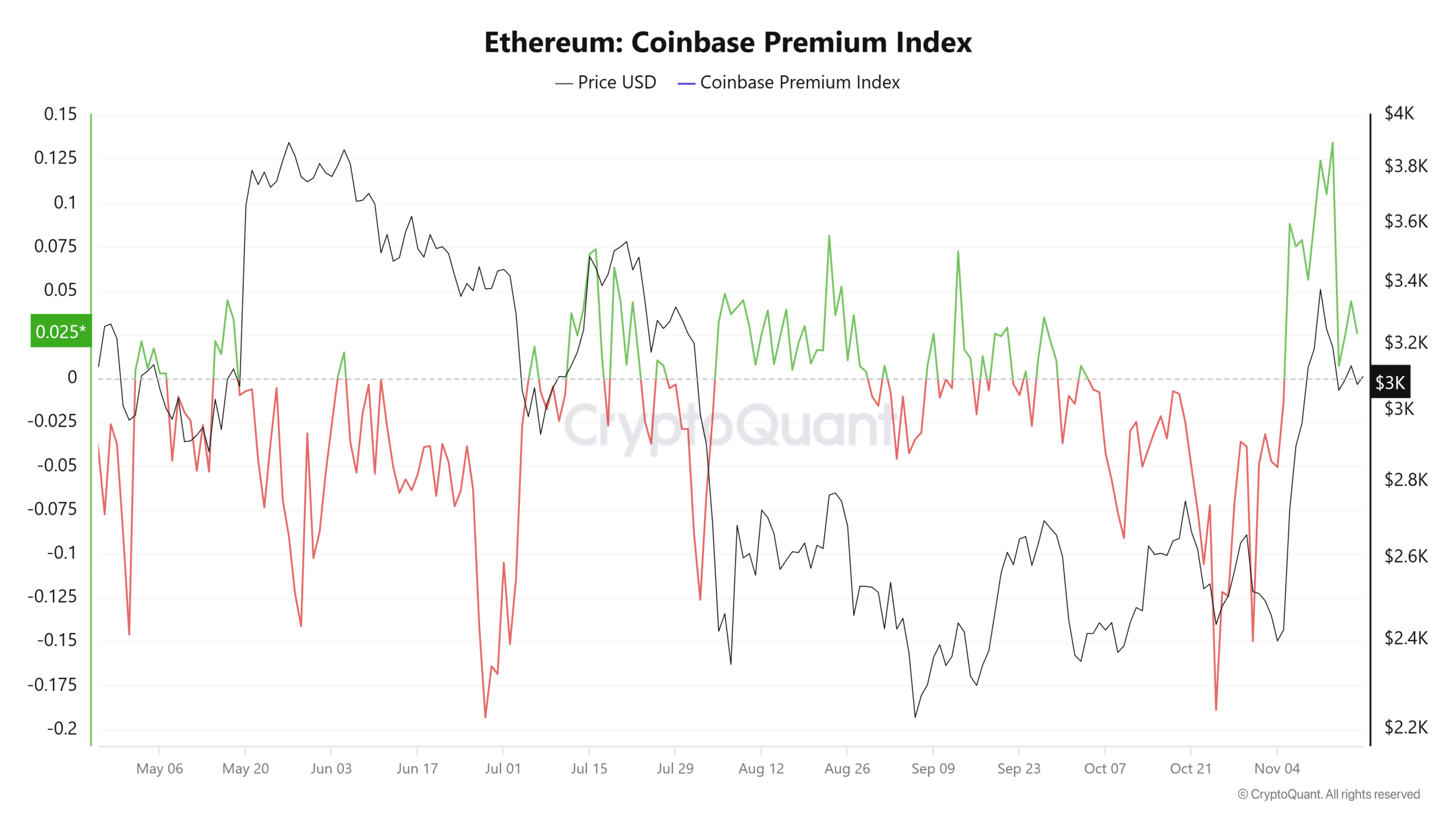

Knowledge from CryptoQuant reveals that U.S. buyers are promoting their ETH holdings, which factors to waning curiosity within the asset and diminishing expectations for a rally.

This pattern is mirrored within the Coinbase Premium Index, which measures the worth distinction between ETH/USD on Coinbase Professional (a U.S. centric trade) and ETH/USDT on Binance (a globally centered trade).

The index has sharply dropped from 0.1346 in April to 0.0256, which indicators weaker demand for ETH amongst U.S. buyers in comparison with world markets.

The sell-off coincides with a surge in Alternate Netflow, which measures the motion of ETH throughout exchanges.

Optimistic Netflow signifies elevated inflows to exchanges, sometimes for promoting, whereas destructive Netflow suggests buyers are shifting property to personal wallets for long-term holding.

ETH’s Alternate Netflow has remained constructive for 3 consecutive days, with an enormous influx of 28,726.8 ETH prior to now 24 hours. This promoting strain has negatively impacted ETH’s value trajectory and would proceed in that path with extra constructive Netflow.

Sellers take management as ETH struggles

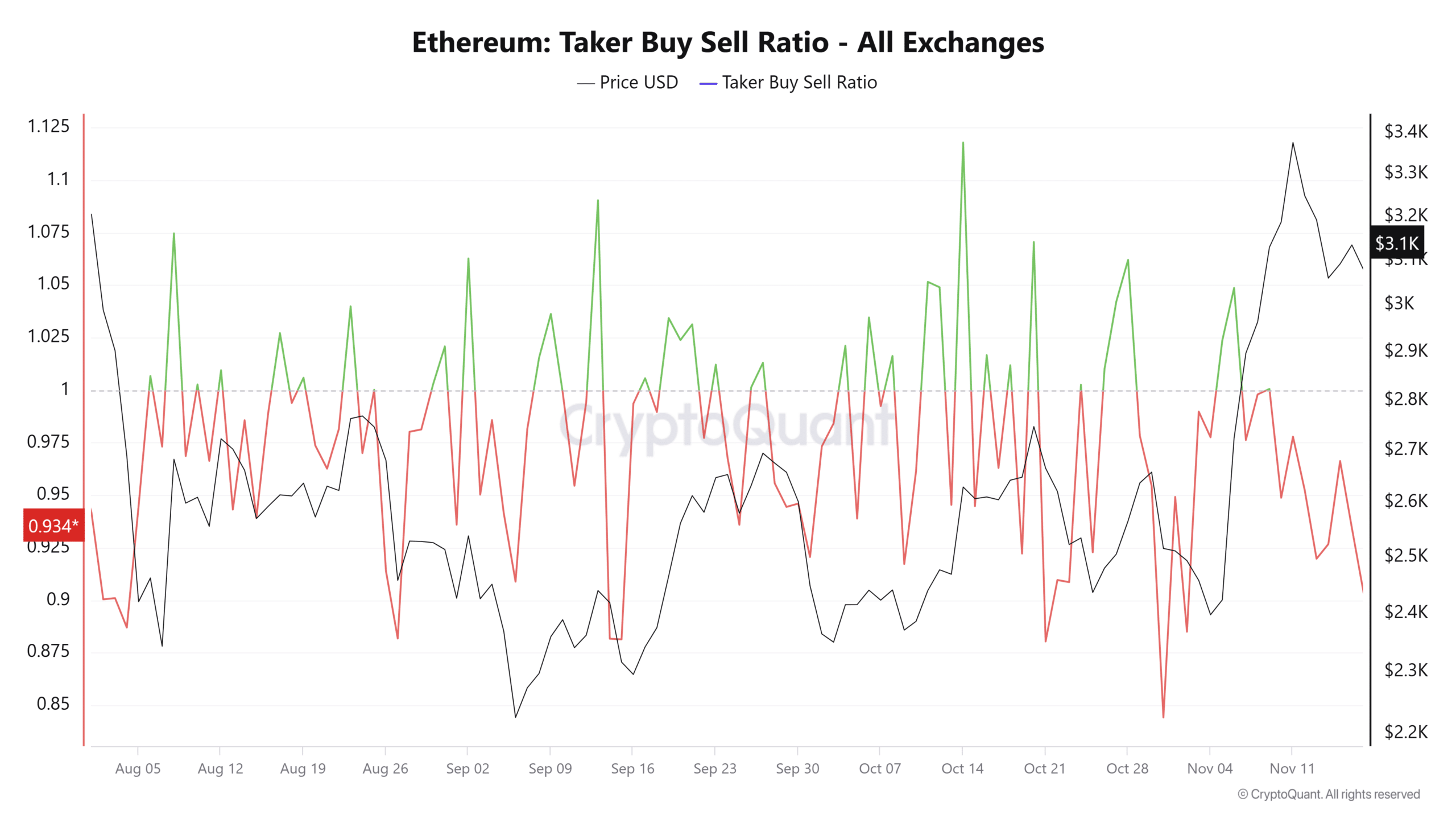

An evaluation of the Taker Purchase/Promote Ratio, a metric used to gauge whether or not consumers (bulls) or sellers (bears) dominate the market, exhibits that sellers at present maintain the higher hand.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

On the time of writing, the ratio sits at 0.9033, under the crucial threshold of 1. This studying signifies that promoting strain outweighs shopping for exercise, as extra buyers offload their ETH holdings.

If these bearish traits throughout a number of metrics persist, ETH is unlikely to interrupt above its resistance line. As an alternative, this resistance stage might act as a value ceiling, doubtlessly triggering additional declines in ETH’s worth.