As soon as once more, there may be hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency knowledgeable, has spotlighted the potential for the crypto asset’s worth to achieve a brand new all-time excessive earlier than the extremely anticipated Halving occasion commences.

One Last All-Time Excessive For Bitcoin Earlier than Halving

The worth of Bitcoin is presently exhibiting new bearish exercise, which could set off damaging sentiments available in the market over the following few days. Regardless of the notable decline, Michael Van De Poppe is optimistic that BTC will attain a brand new top previous to Bitcoin Halving anticipated to happen this month’s finish.

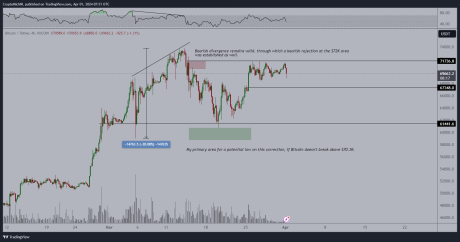

Based on the analyst, the digital asset is at present in a consolidation zone. He additional recognized two distinct essential ranges throughout the decrease timeframes such because the $67,000 threshold as a help degree and the $71,700 mark as a ultimate get away in direction of the height.

It’s value noting that Michael Van De Poppe beforehand forecasted that Tuesday might be when the true strikes are anticipated to start as Bitcoin consolidates. Thus, if the coin holds the $67,000 degree, he’ll suggest a one-last peak check forward of the halving.

Poppe appears to be assured about his prediction now as he asserts that if one of many two aforementioned essential ranges develops, it’ll decide the path of Bitcoin. As a consequence of this, he believes BTC will expertise one ultimate pre-halving all-time excessive.

The put up learn:

Bitcoin is calmly consolidating. Essential ranges (decrease timeframes): $67,000 to carry for help, $71,700 for a ultimate breakout in direction of the ATH. If both of the 2 occurs, in all probability path is chosen. I feel we can have one ultimate ATH check earlier than halving occurs.

Following the current decline, Poppe has issued a warning to the crypto neighborhood on tips on how to work together with the value motion. “You don’t want to chase these large inexperienced candles,” he said.

He advocates getting into the market when BTC‘s worth is down by 15% to 40%. Moreover, he addressed these contemplating investing in altcoins, urging them to speculate when altcoins are down by 25% to 60%.

Attainable Triggers For The Correction

As of press time, Bitcoin’s worth is buying and selling at $65,843, demonstrating a decline of over 5% within the day by day timeframe. Its buying and selling quantity has seen a major uptick of 66% previously day, whereas its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the value of Bitcoin has dropped by practically 10%. One issue thought-about to have contributed to the retracement was the inflow of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since began to settle down progressively.

Data from Wu Blockchain revealed that the merchandise noticed an general internet outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a internet influx of $165 million, whereas Grayscale ETF GBTC skilled a single-day internet outflow of $302 million. Presently, the historic cumulative internet influx for the BTC spot ETFs is pegged at $12.04 billion.

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.