Pantera Capital CEO Dan Morehead says that the political institution is basically being pressured to cave into pro-crypto stances.

Within the agency’s month-to-month Blockchain Letter, Morehead says that the Federal Reserve’s a long time of cash printing has primarily benefited a minority of older demographics whereas punishing the bulk, who now maintain the larger voting bloc.

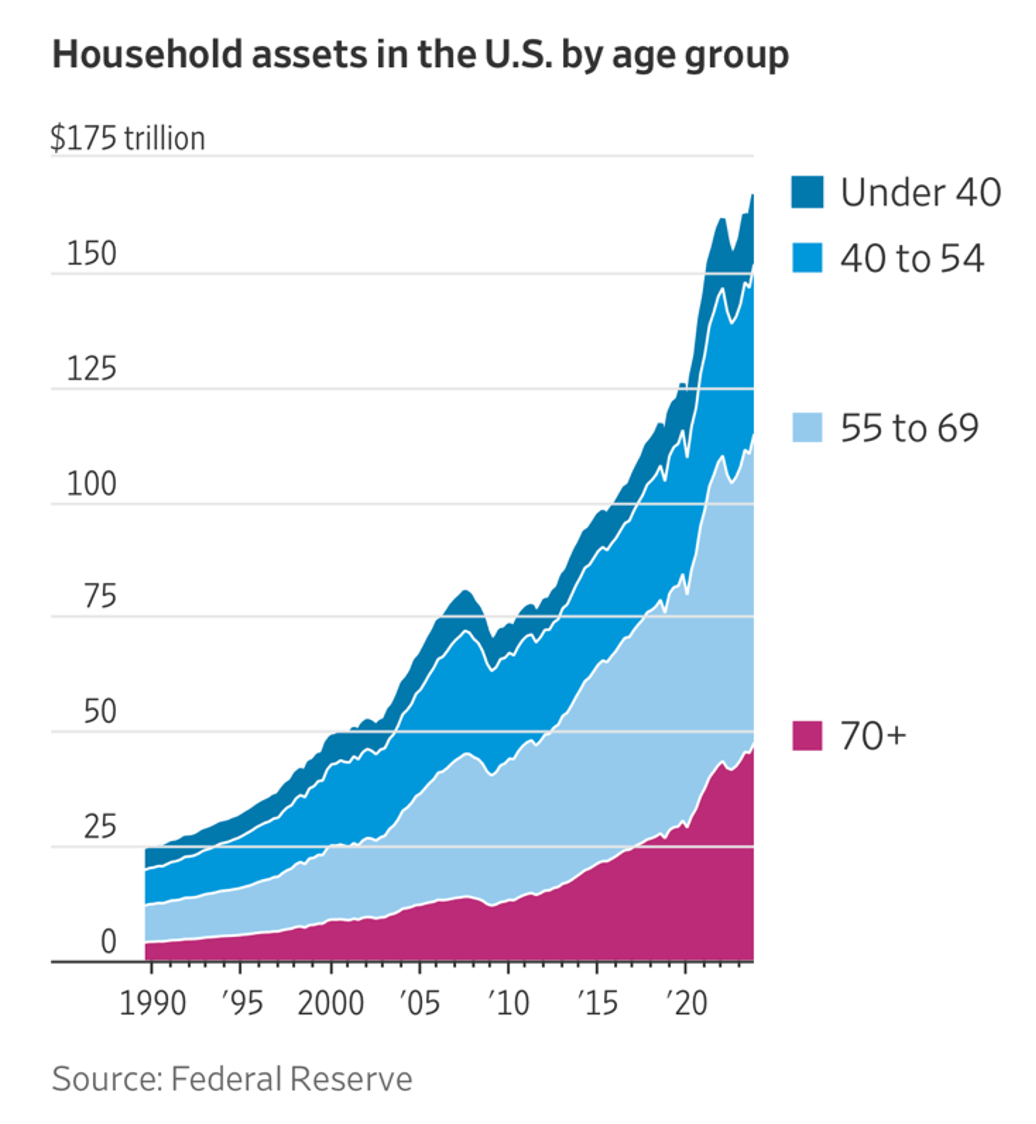

Morehead reveals a chart citing the Fed’s personal information depicting an awesome distribution of wealth to older Individuals whereas the youthful generations more and more get left behind.

“It doesn’t take a Political Science main to determine why each political events collapsed all of a sudden into blockchain.

Nearly all of Individuals are below 40.

The spoils of the Fed’s coverage errors and Congress cash printing have gone nearly solely to the minority of Individuals who’re older.”

Quoting himself at a current Bitcoin convention, Morehead feedback on what it means for BTC and digital property now that former president and present Republican nominee Donald Trump has turn out to be brazenly pro-crypto.

“I really assume it’s the largest information in crypto….

I feel the previous president altering his views in Could is the largest factor in crypto as a result of whether or not he’s elected or the opposite candidate’s elected, everyone simply modified. The SEC was getting an ETF for ETH out inside every week. All the things modified.

And I actually assume this can be a sea change proper now as a result of now politicians see that crypto is standard. Take into consideration this. Nearly all of Individuals are below 40 years previous. All of them love crypto they usually vote. And so politicians can put two and two collectively.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/GrandeDuc