- Bitcoin dominance seemingly wants to achieve between 62% and 70% for an altcoin season to start.

- Nevertheless, extra points throughout varied metrics additionally require severe consideration.

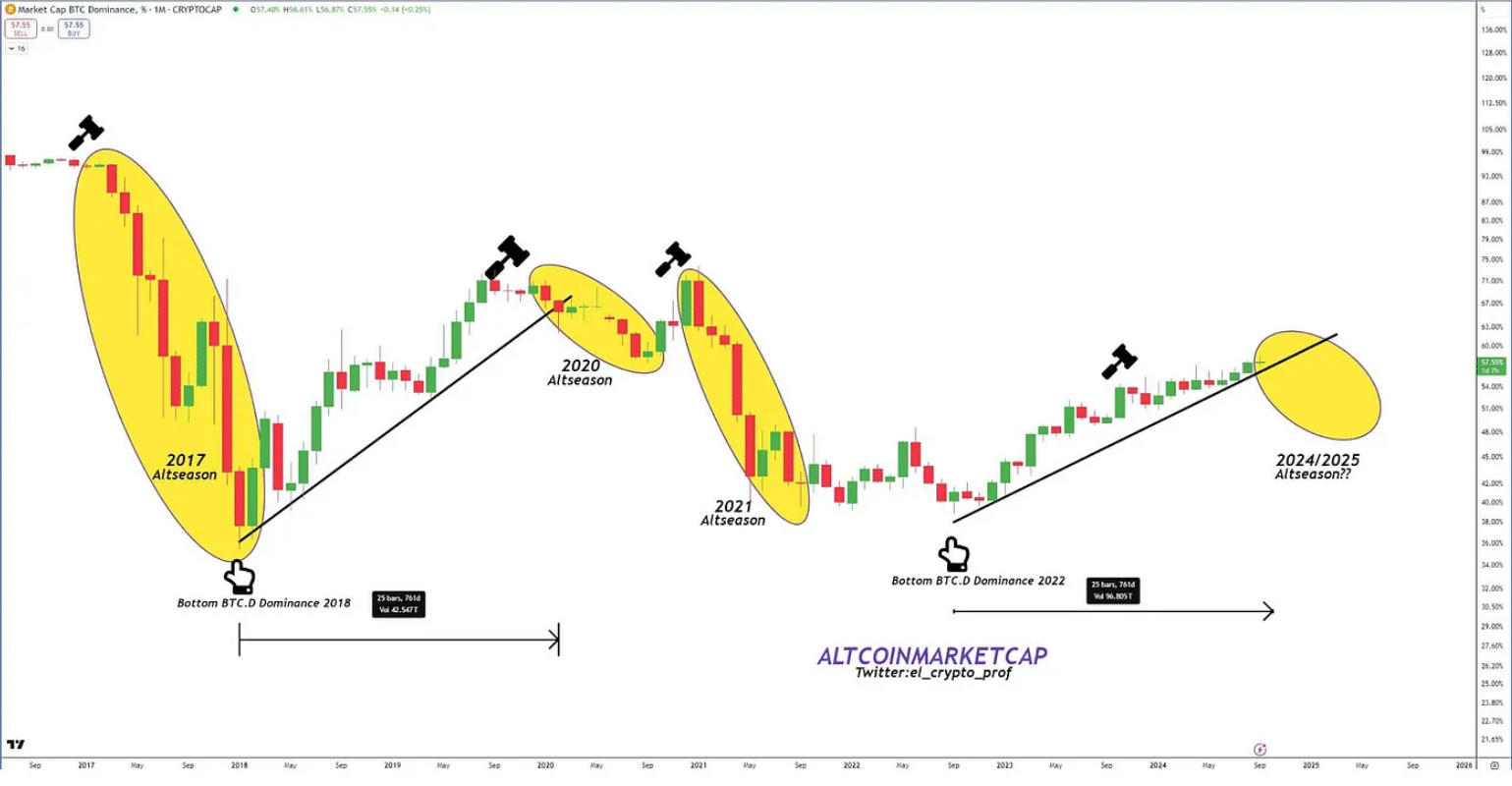

Market sentiment was typically bearish for altcoins in Q3, with Bitcoin [BTC] dominance rising to round 57%, recording a brand new all-time excessive. The Altcoin Season Index presently reads 35, after hitting its lowest-point in mid-August.

Usually, altcoins are likely to carry out effectively after Bitcoin dominance peaks. As Bitcoin captures market share early in a cycle, capital typically shifts to altcoins as soon as BTC dominance begins to fade. This cycle advantages altcoins, as buyers search higher-risk, higher-reward property.

From a statistical standpoint, Bitcoin’s market cap would want to develop by roughly $280 billion to fall inside the 62%-70% vary for an altcoin season to kickstart. This progress is prone to happen when BTC hits $80K, amongst varied different metrics.

Excessive Bitcoin dominance is essential

Over time, Bitcoin’s dominance has considerably declined, dropping from 90% in 2013 – when the market was nonetheless in its infancy – to a low of 39% in 2021, as altcoins started to realize traction.

Notably, every altcoin season has been pushed by particular catalysts, just like the launch of latest cryptocurrencies, technological improvements akin to ERC-20 tokens, and broader developments like DeFi and NFTs.

This implies that past Bitcoin’s market share, particular person contributions from altcoins may even play a crucial position in sparking the following altcoin season.

Presently, altcoin market standings are too restricted to drive a season independently, as altcoin losses typically depend on Bitcoin’s returns for stability. For a shift to happen, Bitcoin would seemingly want to steer with an preliminary rise.

This pattern suggests Bitcoin’s worth might have to exceed $80,000 to attain a BTC dominance above 65%, which may set off substantial capital inflows into the altcoin market.

Want for top danger urge for food

In a current report, AMBCrypto highlighted an rising shift within the altcoin market, calling for strategic measures from Ethereum builders to counter rising competitors.

Internally, this calls for cautious evaluation, whereas externally, Bitcoin’s attraction suffers from a widening danger deficit, not directly hampering altcoins from receiving their due momentum.

As gold costs attain new highs, pushed by rate of interest cuts and geopolitical tensions, Bitcoin’s stagnant efficiency underscores restricted market danger urge for food for crypto.

Traditionally, an upward pattern within the BTC/Gold ratio has been aligned with altcoin season. Subsequently, the present decline in danger urge for food negatively impacts altcoin efficiency, indicating {that a} rising BTC/Gold ratio may function a sign for extra favorable situations forward.

Briefly, as BTC undergoes a pullback, the declining BTC/Gold ratio displays a shift of buyers towards perceived safe-haven property, which undermines Bitcoin’s attraction as a long-term retailer of worth.

This migration underlines the significance of market confidence in BTC’s position as a “digital gold” to help a broader altcoin rally – a rally prone to stabilize as soon as BTC approaches the $80K mark.

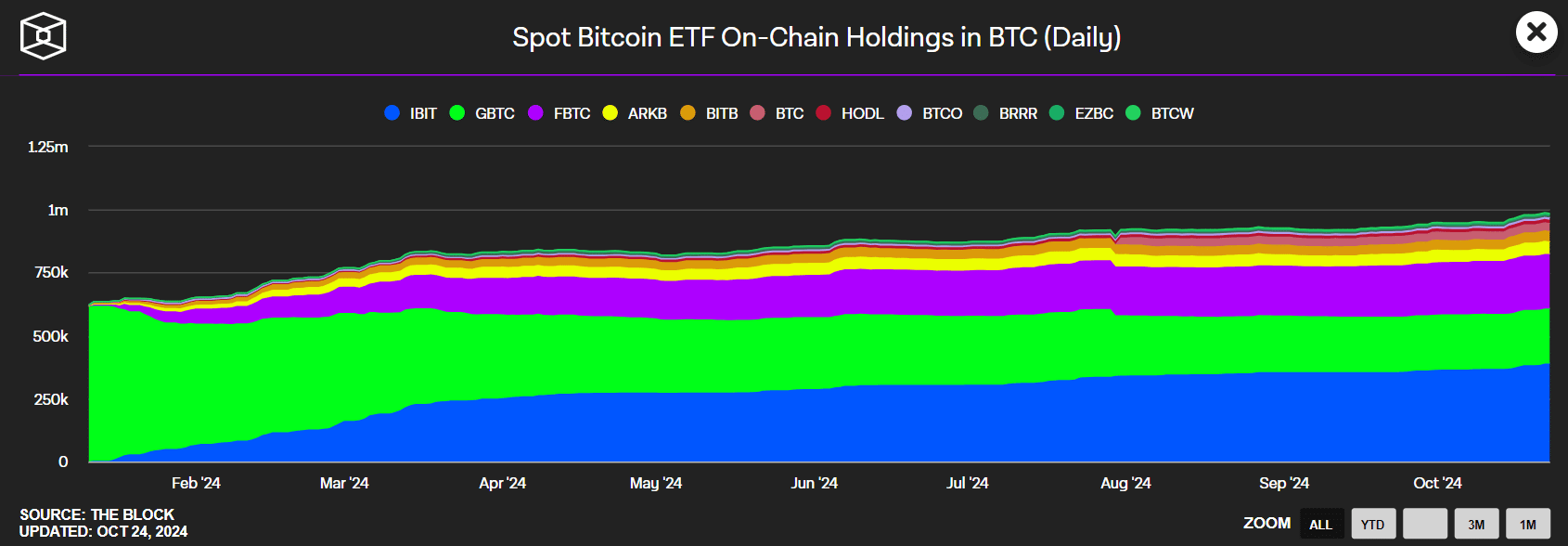

Much less ETF pushed momentum

One other issue is the connection between Bitcoin’s worth surge and ETFs. Whereas ETF-driven rallies are typically optimistic, the impression on altcoins can fluctuate. The ETF market has skilled important progress in 2024.

Nevertheless, when ETFs lead market momentum, funds have a tendency to stay inside Bitcoin or Ether relatively than rotating into altcoins, as mainstream buyers typically have restricted direct entry to them. As an alternative, capital is prone to movement into crypto-related shares.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

In consequence, a mix of inside and exterior elements continues to postpone the onset of altcoin season, which stays carefully tied to Bitcoin’s worth efficiency.

For altcoin season to materialize, Bitcoin would seemingly have to surpass $80K, a threshold that, given present dynamics, could also be difficult to achieve by the top of This autumn.