Commonplace Chartered CEO Invoice Winters expects each transaction to in the future run on blockchain, calling it a “full rewiring” of world finance.

Commonplace Chartered CEO Believes Blockchain Will Host All Cash Finally

As reported by CNBC, Invoice Winters talked about the way forward for finance and Hong Kong’s function within the international digital belongings house at a Hong Kong FinTech Week panel on Monday. “Our perception, which I feel is shared by the management of Hong Kong, is that just about all transactions will decide on blockchains finally, and that every one cash might be digital,” stated the Commonplace Chartered CEO.

The remark comes as there was a push towards digital ledger tokenization around the globe. Funds big SWIFT, for instance, is growing a blockchain-based ledger, as announced in September.

Tokenization of an asset creates a digital copy of it that may be traded on the blockchain. Final yr, Hong Kong launched a undertaking to check the appliance of tokenization in real-life enterprise eventualities, with Commonplace Chartered as a participant.

Commonplace Chartered is a British financial institution that operates around the globe, together with Hong Kong. The establishment, designated as a World Systemically Vital Financial institution (G-SIB) by the Monetary Stability Board (FSB), has been rising its presence within the digital belongings house not too long ago.

Earlier this yr, the financial institution grew to become the first of its stature to launch a spot Bitcoin and Ethereum buying and selling desk for institutional purchasers. It has additionally fashioned a joint venture with Animoca Manufacturers and Hong Kong Telecom (HKT) to acquire a stablecoin license from the Hong Kong Financial Authority (HKMA).

Stablecoins symbolize a outstanding instance of tokenization, performing as blockchain counterparts to fiat currencies. Commonplace Chartered is planning to launch an asset of this sort primarily based on the Hong Kong Greenback (HKD).

The present tokenized belongings might solely be the start if the prediction from the financial institution’s CEO about all cash finally changing into digital is to go by. “Take into consideration what which means: a whole rewiring of the monetary system,” famous Winters.

Bitcoin Has Taken A 3% Hit Throughout The Previous Day

Bitcoin has kicked off the brand new week with one other retrace as its worth is again all the way down to the $107,500 mark. The chart under reveals how the cryptocurrency’s pattern has regarded not too long ago.

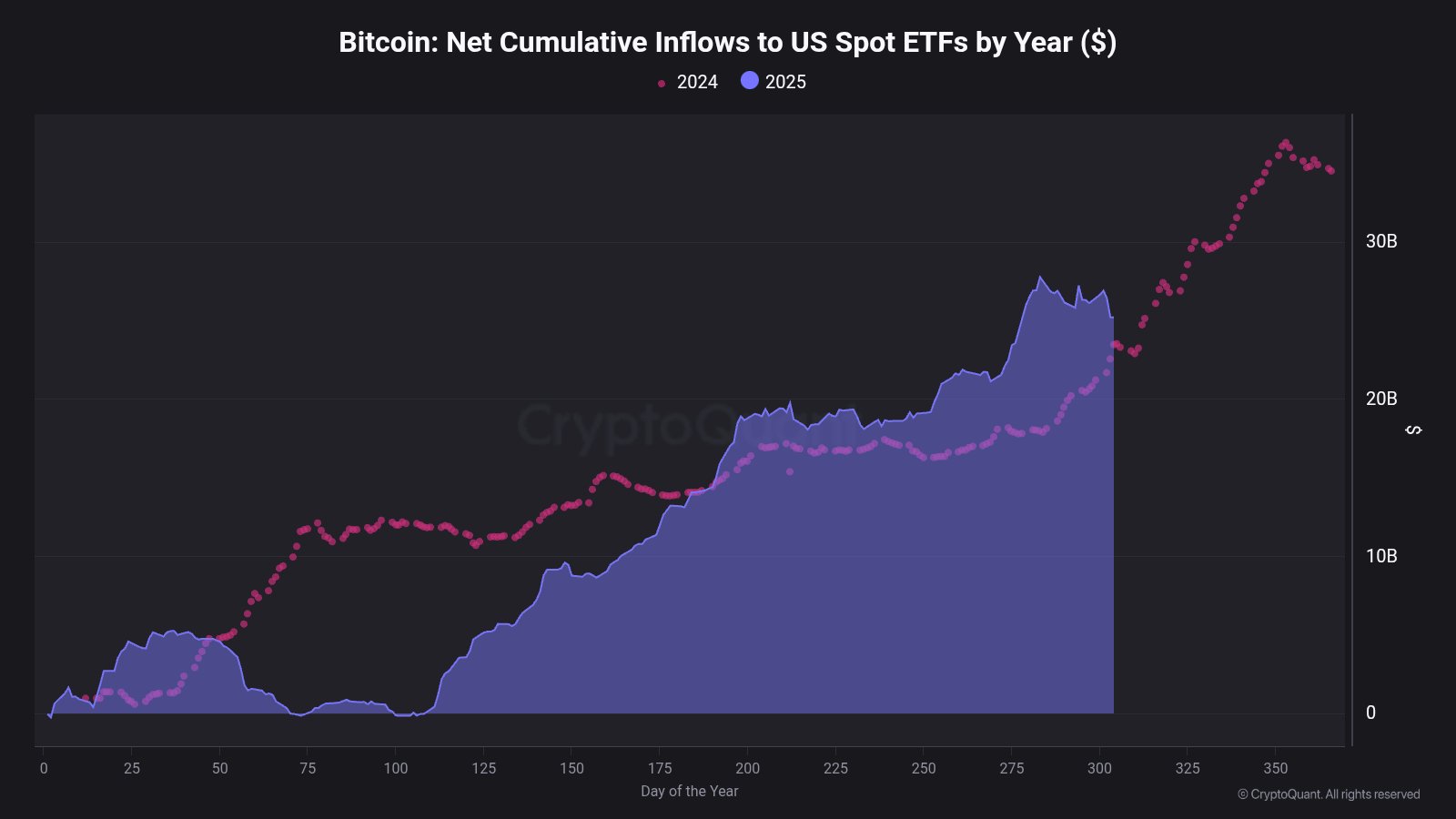

Regardless of the latest bearish wave, nonetheless, Bitcoin remains to be outperforming in 2024 when it comes to the spot exchange-traded fund (ETF) inflows. As CryptoQuant neighborhood analyst Maartunn has identified in an X post, 2025 is forward of 2024 in year-to-date inflows.

How the cumulative spot ETF inflows have in contrast between the 2 years | Supply: @JA_Maartun on X

At this level final yr, US Bitcoin spot ETFs registered round $22.5 billion in cumulative inflows. The identical metric for 2025 is now sitting at $25.18 billion.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.