- Bitcoin’s mining sector is struggling, with income declining sharply

- Transitioning to AI information facilities would possibly current vital value and logistical challenges for Bitcoin miners

In August, Bitcoin [BTC] noticed some vital volatility, buying and selling between $64,000 and $57,000. The cryptocurrency continued its downward development into September, with BTC priced at $56,816.75 at press time.

Regardless of a modest 0.38% hike over the previous 24 hours in line with CoinMarketCap, technical indicators appeared to counsel a persistent bearish development.

Bitcoin mining’s AI guess

That’s not all although. Amidst this uncertainty, BTC mining firms are exploring diversification into high-performance computing information facilities to spice up income.

Nonetheless, Phil Harvey, CEO of Sabre56, a blockchain information heart consulting agency, believes that such a transition is fraught with challenges and might not be as possible because it seems.

Talking to a media outlet, the exec claimed that reworking a crypto mining facility into an AI or high-performance computing information heart is considerably costlier.

He identified that whereas operating a typical mining operation prices between $300,000 and $350,000 per megawatt, AI information facilities demand a a lot larger funding. Someplace alongside the traces of $3 million to $5 million per megawatt— A rise of 10 to fifteen occasions.

Harvey additionally famous that even with a gigawatt of energy, solely about 200 megawatts might feasibly be redirected to high-performance computing duties.

He stated,

“There’s most likely round 20%, I might think about, of every miner’s portfolio that’s truly able to delivering key attributes like energy, information, and land with a view to facilitate AI.”

Bitcoin’s income hunch

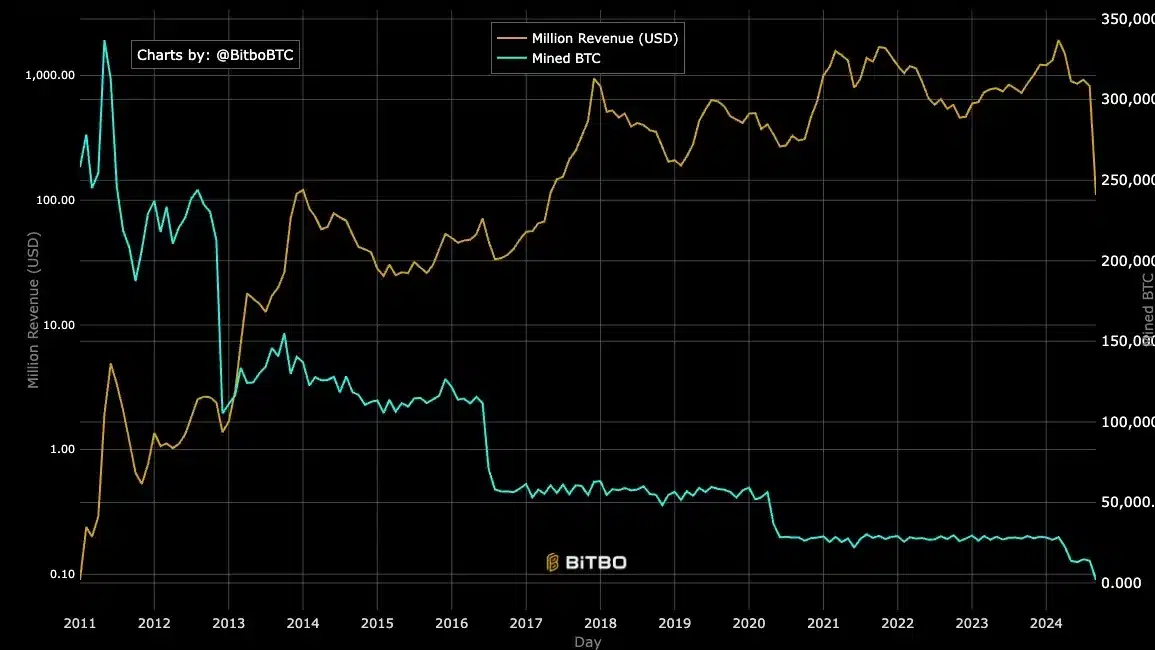

The current push for Bitcoin miners to pivot in the direction of AI information facilities could stem from their vital income struggles.

For context, August marked the worst earnings month for BTC miners in practically a yr, with earnings hitting their lowest since September 2023. Particularly in mild of mined coin portions dwindling.

The numerous operational prices of mining additional exacerbated the state of affairs. If these bills outweigh the rewards, miners could possibly be compelled to capitulate.

This monetary strain has prompted many to discover various income streams, similar to high-performance computing, to stabilize their operations.

In actual fact, a current evaluation by AMBCrypto revealed a big drop in miner income, with the identical falling to $820 million in August.

This represented a decline of over 10% from July’s $927 million and marked a staggering 57% fall from its peak of practically $1.93 billion in March.

March was notable, not just for its excessive revenues but in addition for Bitcoin’s all-time excessive (ATH) surpassing $73,000.

VanEck has a unique perspective to share

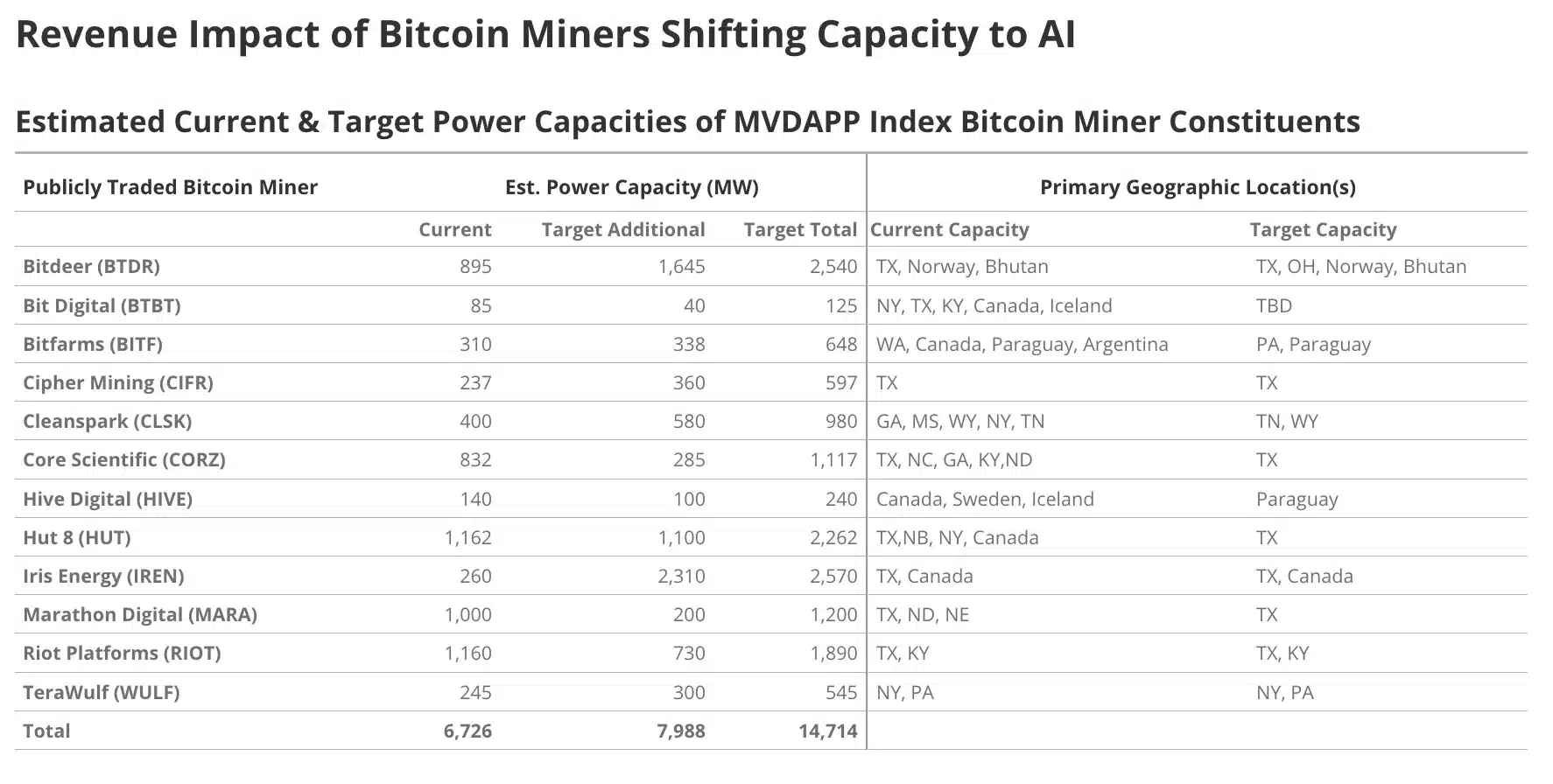

Right here, it’s price noting that in line with VanEck’s projections, publicly traded BTC mining firms might generate substantial revenues by reallocating 20% of their power capability to AI and high-performance computing by 2027.

“Whole extra yearly earnings might exceed a median of $13.9 billion per yr over 13 years.”

The report added,

“AI firms want power, and Bitcoin miners have it.”

Thus, because the Bitcoin mining trade explores the shift to high-performance computing and AI information facilities, the trail ahead stays unsure.

However, how this transition unfolds shall be essential in figuring out whether or not it may efficiently stabilize and improve mining revenues. Particularly within the face of present monetary pressures.