- BTC’s provide absorption by spot ETFs has turned unfavorable.

- This urged a brief decline in curiosity in BTC spot ETFs.

The latest decline in Bitcoin’s [BTC] provide absorption by spot Bitcoin exchange-traded fund (ETF) has indicated a drop in curiosity on this asset class.

This was famous by pseudonymous CryptoQuant analyst Oinonen_t in a brand new report.

The BTC spot ETF market witnesses a slight decline

BTC’s provide absorption by BTC ETFs tracks the speed at which newly mined cash are acquired or absorbed by these funds.

This metric is necessary as a result of elevated provide absorption from spot ETFs may probably result in upward value strain on BTC.

Conversely, a decreased demand can sign a possible decline within the main coin’s worth.

Oininen_t discovered that the coin’s provide absorption not too long ago turned unfavorable and dropped to a low of -0.38. Confirming the place above, the analyst opined,

“Regardless of the hype round upcoming halving in 21 days, bitcoin’s spot value hasn’t moved dramatically inside the previous 30 days. One rationalization for the stagnant value motion is the unfavorable provide absorption of the ETFs.”

The analyst added that when spot ETFs can not take in the newly mined cash,

“The demand for the roughly 900 bitcoins issued each day should come from different sources.”

Nonetheless, within the present market, the retail traders who normally accumulate these cash have shifted their consideration in direction of meme cash.

Up to now few weeks, the values of some Solana [SOL]-based meme cash have grown by triple-digits, resulting in a big uptick within the meme coin market capitalization.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

In line with Oininen_t,

“Though retail traders have proven rising curiosity in direction of bitcoin, their focus may be on the brand new Solana-based tokens and “meme cash.”

Concluding that the unfavorable provide absorption is a brief downside within the spot ETF market, the analyst stated,

“The larger image nonetheless appears to be like promising. In a multi-year situation, I see bitcoin attempting to achieve market capitalization parity with gold, which might imply a 1000 % upside to the present spot value.”

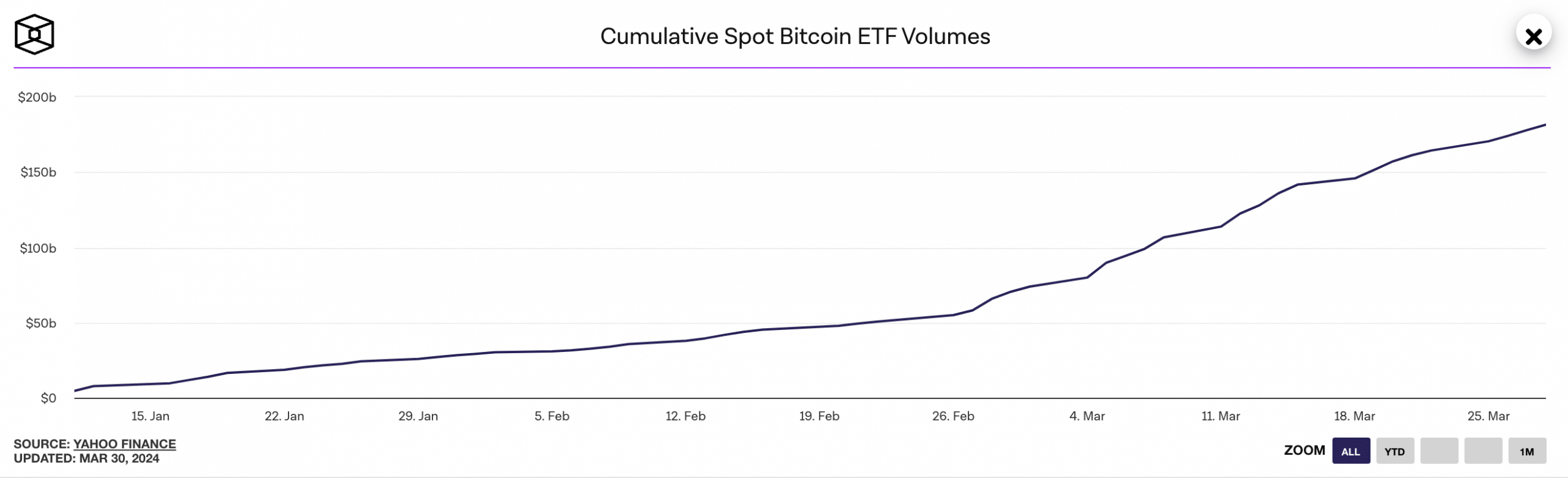

Since its launch, the quantity of Bitcoin spot ETFs have grown considerably. Sitting at $182 billion at press time, the each day cumulative quantity for this asset class has climbed by over 3500%.

With an asset beneath administration (AUM) worth of $24 billion, the Grayscale Bitcoin Belief (GBTC) at the moment holds the most important market share within the BTC spot ETF market.