Keep knowledgeable with free updates

Merely signal as much as the Cryptocurrencies myFT Digest — delivered on to your inbox.

The pinnacle of crypto trade Kraken has hit out at UK guidelines on the promotion of digital monetary property, arguing that they hinder retail traders by slowing down the motion of funds.

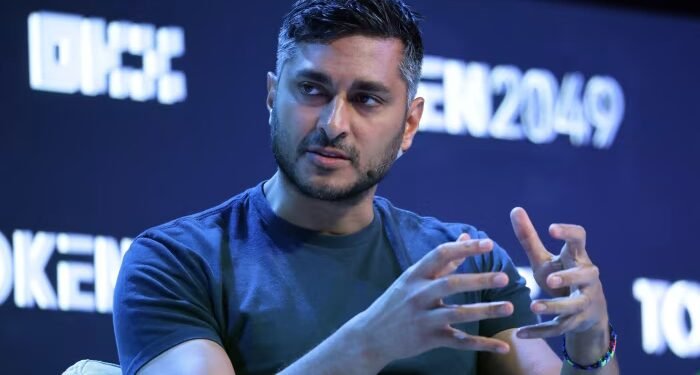

Arjun Sethi, co-chief government, advised the Monetary Occasions: “Within the UK at this time, if you happen to go to any crypto web site, together with Kraken’s, you see the equal to a cigarette field [warning] — ‘use this and also you’re going to die’.”

He added: “Due to the velocity at which they need to do the transaction, it’s worse for shoppers. Disclosures are vital . . . but when there are 14 steps, it’s worse.”

Sethi’s feedback mark the primary main criticism of the UK’s method for the reason that Monetary Conduct Authority introduced financial promotion rules in late 2023.

Corporations advertising their crypto providers within the UK should adjust to the foundations. They contain posting clear threat warnings on their web site and apps, banning incentives to take a position, creating “optimistic frictions” and making customers fill out “appropriateness assessments” to verify whether or not they perceive the dangers of shopping for crypto.

Some prospects may be deterred from investing in crypto in any respect, due to this fact lacking out on potential good points, Sethi mentioned.

The FCA mentioned its guidelines ensured that prospects understood the advantages and dangers of investing in crypto. “Clients should reply questions earlier than a agency makes a monetary promotion to them, however this isn't required each time a buyer makes a commerce, so shouldn't typically stop them appearing the place they need to.

“Some shoppers could make an knowledgeable choice that investing in crypto isn't proper for them — that's our guidelines working as meant.”

The UK regulator has lengthy come underneath hearth from digital asset executives for taking a very cautious method to the trade.

British regulators have confronted calls to be more accommodating to crypto this yr, for the reason that US underneath President Donald Trump has embraced the trade.

The FCA final month sued HTX for failure to adjust to the monetary promotions guidelines. The crypto trade is linked to Justin Solar, a China-born billionaire who has invested tens of millions of {dollars} in Trump’s digital asset ventures.

Kraken was based in 2011 and is likely one of the world’s 15 greatest exchanges by buying and selling volumes.

Sethi has co-led Kraken since October 2024 alongside David Ripley, and in addition chairs Silicon Valley enterprise capital agency Tribe Capital. He mentioned stricter UK guidelines and shopper safety efforts meant Kraken customers in Britain couldn't entry about three-quarters of the crypto merchandise obtainable to these within the US, reminiscent of incomes extra yield and lending by decentralised finance protocols.

Kraken additionally runs a tokenised inventory trade, enabling traders to commerce digital representations of public equities. Sethi mentioned the corporate wouldn't department out into providing tokenised variations of personal firms, in distinction to Robinhood, which confronted a backlash earlier this yr for providing representations of shares in OpenAI.

“The argument Vlad [Tenev, head of Robinhood] is utilizing is flawed,” Sethi mentioned, including that tokenising non-public firm shares was a “horrible thought” as a result of traders risked going through difficulties promoting their investments.

Kraken can also be making ready to listing in New York, though Sethi declined to touch upon timing.