A broadly adopted crypto analyst believes that one synthetic intelligence (AI) altcoin venture is gearing up for a transfer to the upside.

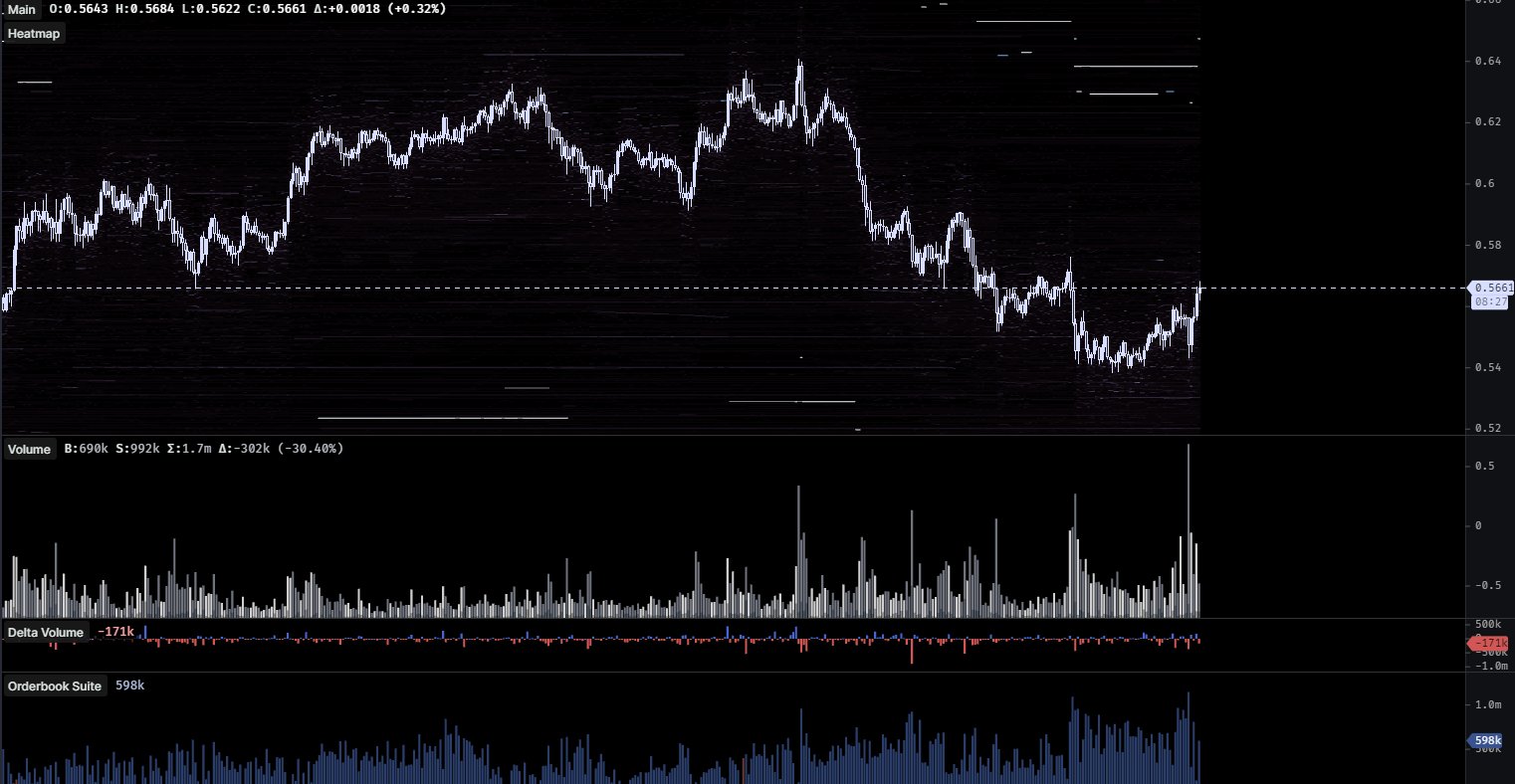

The analyst pseudonymously generally known as The Move Horse tells his 199,800 followers on the social media platform X that the decentralized synthetic intelligence platform for purposes Fetch.ai (FET) seems able to rally based mostly on rising open curiosity (OI) and buying and selling quantity.

OI is a metric that tracks the quantity of a crypto asset’s open leveraged lengthy and quick positions.

In accordance with the analyst, FET bulls are aggressively taking over the availability coming into the market utilizing leveraged lengthy positions.

“FET may be an honest bounce from right here. OI up on vendor absorption, excessive quantity into January lows with a reasonably skewed bid/ask.”

his chart, FET is on the verge of probably flipping the $0.56 degree into assist.

FET is buying and selling for $0.566 at time of writing, up greater than 4% within the final 24 hours.

Subsequent up, the dealer suggests that Bitcoin’s (BTC) halving occasion in April could also be extra bullish than prior occasions as a result of now BlackRock, the monetary large with about $9 trillion in property underneath administration (AUM), will doubtless promote it round their just lately launched spot BTC exchange-traded fund (ETF).

“This Bitcoin halving is completely different from another as a result of it’s the first time a trillion greenback asset supervisor will likely be advertising and marketing it.”

Bitcoin is buying and selling for $43,167 at time of writing, up barely within the final 24 hours.

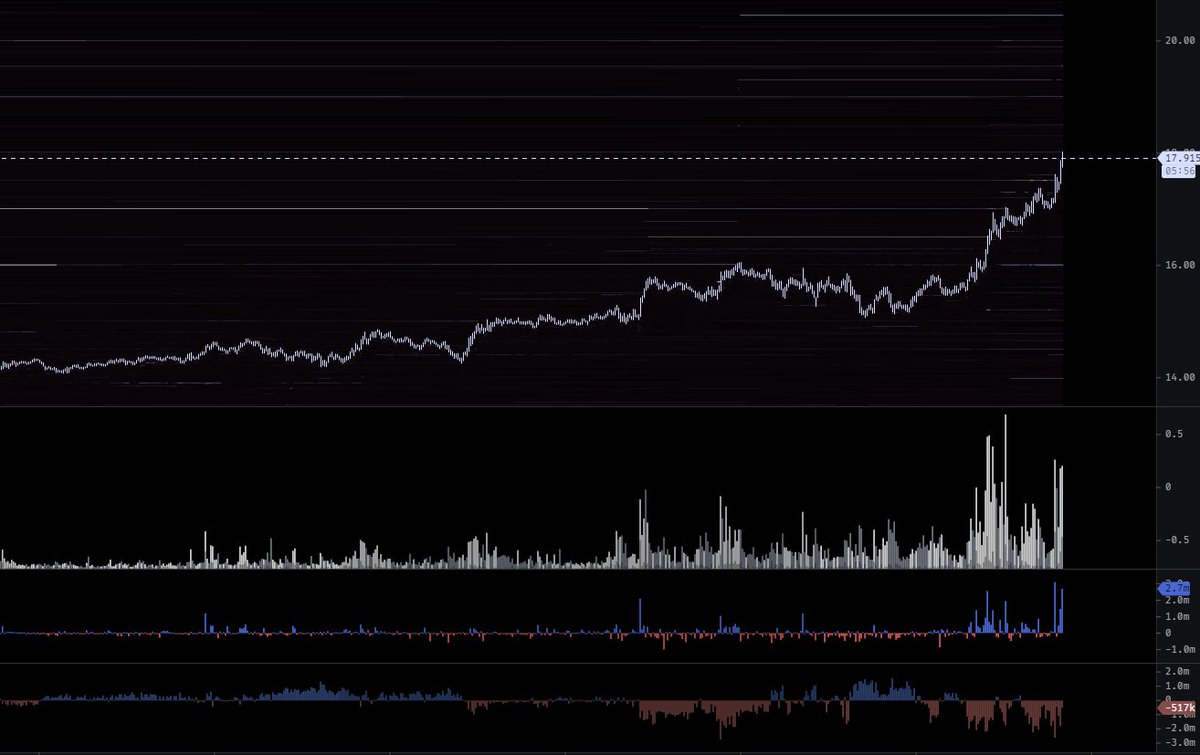

Subsequent on deck, the dealer says that the decentralized oracle supplier Chainlink (LINK) seems to stay in an uptrend because the token runs up in opposition to the $18 resistance degree.

“Spectacular continuation kind transfer. I feel I closed my LINK bag too early.”

LINK is buying and selling for $17.83 at time of writing, down barely within the final 24 hours.

Lastly, the dealer is popping bullish on the Solana-based decentralized alternate (DEX) aggregator Jupiter (JUP).

“Beginning to a purchase somewhat JUP. Mindshare is excessive and I feel negativity off the airdrop mechanics finally ends up creating an imbalanced public sale. Airdrop performs within the quick time period are fairly predictable…

VWAP (volume-weighted common worth) is your pal particularly in newly simply listed alts. JUP VWAP is already anchored from a catalyst which makes it very helpful. No matter what occurs long run, you already know that is going to supply a extremely good lengthy setup quickly.”

Merchants use the VWAP to assist them decide whether or not an asset is buying and selling underbought or overbought based mostly on its intraday worth motion.

Jupiter is buying and selling for $0.579 at time of writing, down greater than 3% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Price Action

Comply with us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Fortis Design/VECTORY_NT/PurpleRender