Bitcoin could also be organising for one more main push towards six-figure costs after reclaiming a key bullish sample and ending a interval of repeated draw back deviations. Based on well-known crypto analyst Rekt Capital, the current transfer places BTC again in place to purpose for the $160,000 goal, supplied it might maintain a vital help stage and break by means of evolving resistance.

Whereas short-term pullbacks are nonetheless doable, the broader technical picture stays intact. Historic worth conduct suggests Bitcoin remains to be in a powerful upward development, however time and worth pressures might quickly drive a choice level for the market.

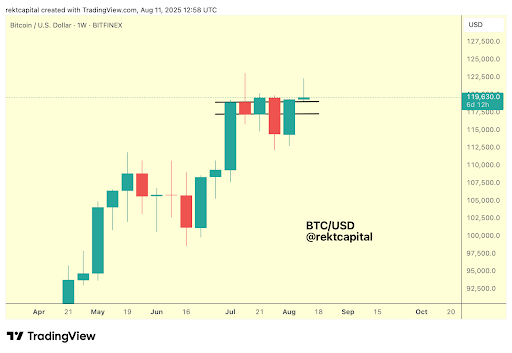

Bitcoin Bull Flag Breakout Revives Lengthy-Time period Bullish Outlook

Rekt Capital’s newest evaluation highlights that Bitcoin not solely reclaimed its Bull Flag sample however has positioned itself above it. That is a vital shift as a result of just a few weeks in the past, BTC failed to substantiate its breakout when it couldn’t maintain the Bull Flag prime. That earlier miss left the sample unresolved and stored the market unsure in regards to the subsequent huge transfer.

Associated Studying

By holding the $119,000 stage as new help, BTC can affirm the breakout and solidify the foundation for a rally. The analyst cautions that the worth might nonetheless dip again into the sample quickly, however so long as $119,000 holds, the bullish structure stays in play.

Ending the current draw back deviation provides to the optimism. A number of sharp deviations from bullish constructions have marked this cycle, however reclaiming and holding above the Bull Flag reveals renewed power from patrons. For long-term bulls, this may very well be the technical reset wanted to maintain the $160,000 target alive.

Key Resistance Ranges That Stand Between BTC And $160,000

Regardless of a current -9% dip, Bitcoin stays in what Rekt Capital calls “Worth Discovery Uptrend 2.” This part, which follows historical price tendencies, has stayed intact as a result of the dip by no means broke the uptrend’s construction or confirmed a breakdown. Nevertheless, the transfer into Week 6 of this uptrend is notable; traditionally, Weeks 5 and 6 have usually been the “hazard zone” for native tops.

Whereas historical past factors to a possible pause right here, the distinctive nature of this cycle could permit for an extension. Nonetheless, the decisive issue is now worth, not simply time. The analyst factors to resistance that first appeared round $124,000 in July however has since advanced right into a dynamic barrier nearer to $126,000.

Associated Studying

Breaking this stage within the subsequent one to 2 weeks might set off a pointy acceleration within the trend, placing the $160,000 roadmap again in focus. Then again, failure to clear $126,000 would create each time and price confluence for a pullback, which Rekt Capital calls “Worth Discovery Correction 2.”

Such a correction wouldn’t finish the long-term bullish case however would delay the following leg up. Till then, all eyes are on these key ranges: $119,000 for help and $126,000 for breakout. How Bitcoin handles them might resolve whether or not the grand roadmap to $160,000 stays on monitor within the weeks ahead.

Featured picture from Unsplash, chart from TradingView.com