After a robust breakout final week that pushed Bitcoin into a new all-time high of $118,667, the world’s main cryptocurrency seems to be taking a breather. As of the time of writing, Bitcoin is buying and selling round $117,953, barely beneath its latest peak. The transfer adopted a string of consecutive day by day good points as bullish momentum swept throughout the crypto business.

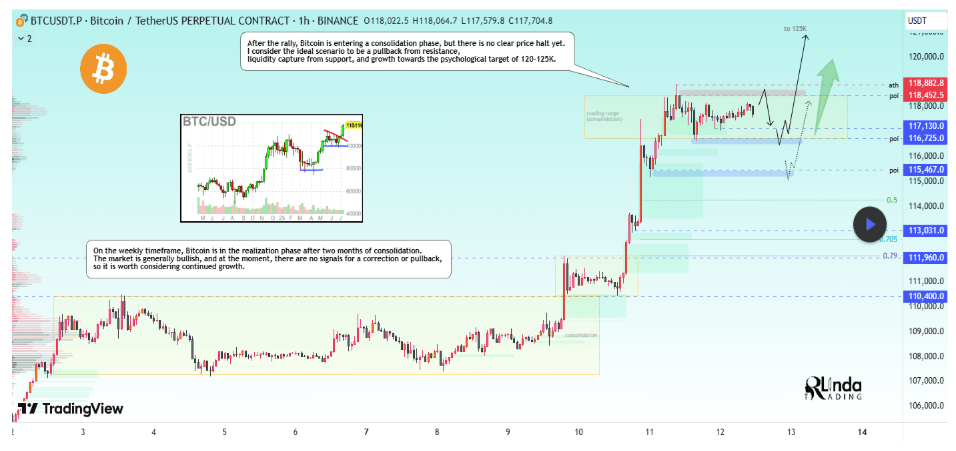

In a technical evaluation shared on the TradingView platform, crypto analyst RLinda identified two situations that will play out over the approaching days and weeks, relying on how Bitcoin reacts to close by resistance and assist ranges.

Associated Studying

Help Zones May Have an effect on Bitcoin’s Subsequent Massive Transfer

RLinda’s technical analysis begins with figuring out the importance of Bitcoin’s latest all-time excessive. Though Bitcoin has entered what appears to be a consolidation part, there’s no confirmed prime simply but. The market construction still favors bullish continuation, particularly contemplating Bitcoin is simply popping out of a chronic two-month consolidation zone and getting into a realization part.

In keeping with the 1-hour candlestick worth chart, Bitcoin is presently buying and selling simply above a assist space beneath $117,500. If Bitcoin fails to carry this zone, the main cryptocurrency might kick off a cascade of corrections that could drive the worth to $115,500, then probably to $114,300, and even again to the earlier all-time excessive of $111,800.

Under that, the 0.5 and 0.705 Fibonacci ranges round $113,031 and $111,960 respectively might act as short-term cushions. The final main defensive purchase zone is round $110,400, the place bulls might step in for a bounce. Mainly, what this implies is that if Bitcoin loses the assist stage at $115,500, it might slip again to $110,000 earlier than encountering one other sturdy purchase assist zone.

Image From TradingView: RLinda

Bitcoin To $125K, However It Should Breach Resistance First

However, Bitcoin can nonetheless push above $118,000 and enhance to $125,000, however solely beneath sure situations. The situation of the rally’s continuation relies upon totally on Bitcoin registering a decisive day by day shut above $118,400 and $118,900. In her phrases, a day by day shut above these worth ranges would trace at a “breakout of construction.” This, in flip, would affirm a transition from consolidation into another impulsive phase upward.

In essence, both the bearish and bullish outlooks rely on how Bitcoin reacts at any of the necessary zones, both assist at $116,700 or resistance above $118,400 earlier than making a directional transfer. Nevertheless, it is very important word that the consolidation after final week’s rally might final for weeks and even months, very like we’ve seen in earlier rallies this cycle.

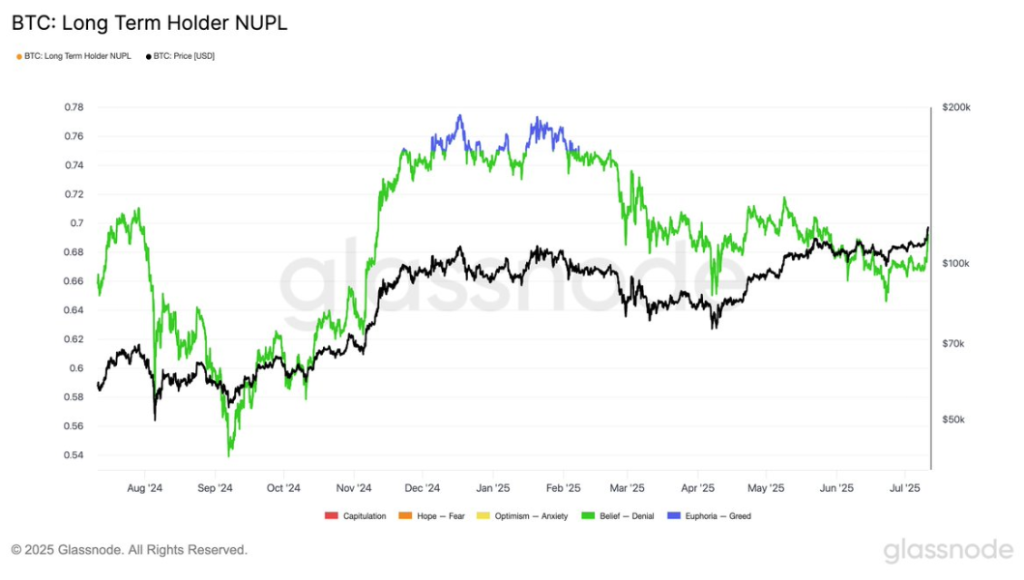

In keeping with the Lengthy-Time period Holder Web Unrealized Revenue and Loss (NUPL) metric from Glassnode, Bitcoin’s present stage of long-term profitability sentiment is at 0.69. That is notably beneath the 0.75 mark related to euphoric market situations, regardless of Bitcoin having simply printed a brand new all-time excessive.

Associated Studying

Bitcoin spent round 228 days above the 0.75 euphoria threshold within the earlier bull market cycle. In distinction, this present cycle has solely seen about 30 days above that stage, which suggests long-term holders haven’t but totally exited into revenue and the main cryptocurrency hasn’t reached overheated situations.

Featured picture from Unsplash, chart from TradingView