A dealer who continues to construct a following with well timed calls on Bitcoin (BTC) and altcoins is issuing a warning on the broader crypto market.

Crypto analyst Benjamin Cowen tells his 1 million followers on the social media platform X that he sees Bitcoin breaking assist at $100,000.

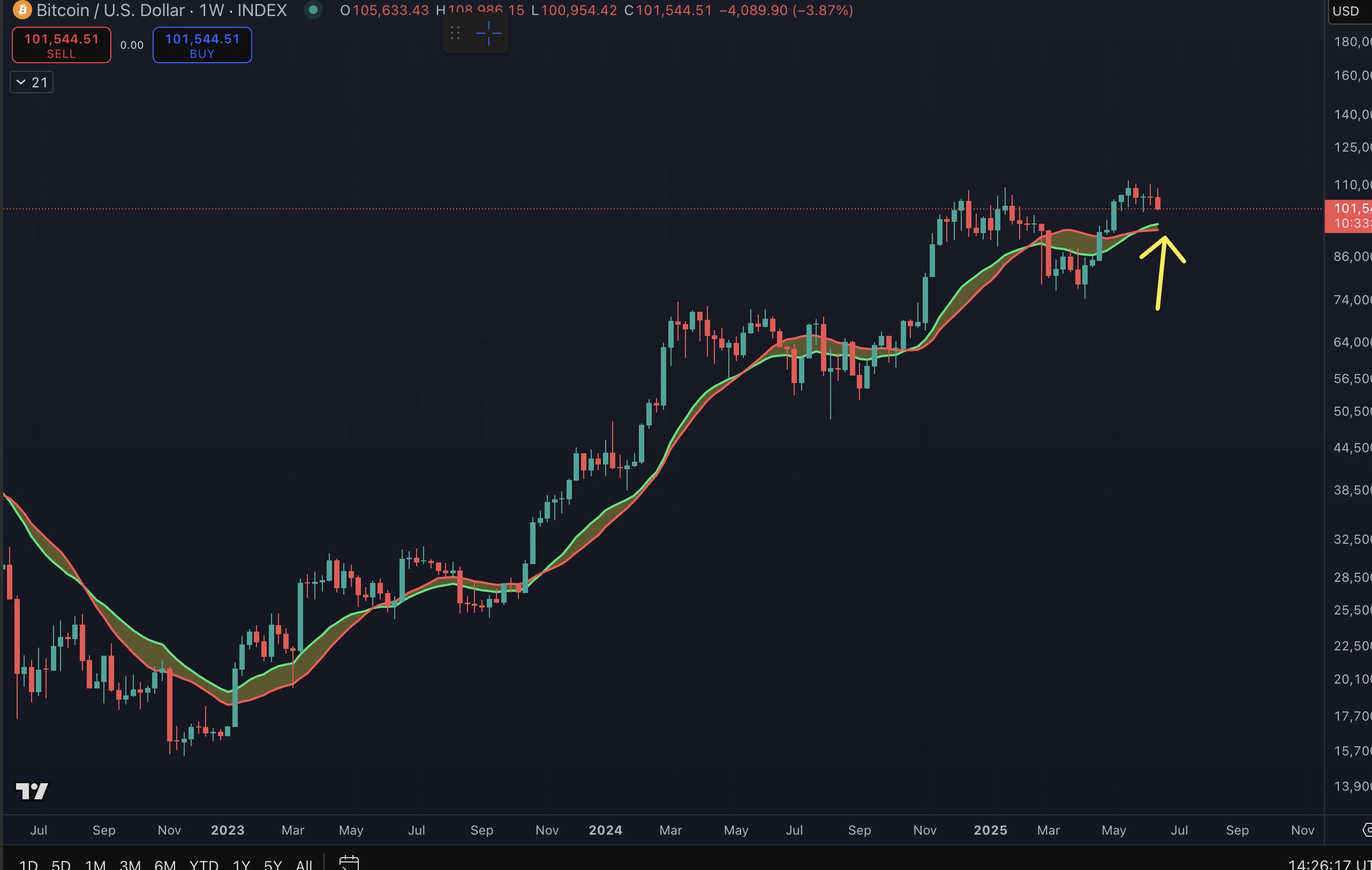

“Will possible see BTC again at its bull market assist band quickly, again within the mid-$90,000 vary.”

The bull market assist band is fashioned by the 20-week easy shifting common (SMA) and the 21-week exponential shifting common (EMA).

The analyst says his prediction relies on Bitcoin’s worth motion within the final two years, when Bitcoin began to roll over and gave up positive aspects within the third quarter.

“I’ve talked about for some time on Youtube that Bitcoin would possible begin exhibiting some weak point round mid-June because the Q3 weak point begins to current itself.

The identical factor occurred the final couple of years.

I feel the following low is round August/September.”

At time of writing, Bitcoin is buying and selling for $105,092.

Trying on the altcoin market, Cowen warns that his anticipated Bitcoin correction will set off a brutal capitulation occasion for alts.

“It could be lastly time to tear the band-aid off for ALT / BTC pairs.

To the vary lows!”

A bearish altcoin versus Bitcoin chart signifies that alts are dropping worth quicker than BTC.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney