A high-stakes wager has landed a crypto dealer within the headlines. He’s identified on-line as James Wynn, and he’s positioned virtually $1 billion on Bitcoin rising additional. He began piling right into a bullish place final week and hasn’t stated when he plans to exit.

Bitcoin Bets Hit Billion Greenback Mark

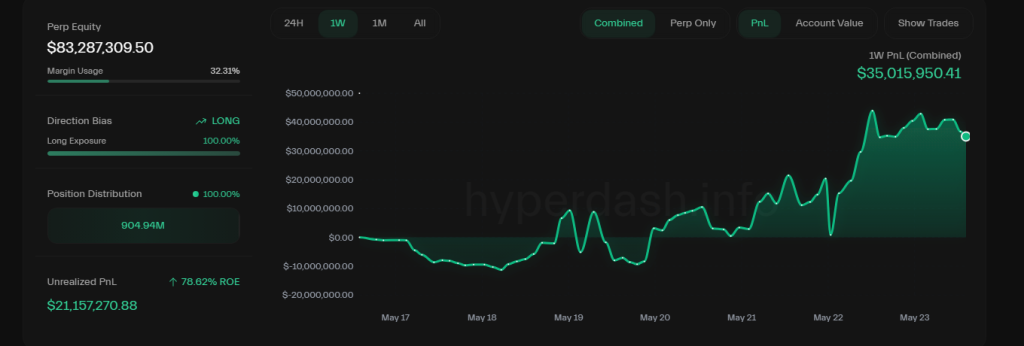

In accordance with Wynn’s posts on X, his place reached about $1 billion on Might 21. He’s utilizing $20 million of his personal funds and borrowed to make the commerce roughly 40 occasions greater than his stake. The wager sits on Hyperliquid, a decentralized trade the place merchants can open perpetual futures positions. Wynn has already closed a part of it, trimming the scale to only over $800 million as Bitcoin climbed.

Lookonchain information reveals he jumped in round a BTC value of $108,084 and set his “kill change” just under $103,640—so if Bitcoin dips that far, the entire commerce goes bye-bye. As of early Thursday, that wager was sitting on a cool $40 million in unrealized positive aspects.

Supply: HyperDash

Dealer’s Previous Success With Memecoin

Wynn didn’t emerge from nowhere. In 2023, he predicted the Pepe memecoin would hit a $4.2 billion market worth. That wager paid off in an enormous means when Pepe peaked at greater than $11 billion in December 2024. A pockets tied to “jwynn.eth” even despatched $7 million of Pepe tokens to Binance in Might 2024. Based mostly on reviews, that transfer helped him pull in eight-figure positive aspects.

Bitcoin simply broke via $111,900!

High dealer @JamesWynnReal‘s 40x leveraged lengthy place of 10,200 $BTC($1.14B) is now sitting on an unrealized revenue of over $39M!https://t.co/Xy0EC0h5Cw pic.twitter.com/5UlbeiA984

— Lookonchain (@lookonchain) May 22, 2025

Large Danger Tied To Value Drop

His commerce isn’t with out hazard. If Bitcoin falls under $100,850, the place might be worn out. Wynn has stated he’d add more cash slightly than face liquidation. In turbulent markets, minor declines could be the set off for cascade-like compelled liquidations. Any substantial sum of money put into the market begs the query: If costs had been to shift just some % in both route, would critical losses be incurred?

Market Logic Favors This Transfer

Reportedly, the Might probabilities of Bitcoin hitting $115,000 are pegged at 64% or thereabouts, as per Polymarket. Commonplace Chartered’s Geoff Kendrick additionally has a bullish view. He predicts Bitcoin might high $120,000 earlier than the top of July. These forecasts line up with Wynn’s personal goal of $115,000–$118,000 by the top of subsequent week, and even $118,000–$122,000 shortly after.

Replace on my little $BTC lengthy place.

Decreased place dimension as we speak, took some earnings round $110k -$111k.

Appeared like a pleasant spot to TP, and appears others are doing the identical proper now.

In my view bitcoin is dying to breakout greater. My goal stays the identical of… pic.twitter.com/BUfWTuqpoU

— James Wynn ???? (@JamesWynnReal) May 22, 2025

Positioning In A Shaky Market

Bitcoin had reached about $111,800 on Might 22, 2025, earlier than the slight pullback. Merchants pointing at speedy positive aspects additionally warn of fast drops. On decentralized exchanges, the funding-rate prices may add up. Massive orders on Hyperliquid may face slippage, which might transfer the market in opposition to Wynn ought to he attempt to unwind too rapidly.

Folks see the trades and suppose its some excessive degree silly playing kinda shit, and sure it’s. However it’s backed by my very own thesis. Which in flip, is a calculated danger.

Since native backside of 74k bitcoin has remained on this channel. Touching the underside appearing as assist simply two… pic.twitter.com/wenpkcWKrG

— James Wynn ???? (@JamesWynnReal) May 20, 2025

Calm Phrases From A Danger-Taker

“Folks see this as high-level playing, and sure it’s,” Wynn stated. He added that his bets relaxation on what he calls a strong thesis. Whether or not he’s proper or fallacious stays to be seen. For now, his willingness to danger massive sums has drawn each admiration and warning from onlookers.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.