The worth of Bitcoin has been fairly bubbly over this weekend, surpassing the $85,000 mark on Saturday, April 19. This constructive single-day efficiency caps off what has been a comparatively secure previous seven days of worth motion for the premier cryptocurrency.

Nonetheless, the price of BTC continues to be far beneath the cycle highs, with the market chief presently greater than 21% away from its all-time excessive. With the Bitcoin worth caught in a broader consolidation vary, buyers seem like shedding persistence with the world’s largest cryptocurrency.

Are Bitcoin Buyers Promoting Once more?

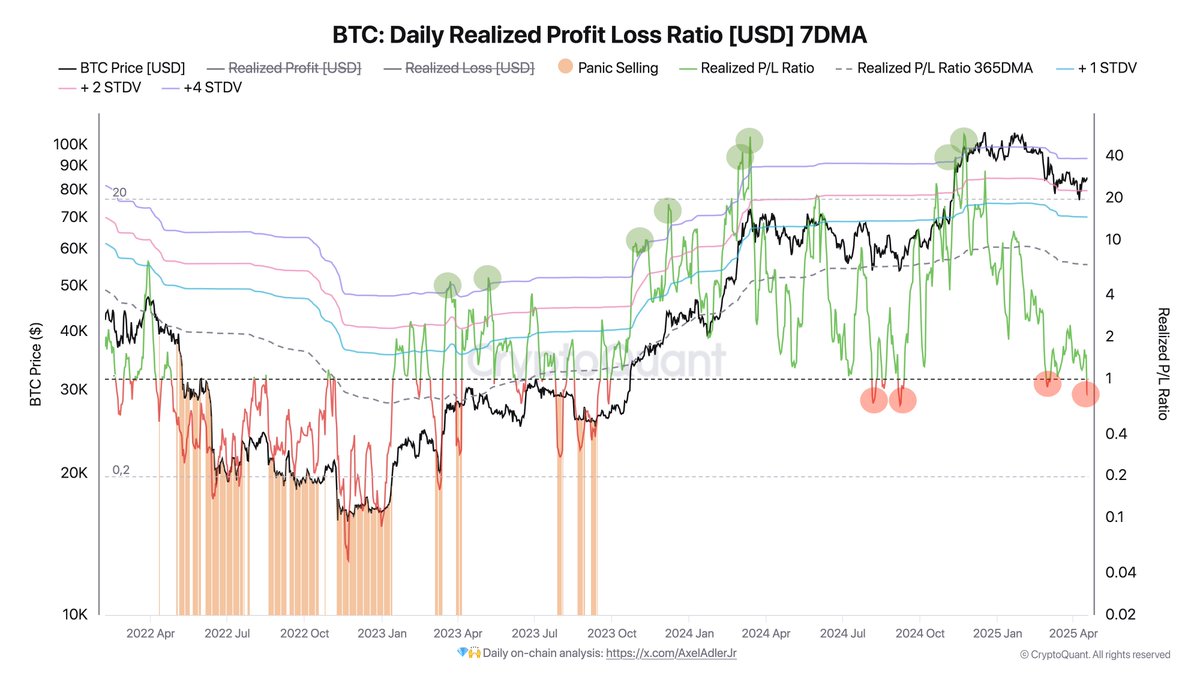

Of their newest publish on the X platform, on-chain analyst with the pseudonym Darkfost revealed that a number of BTC buyers have resumed offloading their property at a loss. The related indicator right here is the Bitcoin Day by day Realized Revenue Loss Ratio, which estimates whether or not extra buyers are promoting at a revenue or a loss.

This revenue/loss ratio is calculated by dividing the overall realized earnings by the overall realized losses over a particular interval. When the metric is above 1, it signifies that extra buyers are promoting in a revenue than at a loss. In the meantime, a less-than-one worth for the indicator means that extra buyers are reducing their losses.

Supply: @Darkfost_Coc on XAs proven within the chart above, the Bitcoin Day by day Realized Revenue Loss Ratio has been above 1 for a number of previous weeks. Nonetheless, the metric not too long ago fell — for the second time in 2025 — beneath the important thing threshold, signaling that almost all of buyers are realizing their losses.

In accordance with Darkfost, the present stage of the indicator is but to point full-scale market capitulation, however moderately a phase of uncertainty and probably accumulation. The on-chain analyst additionally talked about that the metric’s present structure is much like the construction seen in late 2024.

Darkfost, nevertheless, famous that this doesn’t essentially imply that the premier cryptocurrency will witness the identical consequence from this case. When the Bitcoin Day by day Realized Revenue Loss Ratio fell to this stage in 2024, the BTC worth launched into a worth rally above the $100,000 stage.

Darkfost added:

We are able to additionally observe that each time the ratio reached the +4 STDV deviation from the 365DMA, a neighborhood market prime constantly fashioned, adopted by a short-term correction throughout bull section.

The on-chain analyst concluded that, given the excessive stage of uncertainty within the crypto market in current weeks, the extra possible consequence from this case is a capitulation section, the place realized losses will proceed to climb.

Bitcoin Value At A Look

As of this writing, the price of BTC stands at round $85,300, reflecting a 0.8% improve prior to now 24 hours.

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.