- SEC pushed the choice on ETH ETF staking and in-kind redemption to June 2025.

- The regulator has met with key gamers, together with BlackRock, relating to the above points.

The U.S. Securities and Trade Fee (SEC) has delayed choices on staking and in-kind redemption for Ethereum [ETH] ETFs (exchange-traded funds).

The company sought extra time on the staking software on two Grayscale spot ETH ETFs. Because of this, the deadline has been prolonged to the first of June. The issuer made the application in February.

What’s subsequent for ETH ETFs

Others like Bitwise, VanEck, 21Shares, Constancy, Invesco Galaxy, and Franklin Templeton had utilized for related staking provisions for his or her respective ETH ETF merchandise.

As of this writing, solely BlackRock has not utilized for a similar. However Robert Mitchnick, BlackRock’s head of digital belongings, had publicly acknowledged the advantage of staking for the merchandise.

The regulator additionally delayed choices on in-kind creation and redemption for ETH ETFs and BTC ETFs. In-kind redemption, not like present money settlements demanded by Gary Gensler-led SEC, ensures the usage of underlying belongings like ETH or BTC.

The in-kind technique avoids taxable occasions and enhances liquidity. The regulator pushed the in-kind determination deadline to third June.

That stated, the SEC’s crypto process drive has held roundtable discussions with key gamers, together with Jito, MultiCoin Capital, and BlackRock, about crypto ETF staking and in-kind redemption.

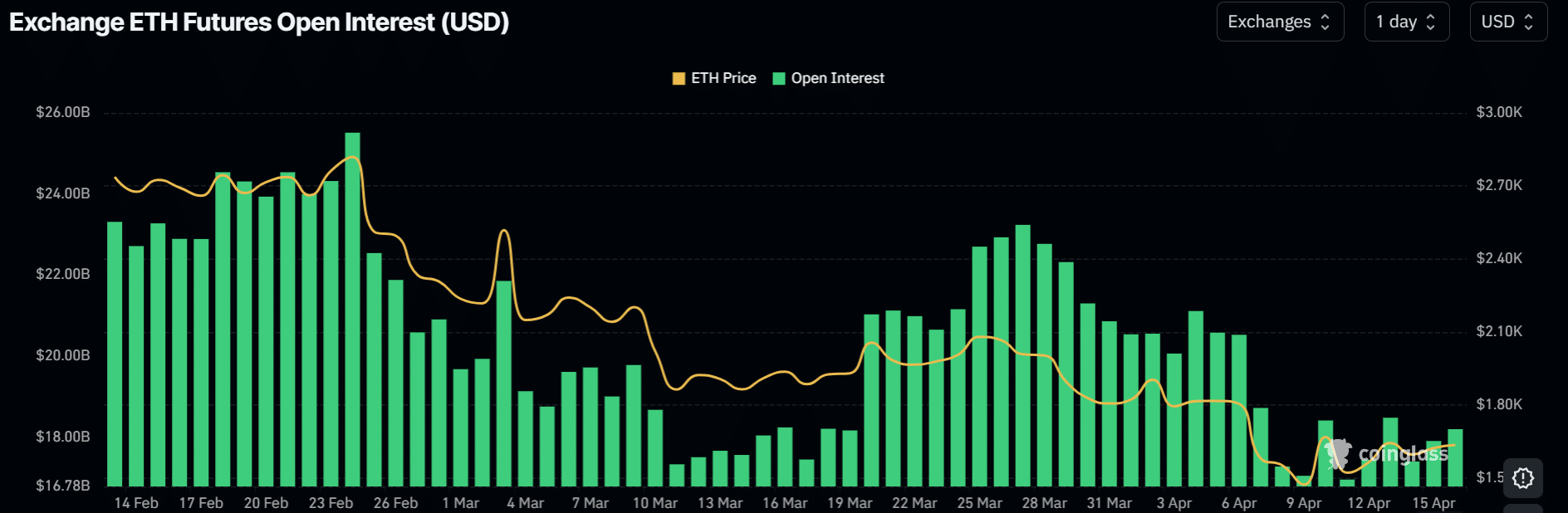

In the meantime, the replace didn’t spur any change in ETH’s speculative curiosity. In response to Coinglass knowledge, Open Curiosity (OI) has been on a decline since February, dropping from almost $26B to under $20 billion.

This meant that the bearish sentiment continued even after the replace.

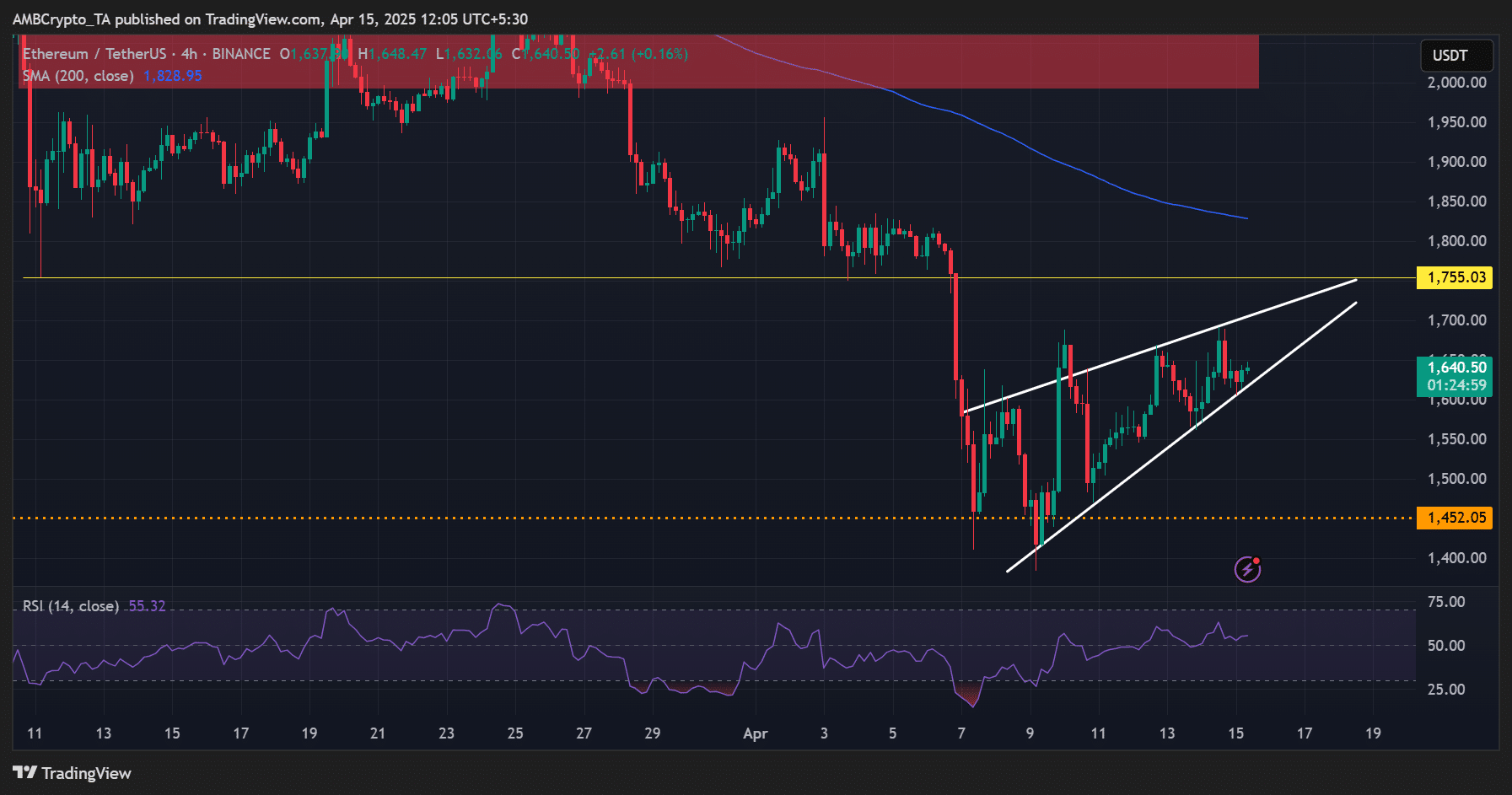

On the 4-hour value chart, ETH chalked a bearish rising wedge, which might drag it under $1500 once more if the sample is validated. Nonetheless, reclaiming $1.8K might permit bulls to advance additional.