- Over 18,000 Bitcoin from short-term holders bought amid macro volatility.

- Trump’s tariff shock highlighted Bitcoin’s sensitivity to macroeconomic headlines.

Bitcoin [BTC] markets confronted main turbulence between the third and the 4th of April as long-dormant cash moved, alternate inflows surged, and costs dropped sharply.

The catalyst behind this market unrest was U.S. President Donald Trump’s sweeping tariff announcement, which rattled international threat property.

What’s behind Bitcoin’s fast response?

To not point out, Bitcoin responded swiftly—falling from $88,500 to $81,000 earlier than recovering close to $83,000, on the time of writing. Apparently sufficient, a notable pattern was noticed.

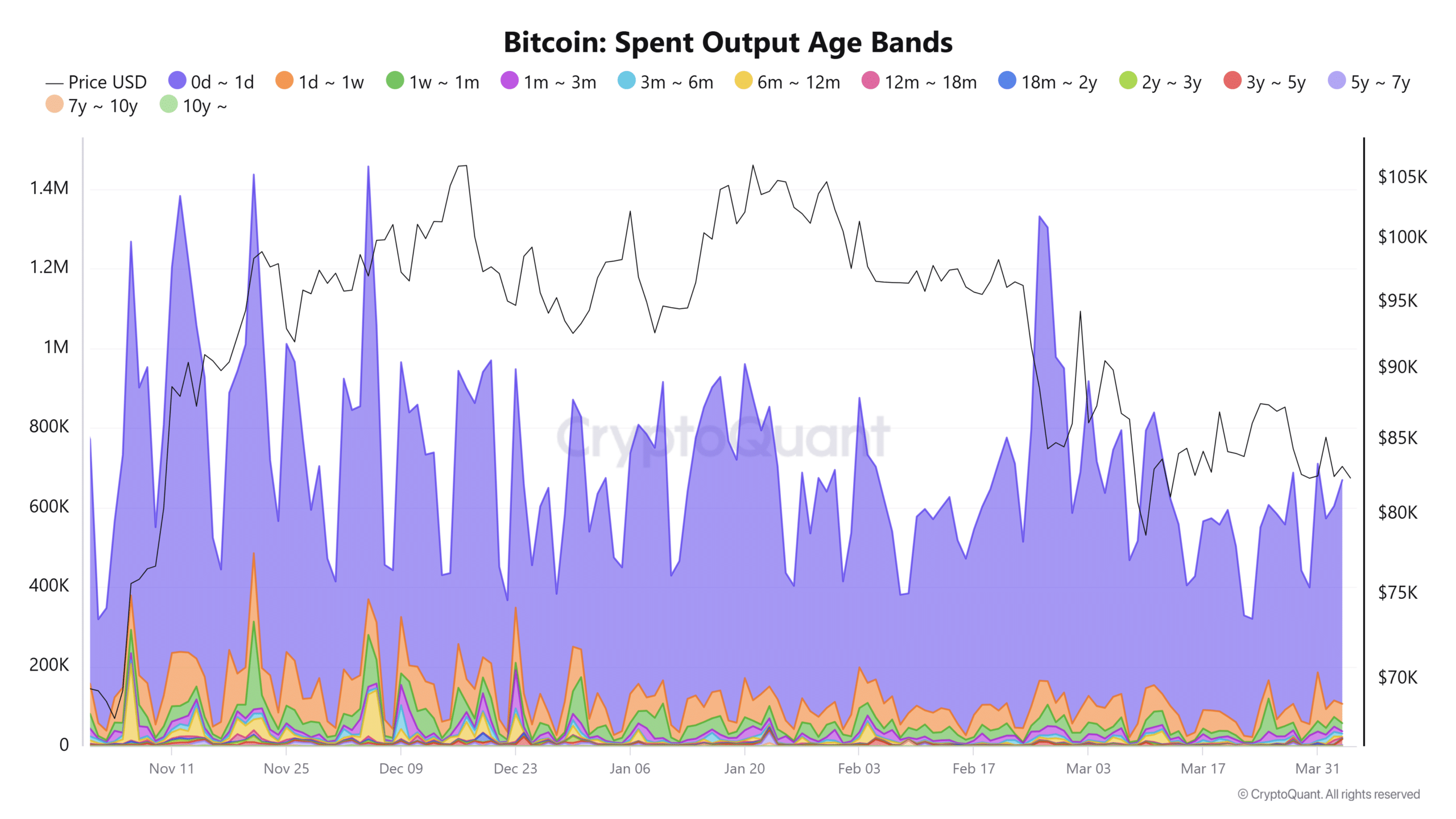

Lengthy-term holders started to maneuver dormant cash, whereas short-term holders contributed to a flurry of sell-side exercise.

In truth, over 1,057 BTC aged between 7 and 10 years had been spent for the primary time in years.

The calm earlier than the storm? Bitcoin value settles amid chaos

This exercise pushed the Spent Output Age Bands above the 50 threshold.

In the meantime, Bitcoin’s value hovered between $82.6K and $83.8K, suggesting long-term holders had been both taking income or reacting to macro uncertainty. However the exercise wasn’t restricted to outdated arms.

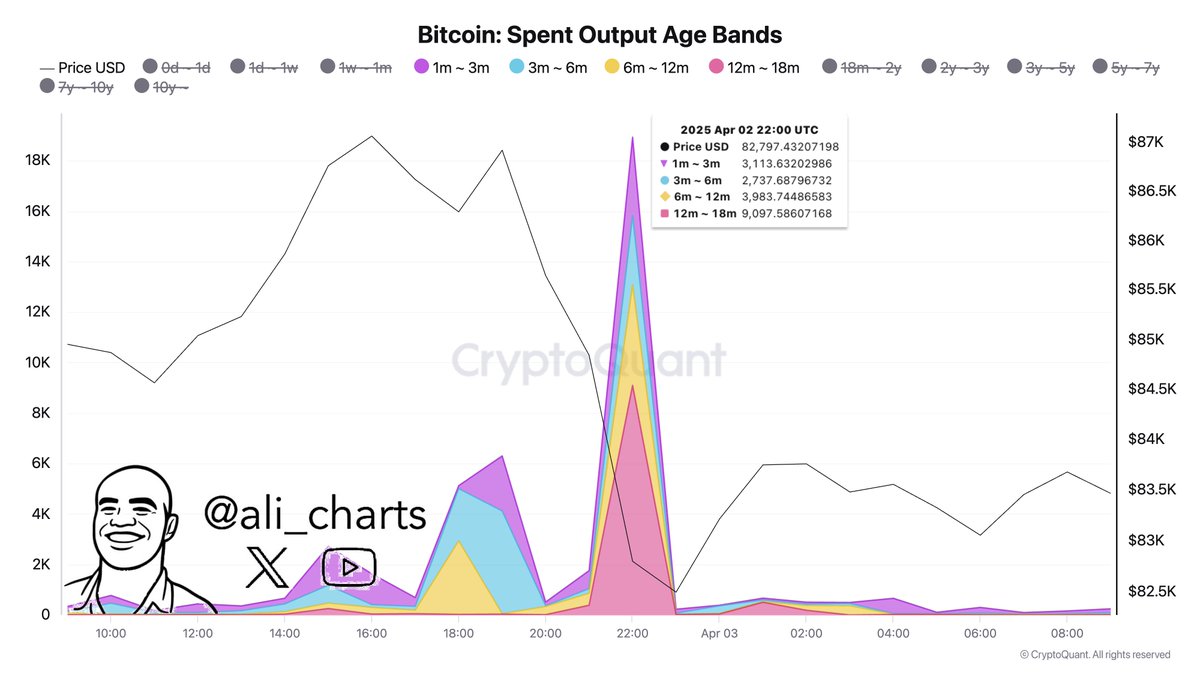

It was confirmed that over 18,930 BTC from holders aged 1 month to 18 months had been moved on-chain. These coordinated actions mirrored not simply panic promoting however a broader market response to exterior information.

Are huge gamers making ready to exit?

In fact, in conjunction to this, a number of alternate confirmed {that a} single block recorded an influx of two,500 BTC into exchanges, primarily Coinbase. This means massive holders had been making ready to promote.

Following the tariff information, Coinbase registered unusually excessive deposit volumes from whale wallets, some transferring between 10–100 BTC in a single transfer.

These inflows instantly aligned with Bitcoin’s sharp drop from $88.5K to $81K, confirming that capital was transferring to exchanges, not chilly storage—usually a bearish indicator.

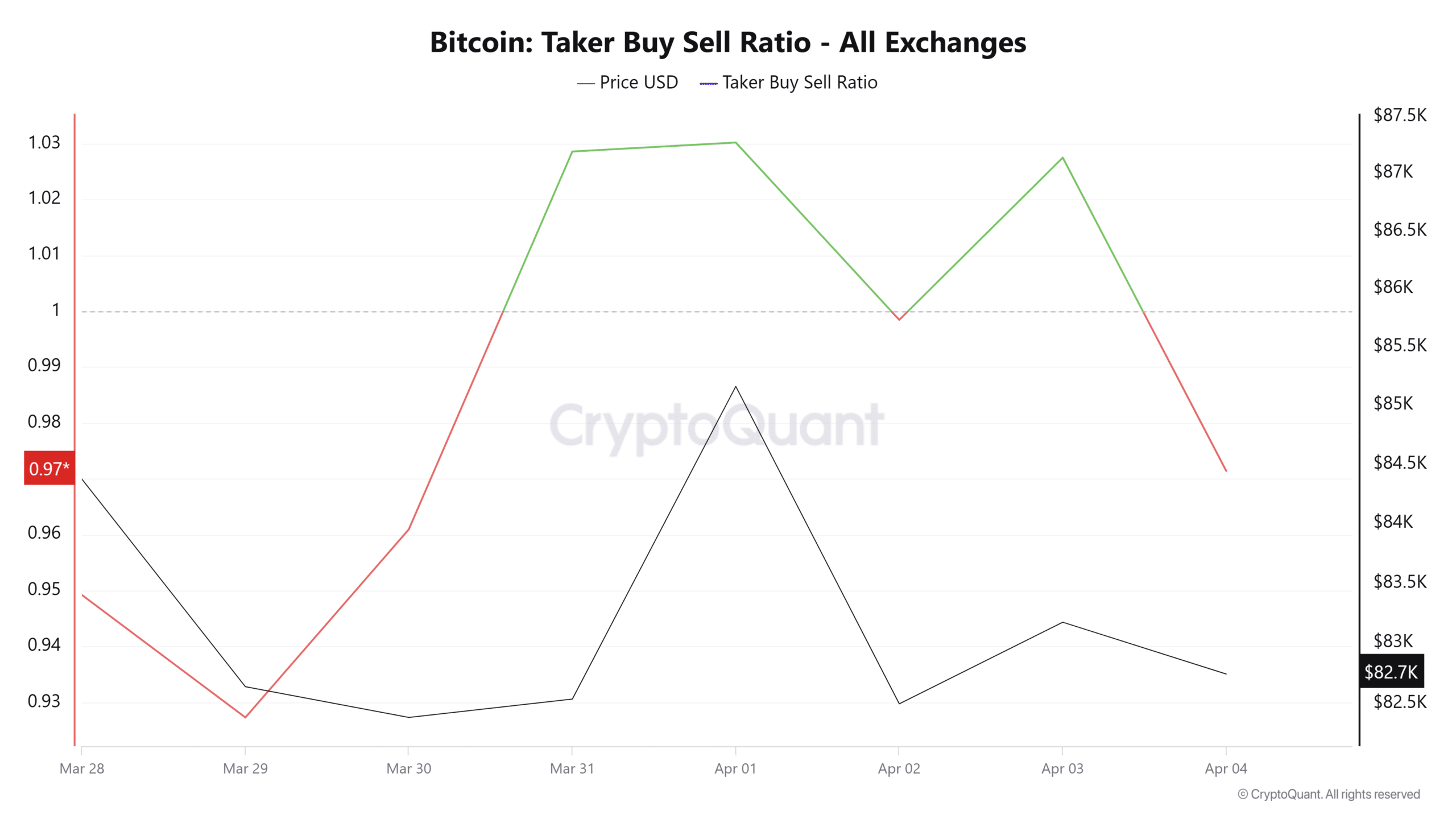

Amid the sell-off, an anomaly surfaced on derivatives alternate Bybit.

The Taker Purchase/Promote Ratio spiked to five.3. Seemingly, it’s a surge in aggressive patrons inserting market buys, closely outpacing sellers.

Placing all of it collectively, the market moved in unison.

Bitcoin markets noticed synchronized motion throughout all holder cohorts, triggered by Trump’s tariff announcement.

The uncommon presence of dormant cash, paired with ongoing high-frequency promoting from newer entrants, created an ideal storm that pushed costs decrease earlier than stabilizing.

How Trump’s tariff take a look at highlights crypto’s sensitivity

Zooming out, Trump’s tariff shock laid naked Bitcoin’s reflex to macro stress—speedy outflows, dormant cash transferring, and speculative swings.

But not all indicators had been bearish. Analysts at Reuters noted that such geopolitical instability might result in greenback weakening, probably driving future demand for Bitcoin as a non-sovereign hedge.

Nonetheless, for now, the charts level to short-term worry and positioning changes, not systemic adoption.