Ethereum (ETH) has been below intense promoting strain, elevating considerations amongst buyers concerning the coming weeks. The pattern stays bearish, and if this momentum continues, ETH may battle to seek out help at key ranges. In comparison with Bitcoin and different altcoins, ETH has been underperforming, fueling a adverse outlook amongst merchants.

In contrast to earlier market cycles the place ETH moved in sync with Bitcoin, current worth motion suggests a disconnect between the 2 belongings. Key metrics from IntoTheBlock reveal that ETH stays largely uncorrelated to BTC, exhibiting a 30-day worth correlation of simply -0.06. This lack of correlation signifies that Bitcoin’s bullish momentum hasn’t translated into power for ETH, including to investor uncertainty.

With Ethereum lagging behind different main cryptocurrencies, analysts warn that additional draw back is feasible until ETH can reclaim important resistance ranges. The market is intently watching whether or not ETH can discover help and reverse this underwhelming worth motion or if the bearish pattern will proceed within the coming weeks. As ETH struggles to regain momentum, buyers stay cautious, ready for a clearer sign earlier than making their subsequent transfer.

Ethereum Correlation With The Market

Ethereum has been caught in a downtrend since late December, dropping over 28% from its native excessive of $4,100. Regardless of Bitcoin’s bullish momentum, ETH has failed to achieve traction, leaving buyers involved about its underwhelming worth motion. Many at the moment are speculating whether or not Ethereum may face one other disappointing 12 months, as altcoins like Solana, Avalanche, and Polygon proceed to outperform ETH by way of worth motion and investor curiosity.

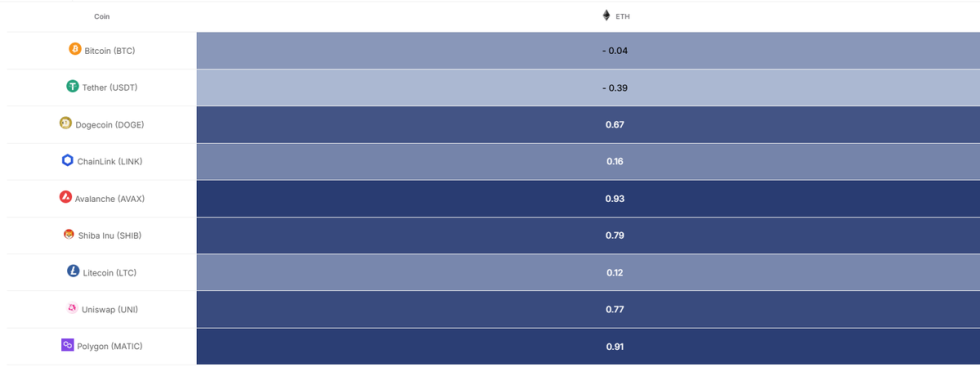

Key metrics from IntoTheBlock present an attention-grabbing perception into Ethereum’s market conduct. In contrast to in earlier cycles the place ETH intently adopted BTC, it now seems largely uncorrelated, with a 30-day worth correlation of simply -0.06.

Which means that whilst Bitcoin strikes increased, Ethereum has struggled to achieve momentum. Nonetheless, different main belongings like Polygon (0.91) and Avalanche (0.93) stay intently correlated, suggesting that ETH’s worth motion is exclusive on this cycle.

Wanting forward, February could possibly be a pivotal month for Ethereum. Traditionally, this has been a bullish interval for ETH, and lots of buyers are hoping for a pattern reversal. If ETH can break key resistance ranges and reclaim misplaced floor, the sentiment round its efficiency this cycle may shortly shift. Nonetheless, failure to achieve momentum may result in continued stagnation, permitting different altcoins to take the highlight.

Ethereum Struggles Under Key Assist As Bears Take Management

Ethereum is buying and selling at $3,090 after failing to carry above the 200-day Exponential Transferring Common (EMA) at $3,137. This key degree was a vital help zone for bulls, however now that it has been misplaced, bearish strain is mounting.

Bulls are in hassle, as the value motion suggests ETH is gearing up for one more leg down. If this promoting strain continues, ETH may set a brand new native low and take a look at decrease demand across the $2,900 mark. A breakdown under this degree would sign a deeper correction, doubtlessly resulting in prolonged consolidation or additional declines.

For Ethereum to regain momentum, bulls should reclaim the $3,300 degree and push increased. This zone has acted as a robust resistance in current weeks, and flipping it into help would affirm a pattern reversal. Nonetheless, if ETH fails to reclaim this mark, the subsequent important degree to look at is under $3,000, the place extra shopping for curiosity might emerge.

With market sentiment leaning bearish, ETH should maintain above key demand zones to keep away from a extra important downturn. If bulls can’t step in quickly, Ethereum may proceed to lag behind Bitcoin and different high altcoins.

Featured picture from Dall-E, chart from TradingView