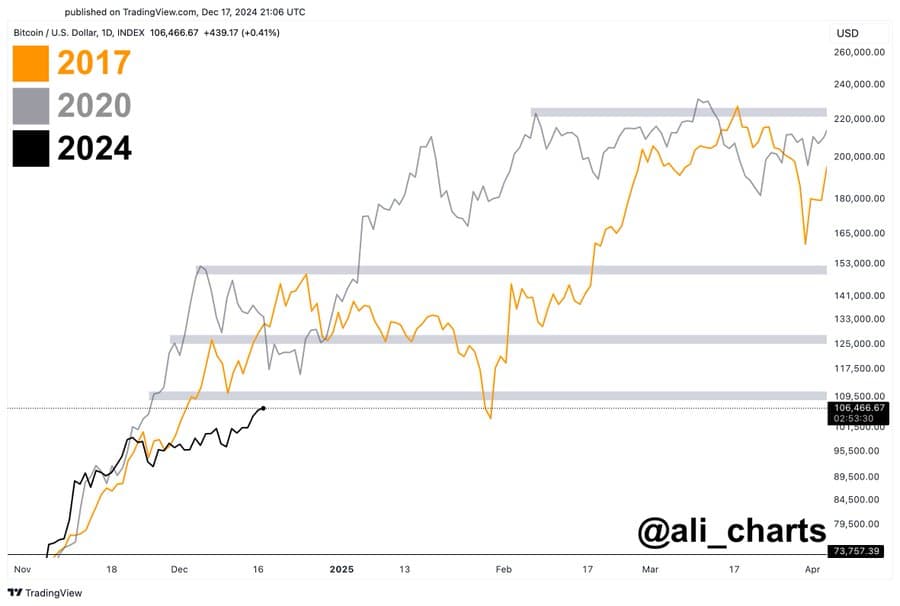

- BTC seemed to be following the trajectory of the earlier bullish cycles of 2017 and 2020, probably setting the stage for a major value surge.

- Lengthy-term holders have been anticipated to play a pivotal function on this part, contributing to upward value momentum.

Bitcoin’s [BTC] has maintained its place above the psychological degree of $100,000 for a number of days, regardless of broader market declines following its all-time excessive of over $108,000.

Over the previous week, BTC has struggled to maintain its month-to-month profitability, posting a modest achieve of 0.64%. Within the final 24 hours, it recorded a 2.05% enhance.

In keeping with AMBCrypto, these fluctuations might be a part of a broader rally, as BTC strikes towards establishing new report highs.

BTC to $220,000: A cautious journey forward

BTC was mirroring the historic patterns of its 2017 and 2020 bullish cycles, suggesting a possible market peak at $220,000, based on crypto analyst Ali Chart.

As BTC follows this trajectory, it’s anticipated to come across three key resistance ranges, the place promoting stress could come up earlier than resuming its upward momentum.

The continued market decline seems to align with this broader construction, progressing towards these crucial zones.

Ali Chart outlined the potential value milestones:

“If Bitcoin (BTC) behaves like in 2017 and 2020, there can be a short correction after reaching $110,000, a steep correction after hitting $125,000, an enormous correction at $150,000, and the top of the bull market at $220,000!”

AMBCrypto evaluation signifies that these corrections will possible be influenced by long-term holders, who’re at the moment contributing to BTC’s downward motion.

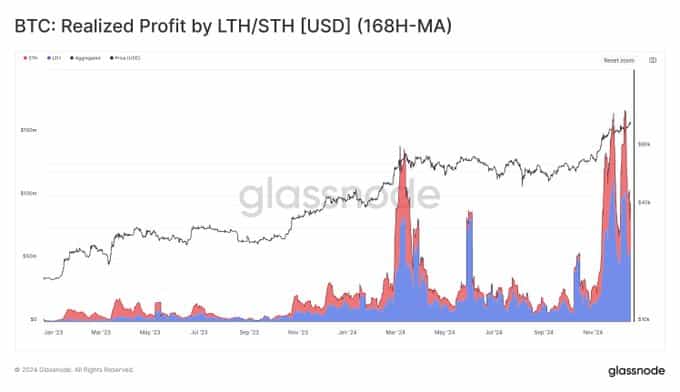

Lengthy-term holders drive distribution available in the market

In keeping with Glassnode, market distribution patterns shifted notably after BTC reached a brand new excessive, crossing into the $90,000 vary in mid-November.

Throughout this era, long-term holders (LTHs) initiated a considerable sell-off, taking earnings and driving market exercise. This sell-off accounted for 54% to 70% of the buying and selling quantity, equating to $73–$117 million per hour.

Notably, a particular market section has been on the forefront of this profit-taking pattern.

Additional evaluation reveals that exercise is basically pushed by BTC holders who’ve held their positions for six to 12 months. This group, a lot of whom accrued over the past market cycle, has been accountable for almost all of profit-taking in latest weeks.

The Spent Output Revenue Ratio (SOPR) for this 6–12 month cohort mirrors patterns noticed in the course of the 2015–2018 bull market. At the moment, the SOPR remained beneath 2.5 all through vital parts of the cycle.

If historical past repeats itself, BTC may quickly enter an exhaustion part the place profit-taking slows and shopping for exercise resumes. This shift would possible result in a renewed rally in BTC costs, as seen in earlier cycles.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto notes that profit-taking and exhaustion patterns could persist as BTC hits new value milestones.

These phases are anticipated to set off corrective strikes earlier than additional rallies. Potential value corrections may happen at key ranges, together with $110,000, $125,000, and $150,000.