- With elevated adoption, Bitcoin’s on-chain knowledge confirmed a “native” backside at $90K.

- Nonetheless, breaking $99K amid macro volatility requires strong groundwork.

Inflation within the U.S. rose barely in October, ticking up by 0.2% month-to-month, spooking the inventory markets. The S&P 500 snapped its seven-day successful streak because the “Trump dump” that adopted the election started to fade.

In distinction, Bitcoin [BTC] diverged from U.S. indexes, climbing over 4% to shut at $95,883. This rebound got here after 4 straight days of losses following its file excessive of $99,317.

Whereas Bitcoin’s Trump-related rally fizzled out over every week in the past, the asset’s resilience amid growing financial uncertainties – notably fears of rising consumption prices as a result of excessive tariffs – stands out.

This worth motion, simply earlier than Thanksgiving, has sparked hypothesis. U.S. buyers might maintain their buying and selling urge for food to push BTC again to $99K.

Nonetheless, this bullish speculation awaits affirmation from convincing on-chain knowledge.

BTC on-chain knowledge alerts backside formation

Not like the March cycle, when greed soared previous 90, this time the index has stayed under this threshold. Nonetheless, the prevailing euphoria presents a major alternative for strategic buyers to safe income. Traders may exit as millionaires or billionaires throughout this era.

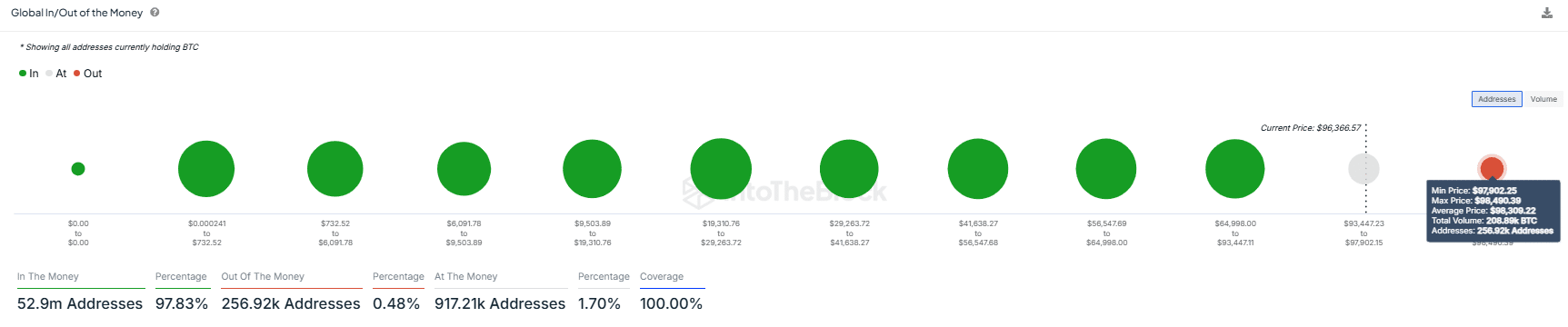

Moreover, with the “Trump commerce” settling, roughly a million BTC, acquired at a median worth of $93,447 by 917K wallets, are banking on bullish on-chain knowledge to validate their dedication to the $100K goal.

Bitcoin’s resilience amid inflationary pressures hints at a possible backside forming close to $90K, a degree briefly examined as short-term holders offloaded their positions.

This might create a robust baseline for contemporary FOMO, doubtlessly incentivizing long-term dedication and setting the stage for a brand new rally, as illustrated within the chart under.

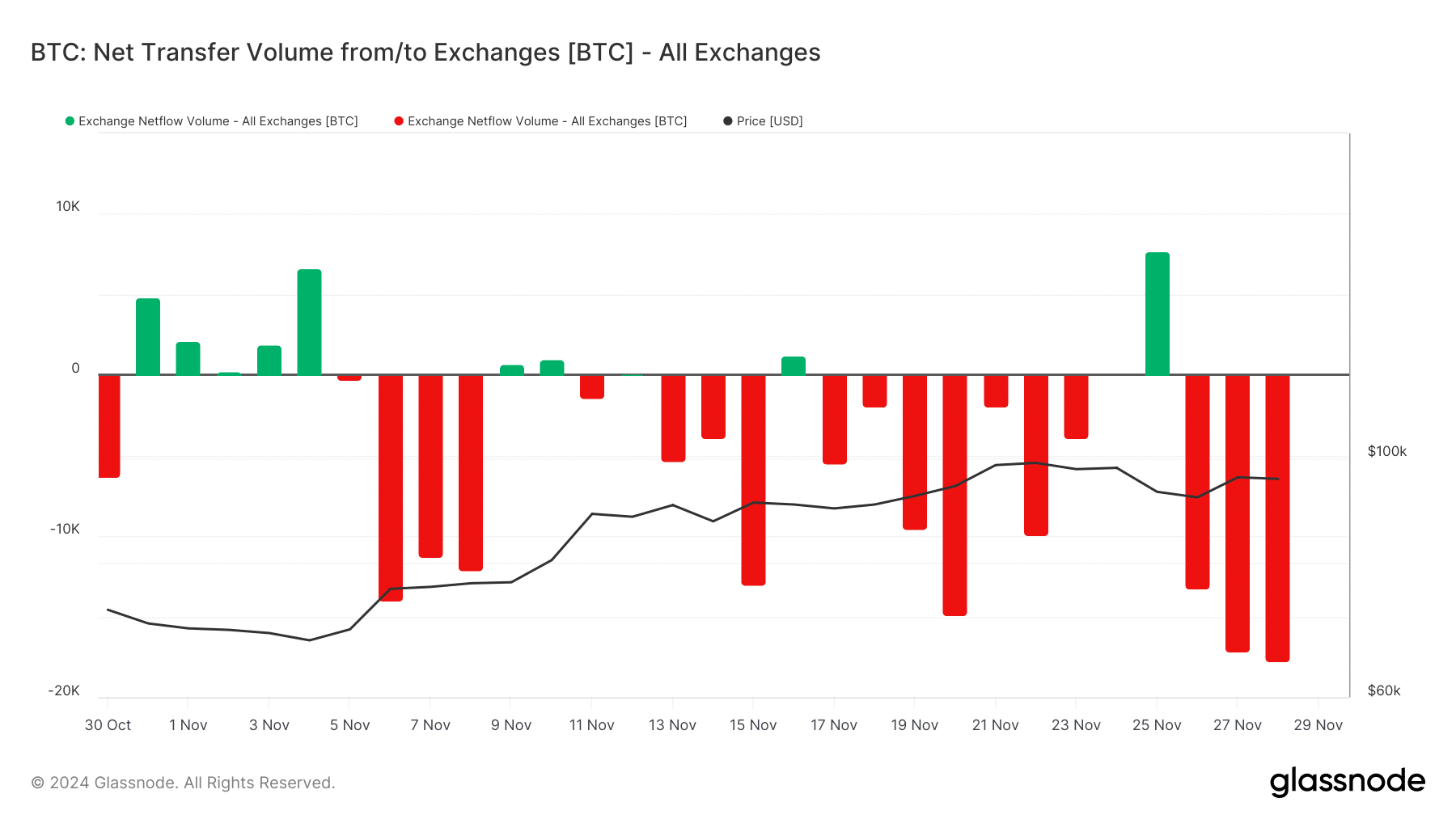

Three days in the past, detrimental internet circulation triggered important exercise from retail buyers, with over 13K BTC being accrued at a median worth of $91K.

This accumulation solidifies a vital liquidity level, positioning the marketplace for potential upside as buyers reap the benefits of perceived discount costs.

Moreover, giant gamers appear to have expressed gratitude for the 12 months’s rally this Thanksgiving, with over 20K BTC withdrawn. This contributed to the value rebounding inside the $96K band.

Collectively, retail and institutional buyers have strategically focused the latest “dip” to $90K, driving a notable uptick in adoption. This has helped counteract the downward strain from short-term holders (STHs) and strengthened a robust backside.

Nonetheless, whereas a backside might have shaped, it’s vital to notice that this might symbolize a “native” backside reasonably than a real “market” backside.

A reversal stays a risk except Bitcoin exhibits related exercise at worth ranges traditionally seen as “high-risk,” just like the $99K degree, the place robust resistance nonetheless exists.

99K resistance requires each micro and macro assist

BTC’s on-chain knowledge exhibits robust assist at $90K, with investor reactions doubtless stopping additional declines and establishing a neighborhood backside for a possible rebound.

In consequence, Bitcoin is again within the $96K vary, restoring internet income after wiping out features made in the course of the closing buying and selling days of the election cycle.

Within the coming days, monitoring these on-chain datasets shall be essential to find out if BTC can maintain regular inside the $95K to $97K vary. This stability may pave the best way for additional upside to $99K, the place important exercise is anticipated.

To start with, the 256.92K addresses holding round 208K BTC acquired at a median worth of $98,309 shall be ‘within the cash’. What they do subsequent will play a vital position in shaping Bitcoin’s worth motion.

Secondly, each “anticipation” and “execution” will play vital roles. Whereas few might count on a breakout above $100K, pushed by social media hype, others will doubtless start executing their exit methods, as seen in latest market conduct.

Thus, the duty of creating $99K as a brand new backside will fall on each on-chain knowledge and broader macroeconomic tendencies.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

In a latest survey, merchants elevated their bets that the Federal Reserve will decrease charges by 25 foundation factors at its December assembly. The market is now pricing in a 64.7% probability of this occurring, up from 55.7% only a week in the past.

This shift may present a strong basis for BTC to interrupt the $100K mark. That is very true if mixed with bullish on-chain knowledge, together with whale exercise, institutional inflows, and long-term holder dedication on the $99K worth level.