- Bitcoin has dragged itself again to the $98,000 worth vary.

- Its Funding Fee has remained optimistic for weeks.

As Bitcoin [BTC] flirts with the $100,000 mark, questions come up in regards to the sustainability of its present rally.

Whereas enthusiasm runs excessive amongst buyers, a number of market indicators recommend that warning could also be warranted.

So, AMBCrypto has analyzed three essential areas to grasp whether or not Bitcoin is coming into an overheated section.

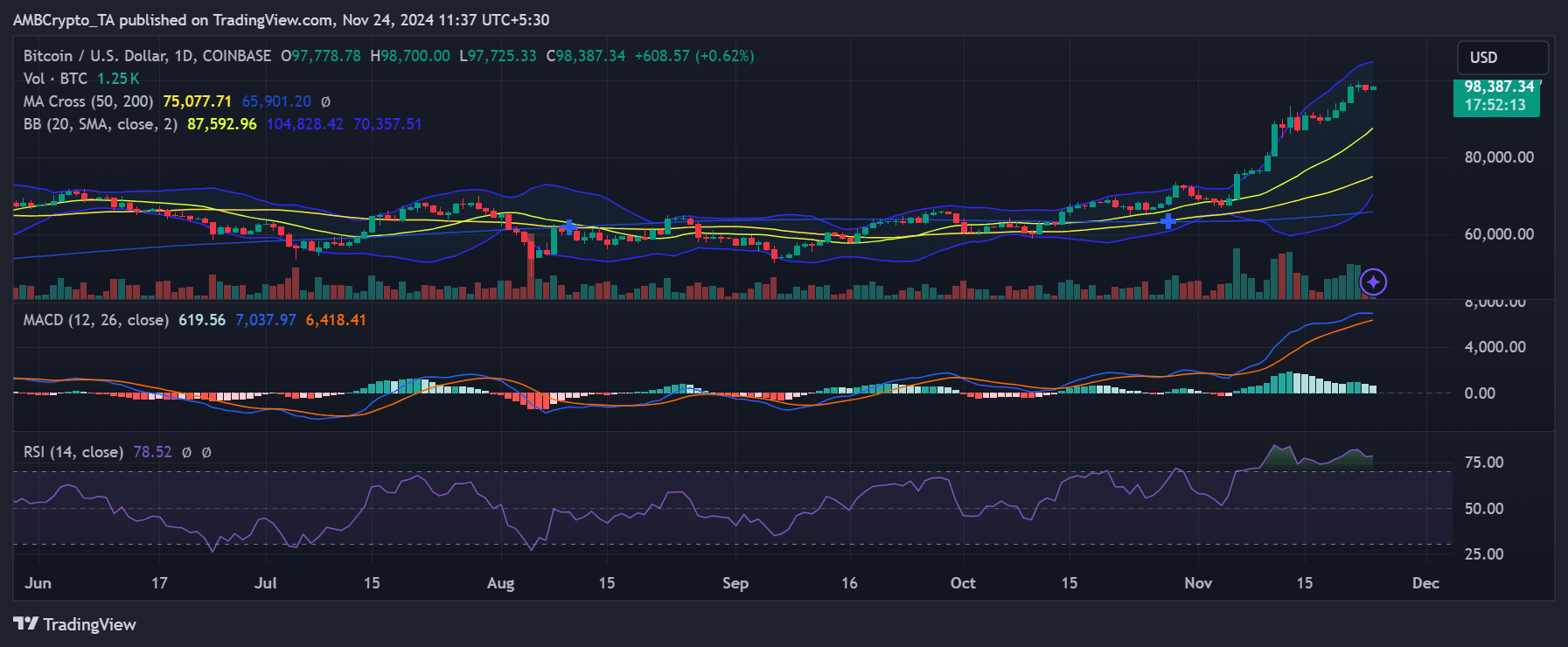

Bitcoin’s worth momentum and overbought circumstances

The every day BTC/USD chart revealed Bitcoin’s sharp upward trajectory, because the king coin broke out from consolidation close to $65,000 simply weeks in the past.

The Relative Power Index (RSI) stood at 78.6, indicating that Bitcoin was in overbought territory. Traditionally, RSI ranges above 70 typically precede short-term corrections as merchants lock in income.

Moreover, Bollinger Bands confirmed the worth buying and selling close to the higher restrict, hinting at elevated volatility.

With the 20-day shifting common considerably lagging the spot worth, a imply reversion might be on the horizon, particularly if profit-taking accelerates.

As of this writing, BTC was buying and selling at round $98,200, a slight improve from the 97,000 worth zone it dropped to within the final buying and selling session.

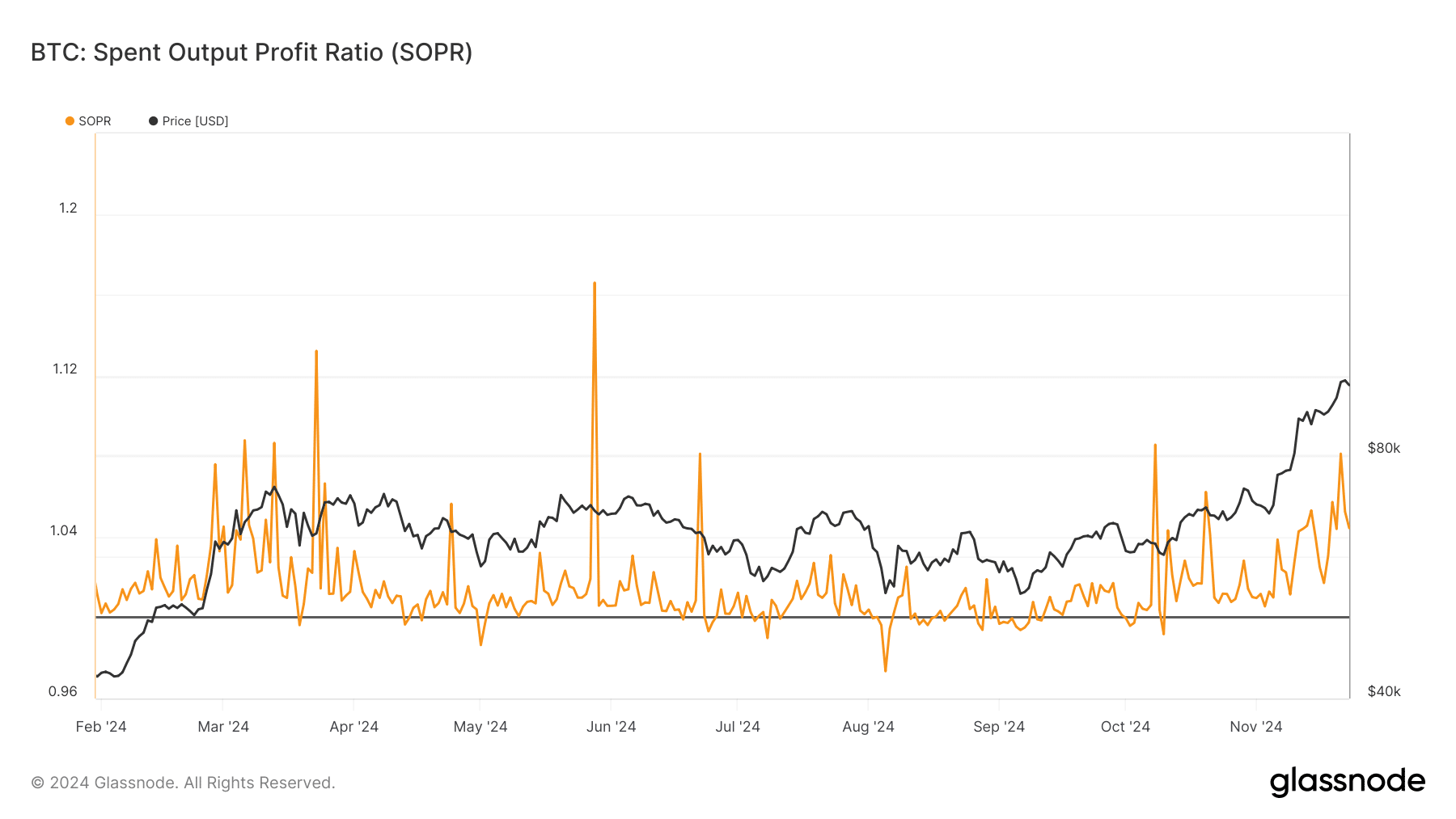

Bitcoin SOPR exhibits profit-taking

The Spent Output Revenue Ratio (SOPR) chart painted a clearer image of market habits. SOPR, which measures whether or not cash moved on-chain are in revenue, has been steadily rising alongside Bitcoin’s worth.

AMBCrypto’s evaluation confirmed that the SOPR values rose to round 1.08 through the previous week, indicating heightened ranges of realized revenue.

Traditionally, such elevated SOPR ranges typically coincide with native tops, as buyers more and more money out throughout bullish euphoria.

A sudden dip in SOPR would sign elevated promoting stress, doubtlessly triggering a broader correction. As of this writing, the spike has barely dropped, and the BTC SOPR was round 1.04.

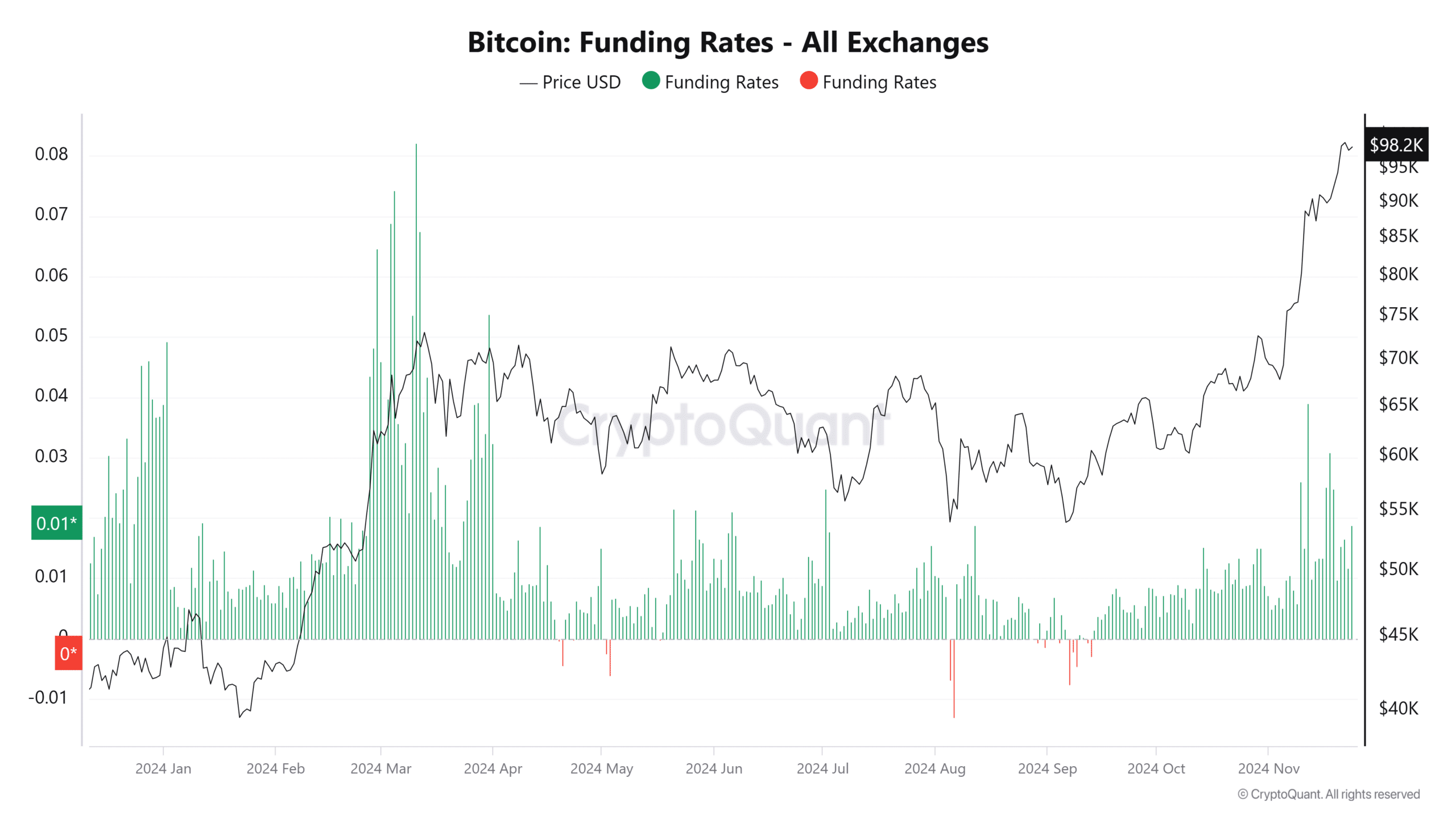

An overleveraged market

One other pink flag got here from the Bitcoin Funding Charges chart, which confirmed a pointy uptick throughout main exchanges.

Funding Charges are optimistic when lengthy positions dominate the market, and excessively excessive charges recommend over-leveraging.

At press time, Funding Charges have been approaching ranges final seen through the 2021 bull market peak, implying that speculative enthusiasm might be overheating.

Ought to a correction happen, overleveraged positions would seemingly exacerbate the sell-off by liquidations, including downward stress.

Market reset earlier than secure tendencies?

Whereas Bitcoin’s rally is undoubtedly historic, the convergence of overbought RSI ranges, excessive SOPR values, and spiking Funding Charges signaled potential overheating.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

A wholesome correction might reset the market, paving the way in which for sustainable development relatively than speculative mania.

Whereas Bitcoin might proceed its upward trajectory, the dangers related to its fast ascent can’t be ignored.