- Bitcoin Choices expiry may be important, because the expiration of huge numbers of contracts can result in sharp worth actions

- Name choices had been dominant at press time, with $7.9 billion in Open Curiosity indicating a bullish sentiment.

Bitcoin’s [BTC] Choices market is at the moment in a state of suspense because the high-stakes expiry on 27 December approaches. With bulls eyeing the $100k goal following a surge in capital stream post-election, the Open Curiosity has skyrocketed – Hitting a brand new excessive of $50 billion.

Nevertheless, reaching $100k and sustaining it are two completely different challenges. Whereas the present bullish sentiment, pushed by a mixture of micro and macroeconomic elements, suggests a possible new all-time excessive, the Choices market have to be carefully watched.

The $11.8 billion value of end-of-year name and put orders set to run out may considerably affect Bitcoin’s worth motion within the coming days.

Bitcoin Choices present bias with name order dominance

Bitcoin, on the time of writing, was buying and selling beneath $90k, with its market dominance exceeding 60%. During the last 24 hours, some worth correction gave the impression to be taking form too.

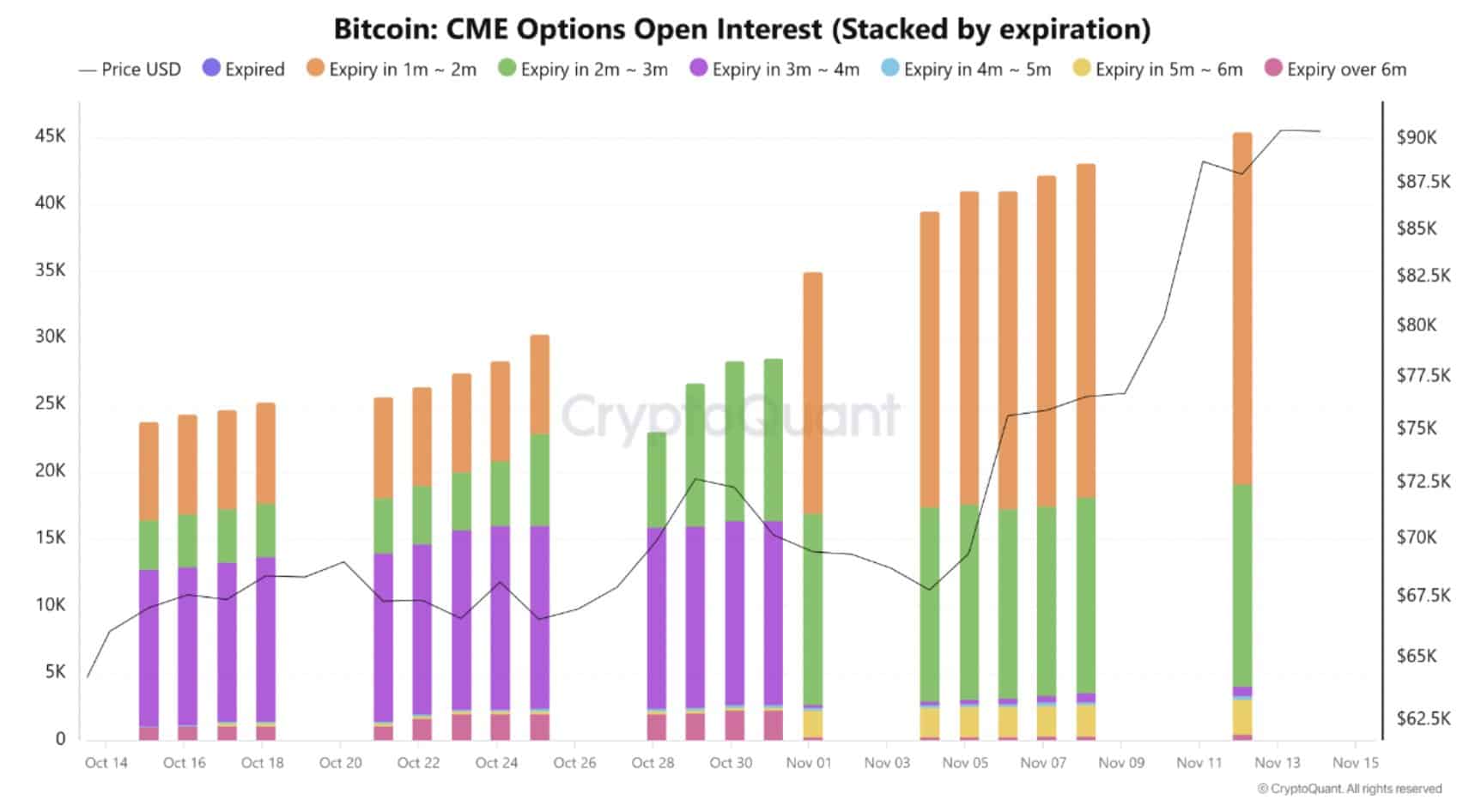

Within the Choices market, Deribit led with a 74% market share, whereas CME and Binance every held round 10.3%. This focus of exercise on Deribit highlighted the place the vast majority of betting on Bitcoin’s worth motion is going on.

In response to Coinglass data, calls (bets on the worth going up) make up almost 70% of the orderbook, signaling sturdy bullish sentiment. Actually, many buyers seem like betting on Bitcoin reaching $100k, anticipating additional upside.

Nevertheless, if Bitcoin hits the $100k goal, a big quantity of Choices contracts (value $11.8 billion) will expire, with the vast majority of these being Name Choices (bets on the worth going up).

Consequently, merchants who maintain these Name Choices are more likely to train them or promote to lock of their income. This will create promoting stress, particularly if many merchants resolve to exit without delay.

Subsequently, sustaining the $100k worth stage largely is dependent upon how these contracts unfold. A short lived pullback may happen in two situations – When Name Choice holders train their contracts and when Put Choices start to dominate.

Can Bitcoin hit $100k amid rising volatility?

Although Bitcoin hit a brief dip after 5 days of constant uptrend, primarily because of miner promoting, long-term holders proceed to keep up their positions. This, even because the market turns into more and more over-leveraged with derivatives.

As extra merchants enter the Bitcoin Choices market, with a excessive variety of stakes set to run out earlier than the tip of this quarter, volatility is hitting new highs every day.

Regardless of this volatility, Bitcoin has continued its upward momentum, indicating that lengthy positions are nonetheless dominating the market throughout numerous indicators.

Merely put, the market hasn’t overextended but. Regardless of the RSI being in excessive ‘overbought’ territory, miners offloading, and weak arms exiting for short-term positive aspects, the influence on Bitcoin’s worth hasn’t been drastic – One thing that might usually be anticipated in such situations.

Which means that the bulls are holding sturdy, and the $100k goal is inside attain. Actually, if Bitcoin hits this goal earlier than the tip of the month, it wouldn’t be stunning.

Learn Bitcoin (BTC) Price Prediction 2023-24

Nevertheless, a shadow of uncertainty nonetheless looms within the Choices market the place $11.8 billion value of contracts will finally resolve whether or not Bitcoin enters the brand new 12 months on a bullish or bearish observe.

The latter appears extra seemingly, given the excessive stakes related to the $100k worth goal and the decision orders set to run out as volatility rises within the days forward.