- Shopping for stress on Bitcoin elevated over the past week.

- BTC efficiently examined a help and would possibly quickly transfer in the direction of $68k.

Bitcoin [BTC] has as soon as once more entered the consolidation part as its worth lingered round $67k. In the meantime, the big-pocketed gamers within the recreation selected to money in revenue. Will this have a destructive impression on BTC’s worth within the coming days?

Bitcoin whales create buzz

Ali, a preferred crypto analyst, lately posted a tweet highlighting an attention-grabbing growth. As per the tweet, Bitcoin whales lately cashed in over $1.4 billion in income. This was evident from the huge rise in BTC’s long-term holders whales’ realized revenue in USD.

In actual fact, AMBCrypto additionally reported earlier the rise in BTC whale exercise. BTC whales’ have elevated as they increase their holdings in the direction of the 4 million mark. With this, BTC whales reached the 2021 ranges.

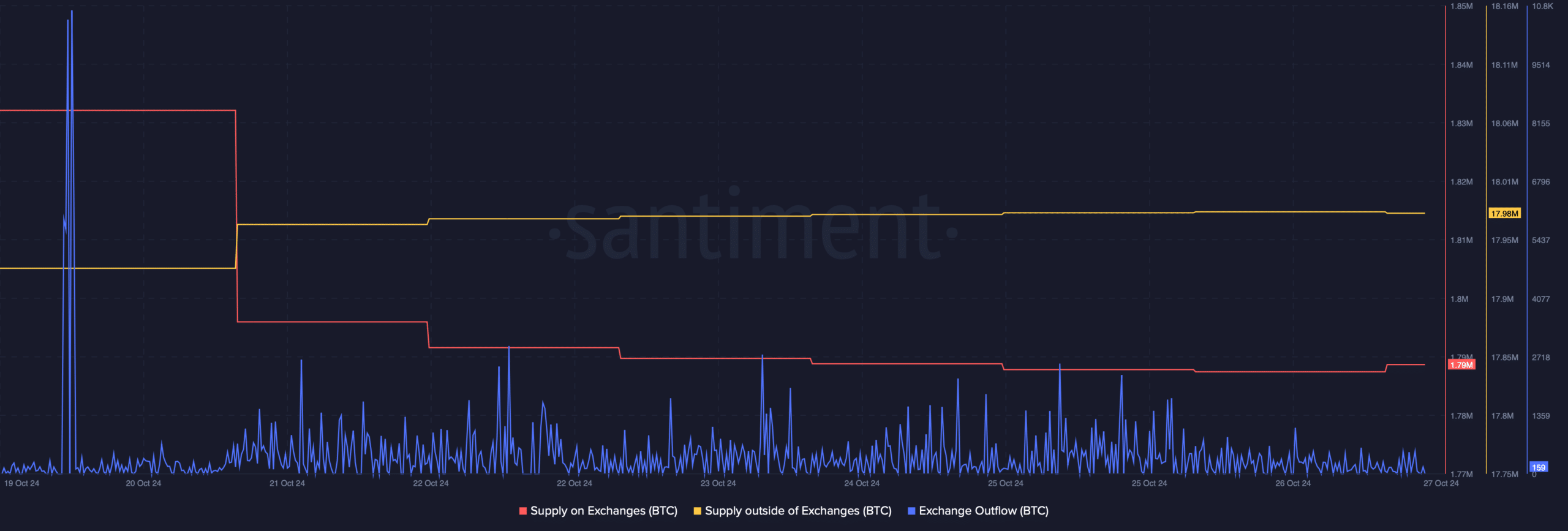

AMBCrypto then deliberate to verify market sentiment to search out out whether or not the surge in whale exercise had any impression on shopping for conduct. As per our evaluation of Santiment’s knowledge, BTC’s alternate outflow spiked on the twentieth of October 2024.

Due to that, BTC’s provide on exchanges dropped whereas its provide outdoors of exchanges elevated. All of those metrics indicated that purchasing stress on the king coin was excessive. A hike within the metric is taken into account a bullish sign as it’s usually adopted by worth hikes.

Will BTC lastly flip unstable once more?

Whereas all this occurred, BTC’s worth began to consolidate. The king coin’s worth moved solely marginally over the past week. At press time, it was buying and selling simply above $67k.

To higher perceive whether or not the rise in shopping for stress will permit BTC to register features, AMBCrypto checked CryptoQuant’s knowledge.

In response to our evaluation, BTC’s aSORP turned purple. This indicated that extra buyers have lately began promoting at a revenue. In the course of a bull market, it will possibly point out a market high.

One other bearish metric was the NULP. The metric revealed that buyers have been in a perception part the place they’re at present in a state of excessive unrealized income.

Aside from this, Bitcoin’s long/short ratio additionally witnessed a serious decline. A drop within the metric signifies that there are extra quick positions available in the market than lengthy positions.

Each time that occurs, it signifies that bearish sentiment round an asset is rising.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

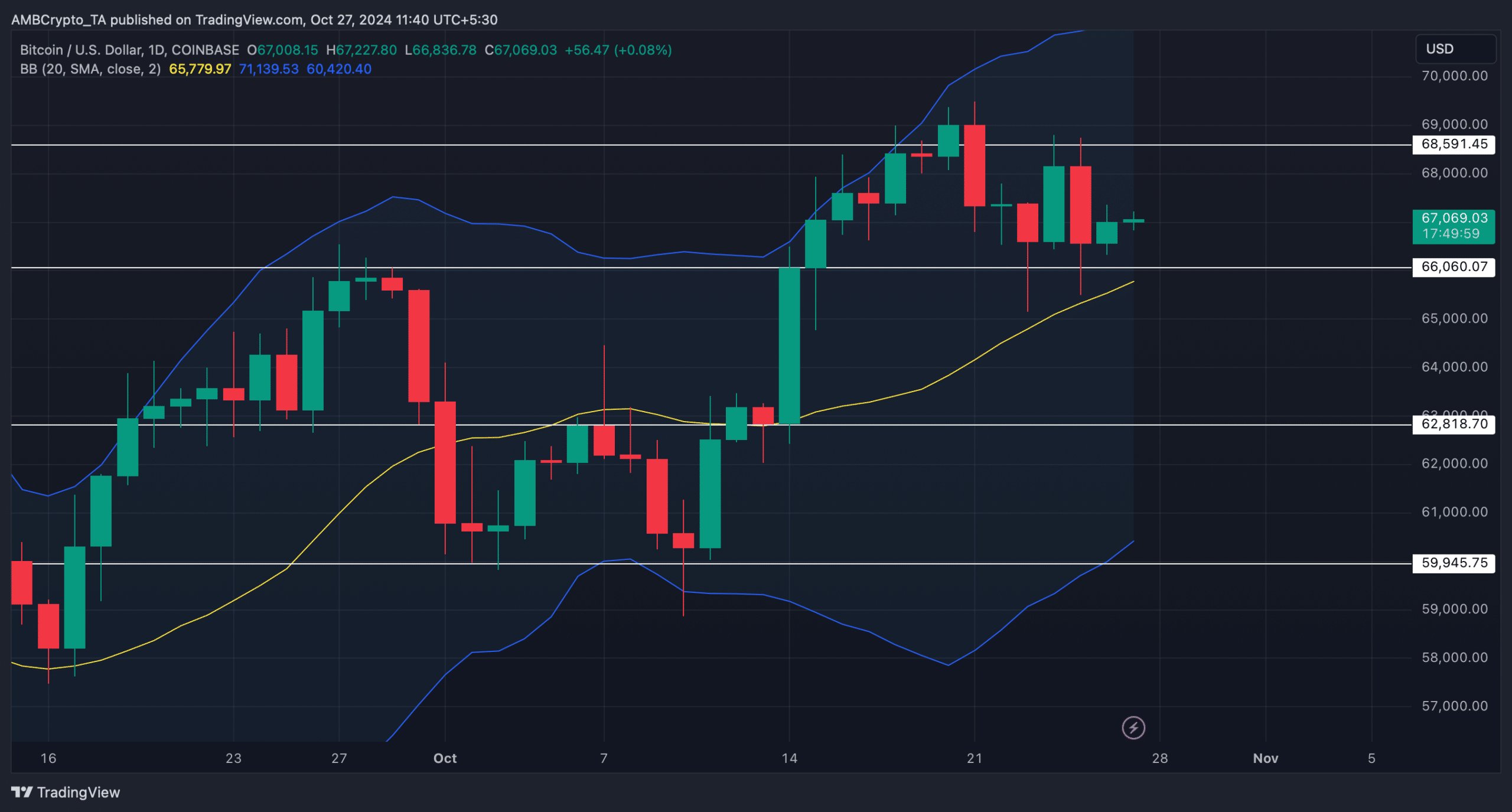

We then took a take a look at the king coin’s every day chart. The Bollinger Bands revealed that BTC has efficiently examined its help on the 20-day SMA.

Furthermore, the technical indicator additionally urged that BTC’s worth was in a excessive volatility zone. These indicated that in case of an upward worth transfer, BTC would possibly quickly attain its resistance at $68.5k.