- Bitcoin’s ETF inflows and elevated miner profitability recommend that BTC’s upward worth momentum might proceed.

- Lively addresses and rising open curiosity quantity sign sturdy market exercise, regardless of blended derivatives information.

Bitcoin [BTC] has seen a gradual improve in worth in current weeks, sparking curiosity within the underlying components driving this momentum.

In accordance with a CryptoQuant analyst, Amr Taha, there’s a noteworthy relationship between Bitcoin ETF web flows and Miner Revenue/Loss Sustainability, which may very well be influencing Bitcoin’s worth actions.

The analysis, shared on the CryptoQuant QuickTake platform, sheds gentle on how these two indicators work together and their potential impression in the marketplace.

Bitcoin ETFs, miners crew up!

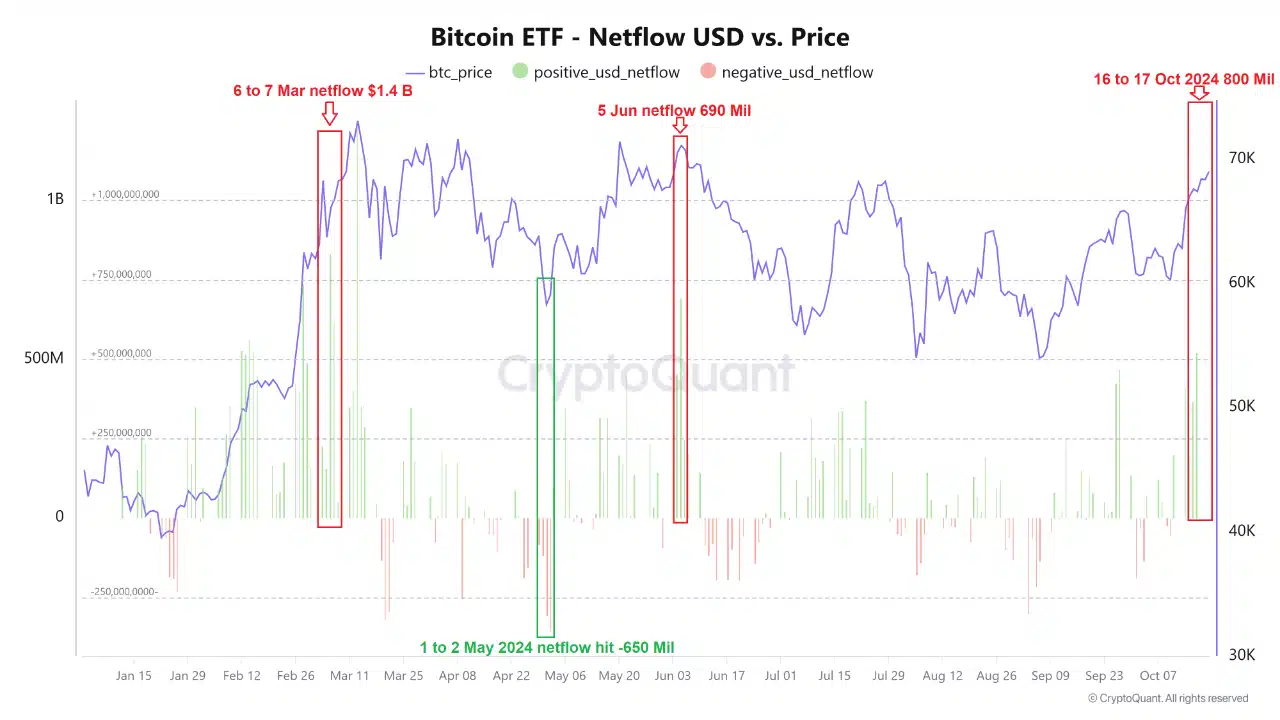

Taha’s evaluation focuses on the web move of capital into Bitcoin ETFs, highlighting that enormous optimistic web flows typically happen close to market peaks, whereas unfavourable web flows are inclined to coincide with market bottoms.

This pattern means that when capital flows into Bitcoin ETFs, it will probably result in upward price pressure, whereas capital outflows might end in downward strain.

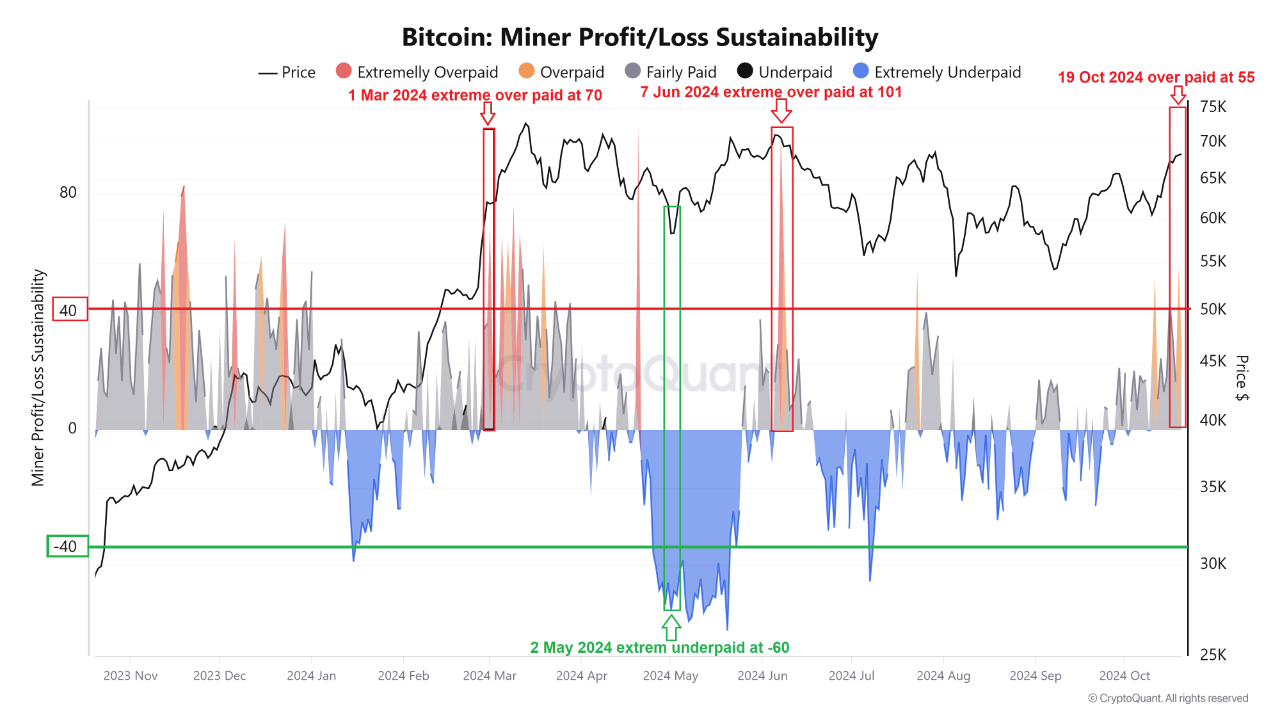

Moreover, the Miner Revenue/Loss Sustainability chart helps observe whether or not Bitcoin miners are working profitably primarily based on the distinction between Bitcoin costs and miners’ working prices.

The chart identifies “overpaid” zones, when miners are producing vital earnings, and “underpaid” zones, when miners are dealing with losses.

Taha’s evaluation affords key insights into how BTC costs are linked to miner profitability. As Bitcoin costs rise, miners are usually in additional worthwhile positions, as seen in March, June, and October 2024.

Throughout these intervals, miners generated vital earnings, with miner sustainability metrics rising above 40.

Nonetheless, when capital exits Bitcoin ETFs, miners’ income can lower because of the promoting strain, pushing them right into a much less worthwhile or loss-making place.

A notable instance of this occurred in Might 2024, when Bitcoin costs fell sharply, resulting in a miner sustainability stage of -60, indicating that miners have been extraordinarily underpaid.

It’s value noting that up to now, BTC ETFs has been experiencing optimistic momentum, data from Sosovalue exhibits that BTC ETFs have registered steady inflows above $200 million previously seven days.

This marked a 7-day consecutive streak of inflows, which mirrored elevated demand for BTC-related monetary merchandise and will assist additional worth will increase.

In the meantime, CryptoQuant information confirmed that miner inflows have additionally elevated, with a peak of 11,810 BTC on the 14th of October and one other vital influx of 9,302 BTC on the twenty first of October.

The correlation between ETF inflows and miner reserves means that each institutional curiosity and miner exercise are contributing to Bitcoin’s present worth momentum.

Lively Tackle development and market information

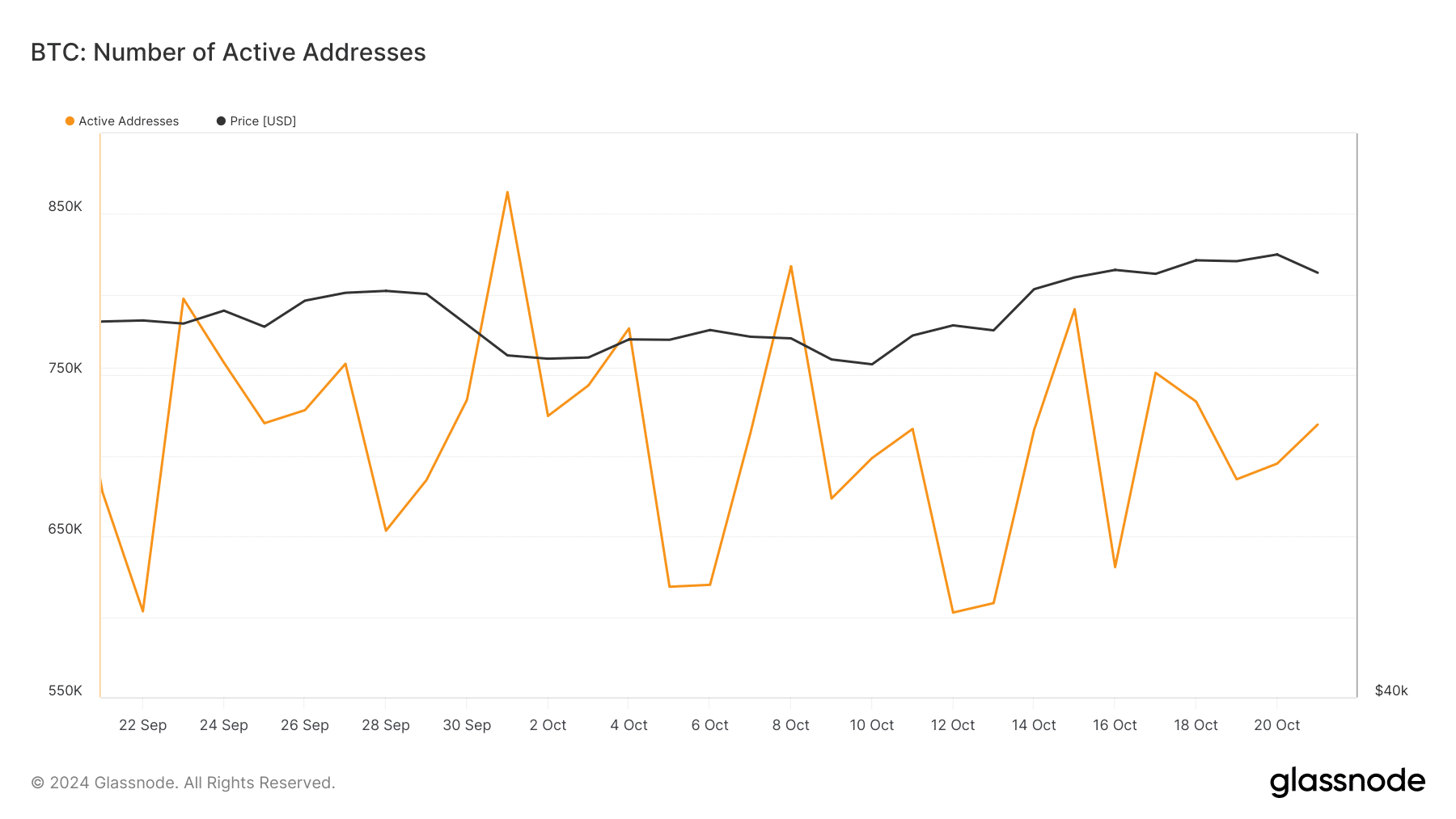

Past the ETF and miner-related metrics, data from Glassnode indicated that Bitcoin’s community exercise has picked up in current days.

Lively Bitcoin addresses elevated from 630,000 on the sixteenth of October to over 719,000 by the twenty second of October.

This development in energetic addresses indicators better consumer engagement and transactional exercise on the BTC community, doubtlessly contributing to the asset’s bullish momentum.

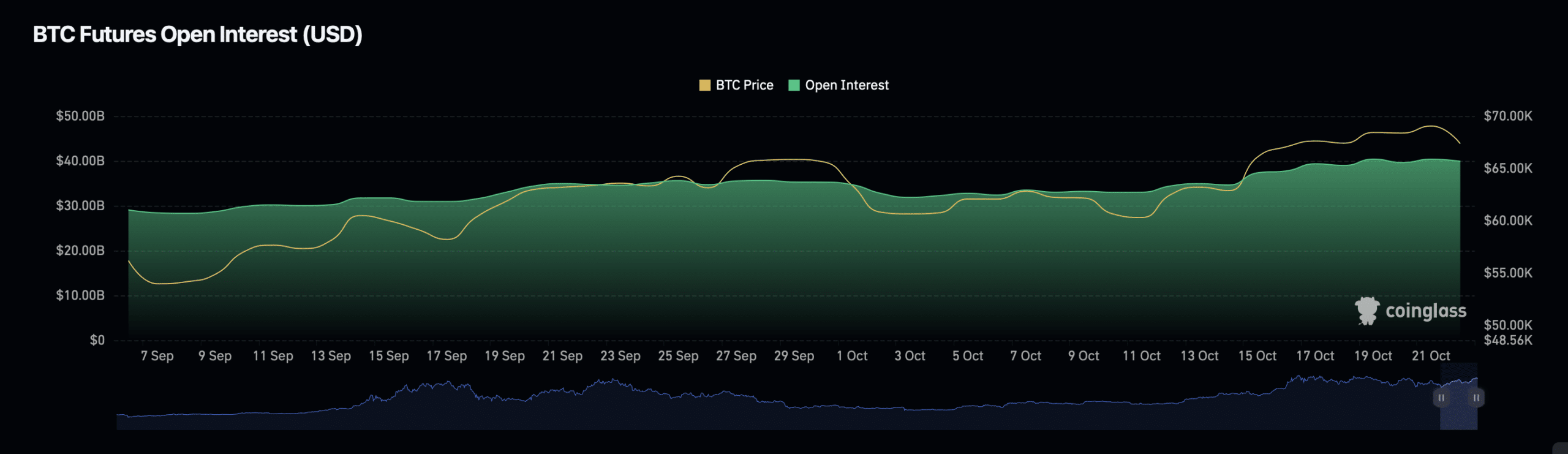

In distinction, data from Coinglass highlighted some blended indicators in Bitcoin’s derivatives market.

Bitcoin’s Open Curiosity, which measures the whole worth of excellent spinoff contracts, has decreased by 3.17% to a press time valuation of $39.36 billion.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Nonetheless, Bitcoin’s Open Curiosity quantity has surged by 55.69%, reaching $68.28 billion.

The rise in Open Curiosity quantity means that whereas fewer positions are being held total, the scale of the positions is rising, indicating a potential buildup of market exercise in anticipation of great worth actions.