- Bitcoin has declined by 5.41% over the previous week.

- Market fundamentals counsel a possible upside if Bitcoin closes above 21-week EMA.

After defying expectations in September, Bitcoin [BTC] has had a troublesome begin in October, a month that’s often related to an upswing. As such, over the previous week, BTC has skilled a pointy decline.

In reality, as of this writing, Bitcoin was buying and selling at $61980. This marked a 5.41% decline on weekly charts, with the extension of the bearish pattern by 0.34% on every day charts.

Previous to this decline, BTC had been on an upward trajectory, climbing by 9.87% on month-to-month charts.

The present market situations increase questions on whether or not BTC will proceed with an uptrend, particularly following the latest downtrend.

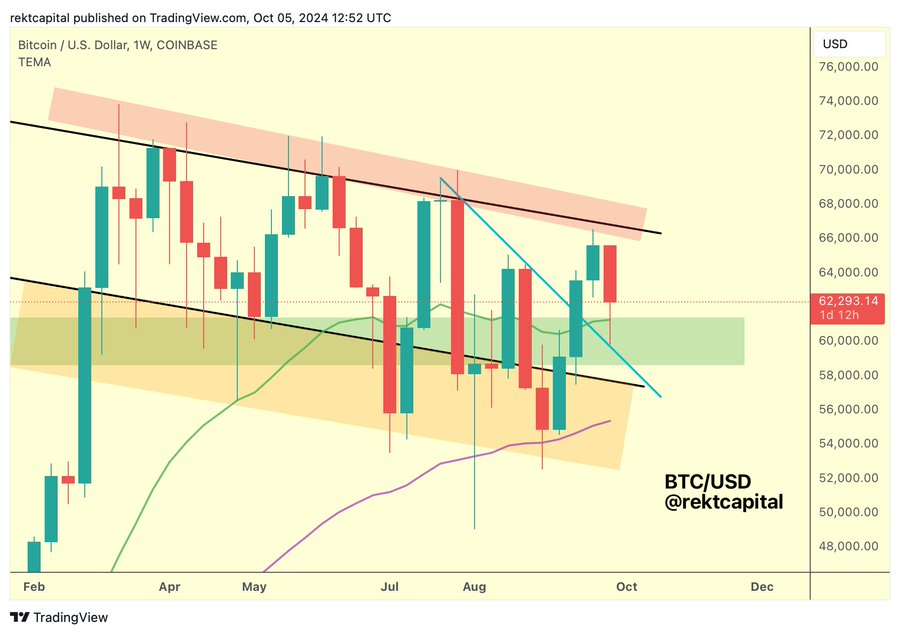

Inasmuch, well-liked crypto analyst Rekt Capital has steered a possible rally, citing a 21-week bull market EMA.

What market sentiment suggests

In his evaluation, RektCapital posited that 21-week EMA has been efficiently retested as help.

As BTC holds above this stage, it confirms that the market sentiment stays bullish. This means that consumers are getting into the market and value motion is favoring the upside.

In line with this evaluation, BTC has damaged above a downtrend line that has acted as resistance for months. Such a transfer is a bullish sign, because it suggests the tip of the downtrend and a possible shift in momentum.

Subsequently, a robust shut above the 21-week EMA and confirmed breakout from the multi-month downtrend would sign additional upward momentum, particularly after a bullish weekly shut above $62k-$63k.

What Bitcoin’s charts counsel

Undoubtedly, the evaluation supplied by RektCapital provided a promising outlook for BTC. Subsequently, it’s important to find out what different market indicators say.

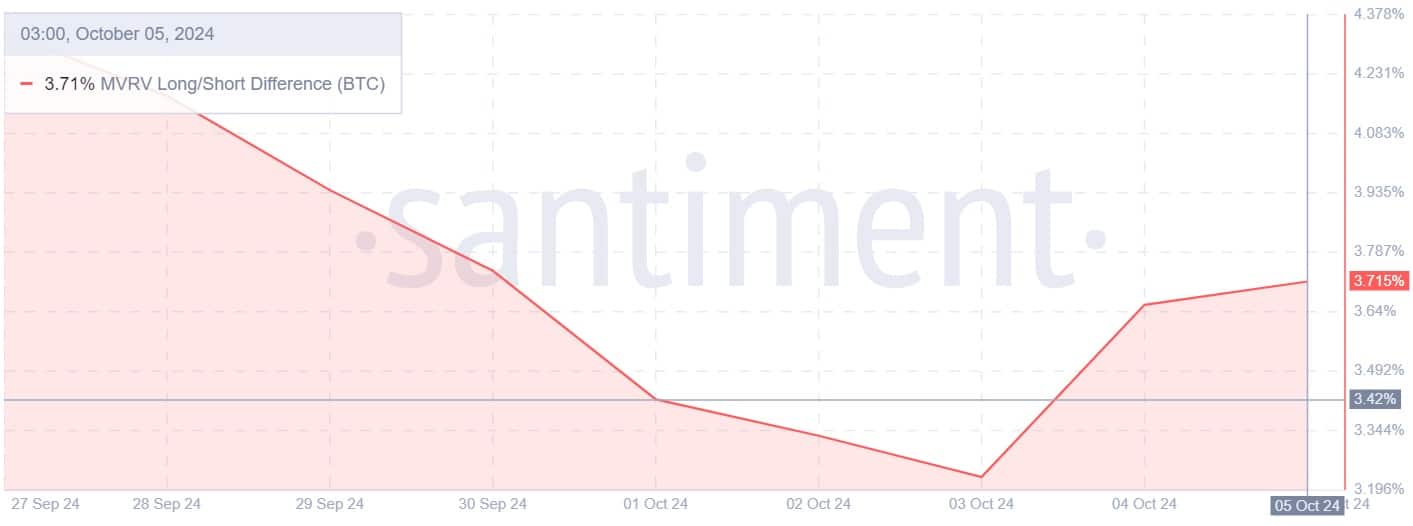

The primary indicator to think about is Bitcoin’s MVRV lengthy/quick distinction, which has shifted from downtrend to uptrend.

The MVRV lengthy/quick distinction has been rising because the 4th of September after declining the earlier days.

This means that long-term holders are extra assured of their positions and fewer more likely to promote s they’re already in revenue. Because the variations rise, it means that long-term holders consider within the upside.

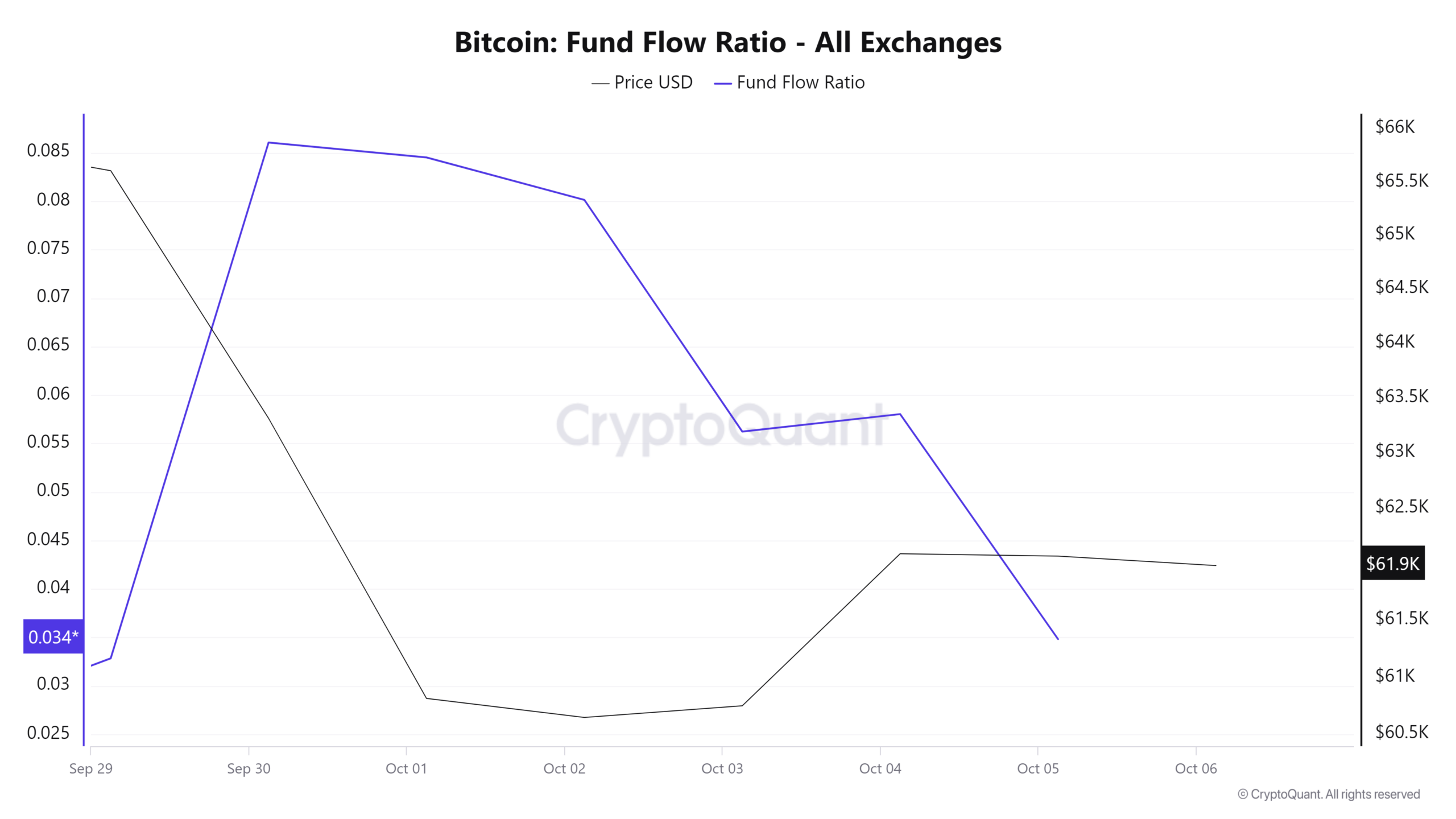

Moreover, the Fund movement ratio has been declining for the previous six days regardless of market downturns. This means traders are depositing much less BTC into exchanges to promote, however as an alternative, they’re storing in personal wallets.

Such market conduct signifies accumulation as traders anticipate additional features.

Lastly, Bitcoin’s Funding Charge Aggregated by Trade has remained largely optimistic all through the week. This means that traders are taking lengthy positions anticipating future value features.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Merely put, has been buying and selling sideways over the previous few days, with traders rising accumulation whereas others take lengthy positions. Such a shift suggests the market is nicely positioned for additional features.

If the market sentiment holds, BTC will try $62785 resistance within the quick time period.