The value of Bitcoin put in one other constructive efficiency over the past seven days, trying to finish the month and begin October on a fair stronger footing. Persevering with its resurgence over the previous few weeks, the premier cryptocurrency climbed as excessive as $66,000 on Friday, September twenty seventh.

Current information exhibits that there is perhaps a rising correlation between the efficiency of the US inventory market and the worth of the world’s largest cryptocurrency. The query right here is — how might this affect the behavior of investors?

How Did Bitcoin And S&P 500 Carry out In September?

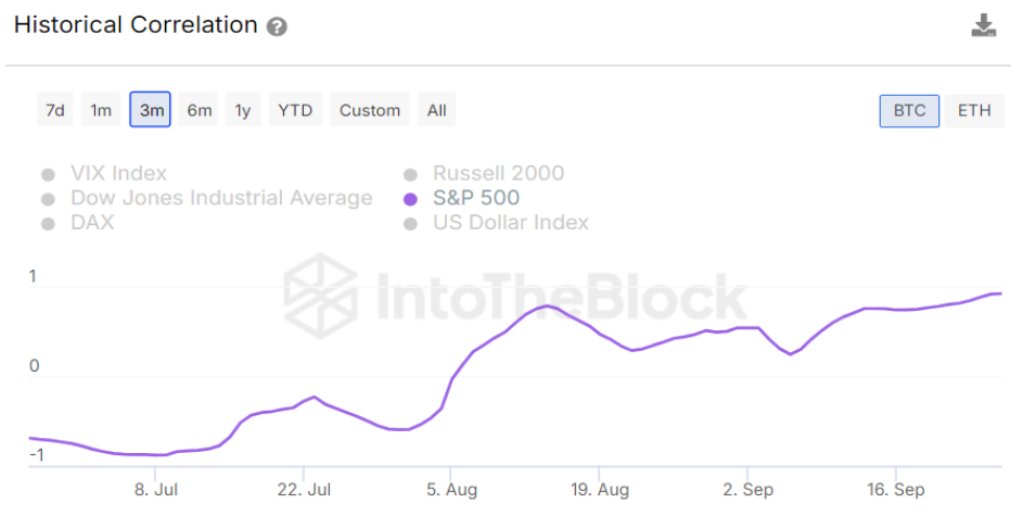

In a latest put up on the X platform, crypto intelligence agency IntoTheBlock revealed the correlation between the Bitcoin value and the S&P 500, probably the most standard inventory market indices, has reached its highest level in additional than two years. For readability, the S&P 500 index tracks the efficiency of 500 of the biggest exchange-listed corporations in america.

The Bitcoin value registered a surprisingly constructive efficiency in September, a month identified to be traditionally bearish for the flagship cryptocurrency. In line with information from CoinGecko, the worth of BTC is up by greater than 11% prior to now month.

Supply: IntoTheBlock/X

In the meantime, the S&P 500 index has undergone a fast and powerful restoration, printing a brand new all-time excessive after an preliminary stoop at first of the month. Knowledge from TradingView exhibits that the index is up nearly 4% in September.

The connection between the inventory market and the cryptocurrency market has all the time been intriguing, as buyers look to make the most of alternatives both market affords. Nonetheless, a robust correlation between these two asset lessons is deemed to slim the diversification alternatives they provide to buyers.

As of this writing, Bitcoin value stands round $66,024, reflecting a mere 1.1% enhance prior to now 24 hours. In the meantime, the S&P 500 Index continues to hover round 5.8K, with a 0.4% rise prior to now day.

World Liquidity Surges By $1.426 Trillion In A Week

In style crypto pundit Ali Martinez took to the X platform to share that there was a notable surge within the quantity of capital within the world monetary markets. Knowledge supplied by Martinez exhibits that world liquidity jumped by $1.426 trillion prior to now week.

World liquidity surged by $1.426 trillion this week, hitting $131.6 trillion. #Bitcoin and different danger property are gaining, although this liquidity increase might roll over into October. pic.twitter.com/PtFDjkR7wU

— Ali (@ali_charts) September 27, 2024

Bitcoin and different danger property have been the foremost beneficiaries of the rising world liquidity, as their values have gained as a result of elevated capital inflow. Martinez additionally famous that this liquidity increase might roll over into October.

The value of BTC breaks above $66,000 on the each day timeframe | Supply: BTCUSDT chart from TradingView

Featured picture from iStock, chart from TradingView