- BTC bulls are concentrating on $64K, eyeing $68K as the subsequent resistance degree.

- Can they overcome 4 days of failed makes an attempt to push BTC above this key goal?

Bitcoin [BTC] bulls are concentrating on the $64K mark, a key degree final reached throughout the late August rally, making it a important turning level.

To keep away from repeating previous downturns, bulls should counter any bearish strain. If profitable, the subsequent resistance may materialize round $68K.

Bitcoin: Bull run hinges on $64K

The present cycle carefully resembles the early August pattern, with BTC rising to $64K after retracing beneath $55K. Nonetheless, the 18-day surge then was marked by inconsistent bearish strain.

In distinction, whereas this cycle exhibits extra constant inexperienced candles, the expansion charge is much less regular, inflicting volatility amongst stakeholders.

Consequently, as a substitute of charge cuts boosting bullish sentiment, ongoing volatility has stored BTC from retesting $64K, at present buying and selling at $63,543 – marking the fourth straight day beneath this benchmark.

Moreover, this benchmark has been examined 5 instances since March, when BTC reached its ATH of $73K. Notably, it was solely in July that bulls prevented a pullback, pushing BTC to $68K.

Merely put, the $64K mark has been an important turning level for Bitcoin.

Whereas quantity indicators level to a bullish pattern, the actual problem is whether or not different buyers will again a breakout or if bears will as soon as once more block BTC’s ascent.

Present value could also be out of attain

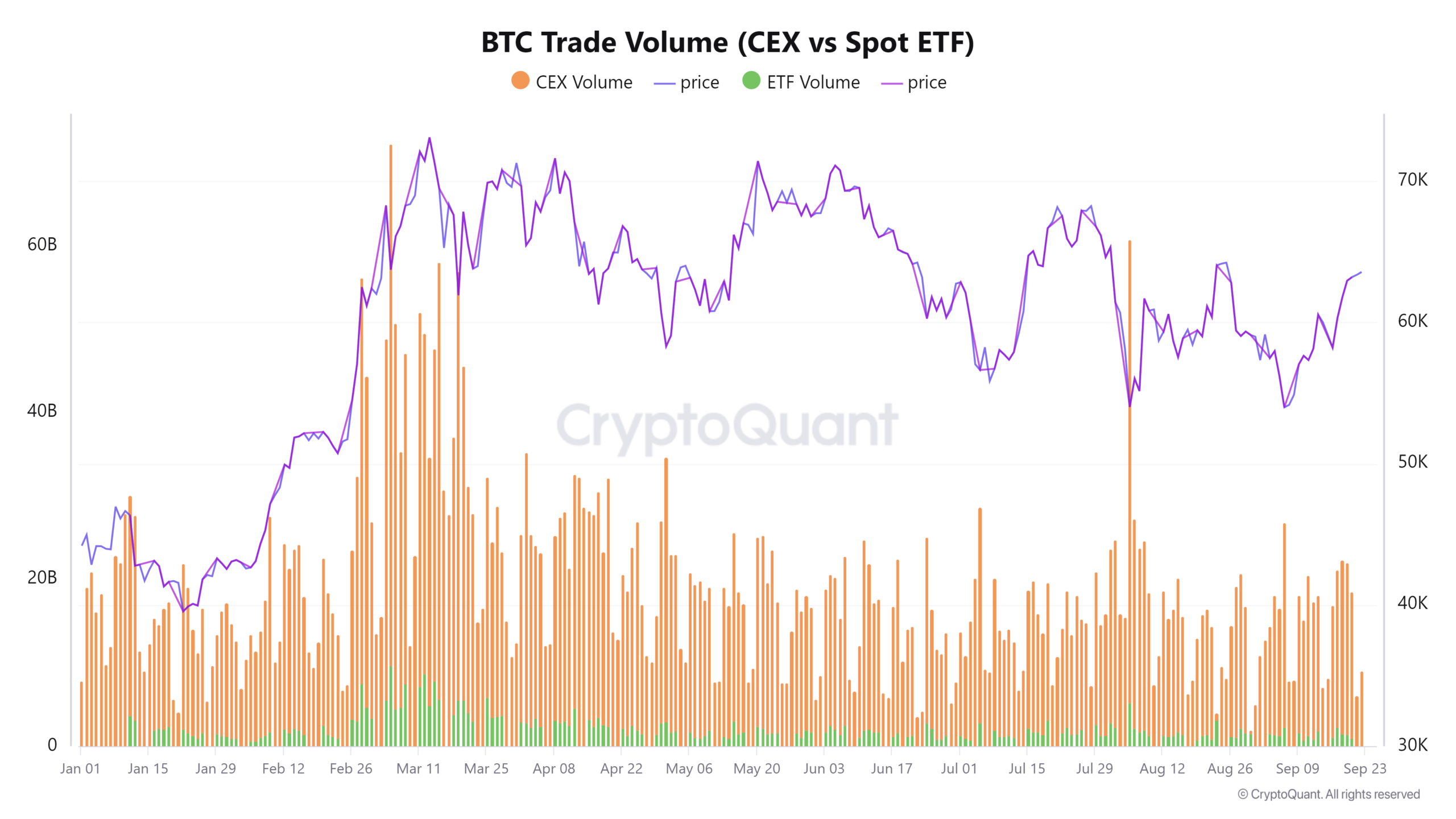

Over the previous two days, BTC buying and selling quantity on CEXes has plunged from $17B to $6B. This sharp drop may amplify volatility, shaking investor confidence in a possible pattern reversal.

The chart beneath would possibly point out a possible market high, usually coinciding with diminished buying and selling exercise on CEXs.

Conversely, when alternate volumes spike throughout sharp BTC declines, it often presents a perfect dip-buying alternative.

Per AMBCrypto, diminished alternate exercise would possibly recommend two potentialities: both buyers are cashing in on good points from the September cycle, or they’re ready for a dip to purchase BTC at a lower cost.

If this pattern holds, it may actually set the stage for a resurgence of positions shorting Bitcoin. Consequently, an opportunity at a breakout might falter. Nonetheless,

There would possibly nonetheless be hope

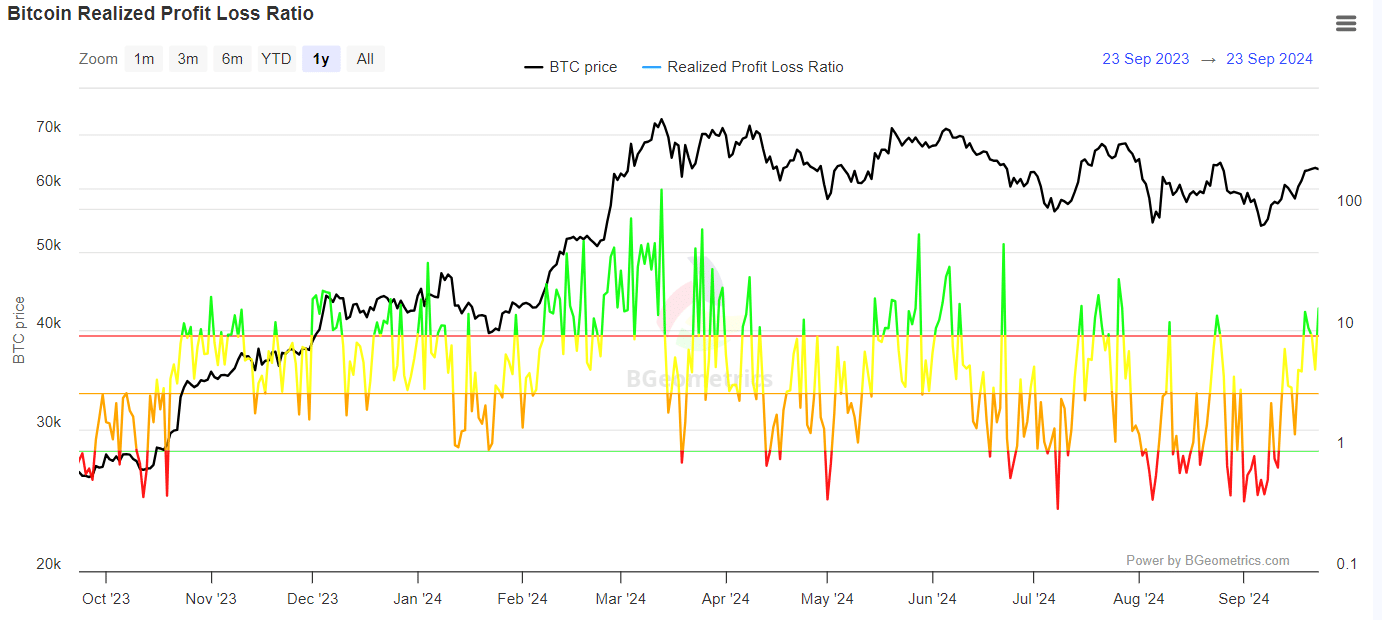

As essentially the most risky month involves a detailed, the potential for “Uptober” may sign a bullish turning level for the market, a glimmer of hope illustrated within the chart beneath.

On the day Bitcoin skilled a minor 0.37% decline, the RPL ratio dropped, indicating losses. Nonetheless, since then, a majority of transactions have occurred greater than the unique acquisition value.

Including to this evaluation, massive transaction volumes have surged, with transactions exceeding $100K seeing vital exercise.

Clearly, bulls are pushing towards the resistance that has held Bitcoin beneath the $64K benchmark. At present, the sharp decline in CEX quantity is reinforcing brief dominance, appearing as a barrier.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, if the market stabilizes, as evidenced by sellers realizing income, FOMO may incentivize a longer-term dedication.

Finally, monitoring CEX quantity alongside speculative market exercise is essential. Their dominance might push BTC again beneath $60K if unchecked.