- Lowered danger hedging and elevated on-chain exercise instructed rising confidence in Bitcoin’s worth potential.

- Bitcoin could also be positioned for a breakout attributable to rising open curiosity and a decrease NVT ratio.

Bitcoin [BTC] choices market had been displaying a shift, with merchants pulling again on danger hedging. This improvement instructed {that a} breakout could possibly be on the horizon.

As on-chain metrics enhance, Bitcoin’s present momentum raises the query: Are new worth highs inside attain?

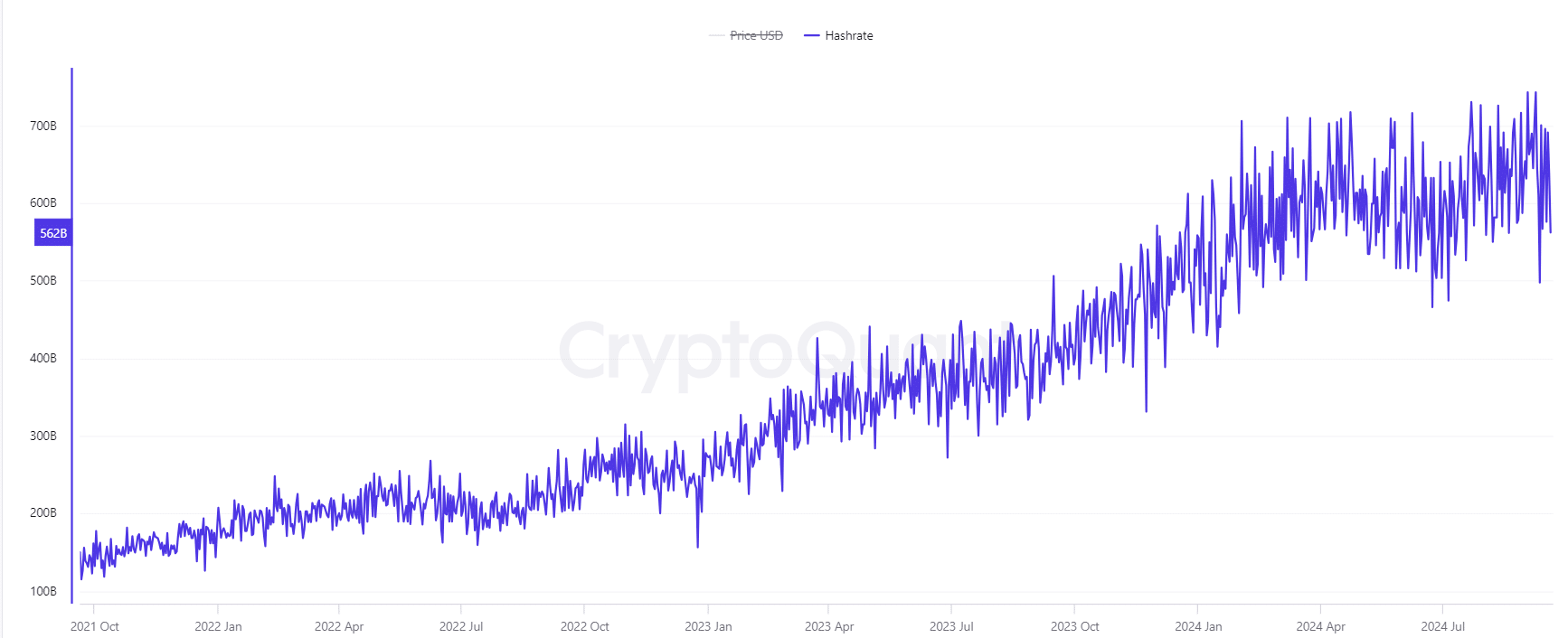

Is Bitcoin’s hash price reflecting rising confidence?

On the time of writing time, the hash price has risen to 562B, displaying a 0.61% enhance previously 24 hours. This metric is essential as a result of the next hash price usually signifies that miners are assured in Bitcoin’s long-term outlook.

When miners make investments extra assets into securing the community, it sometimes correlates with stability or expectations of an upward worth motion.

Do these metrics recommend rising demand?

On-chain exercise remained sturdy. In accordance with CryptoQuant data, the variety of energetic addresses stands at 8.685 million, a 0.91% enhance over the previous day.

Equally, the each day transaction depend has grown by 1.29%, reaching 584,631K.

Each metrics spotlight elevated community exercise, which frequently precedes notable worth actions. Rising transaction quantity signifies rising curiosity and engagement, doubtlessly laying the groundwork for a worth surge.

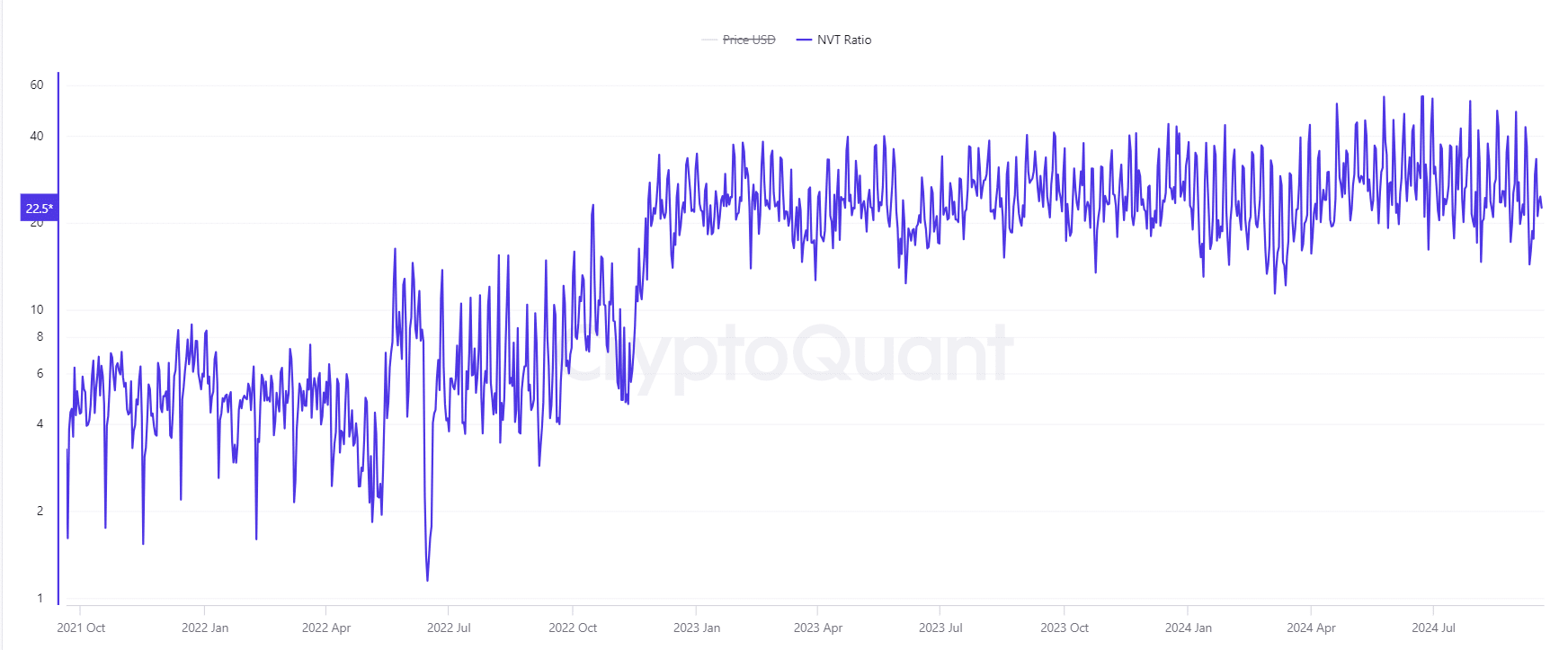

Is Bitcoin undervalued primarily based on the NVT ratio?

Wanting on the NVT ratio, which at present sits at 22.549 (an 8.36% lower), Bitcoin could be undervalued.

The NVT ratio measures the connection between market cap and transaction quantity, and a decrease ratio suggests the community is seeing extra exercise than the value displays.

This imbalance can sign a robust potential for upward worth motion, particularly when paired with constructive on-chain developments.

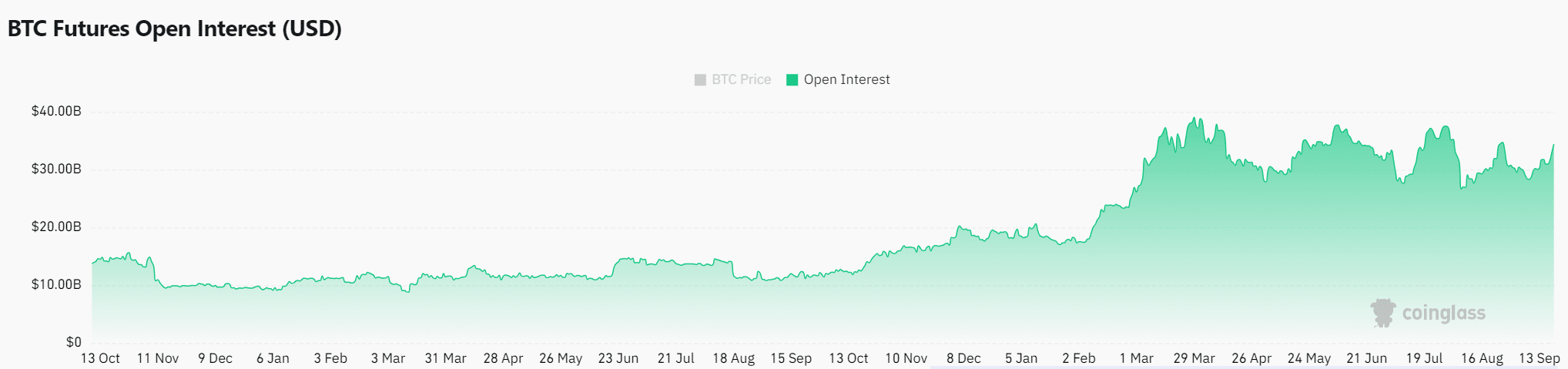

Might the surge in open curiosity set off a worth breakout?

Open curiosity in Bitcoin choices has elevated by 3.86%, reaching $35.38B. Moreover, with Bitcoin buying and selling at $63,402.45, up 1.34% during the last 24 hours at press time, the discount in danger hedging is notable.

When merchants scale back their protecting places, they usually count on much less volatility and a possible worth breakout. This market habits suggests rising optimism for Bitcoin’s worth motion.

Real looking or not, right here’s ETH’s market cap in BTC’s terms

Are new vary highs doubtless?

With a rising hash price, growing on-chain exercise, and a decreased NVT ratio, BTC seems positioned for an upward motion.

The surge in open curiosity, mixed with decreased danger hedging, strongly signifies that new vary highs could also be simply across the nook.

![Security alert [12/19/2016]: Ethereum.org Forums Database Compromised](https://dollar-bitcoin.com/wp-content/uploads/2025/02/1739022293_eth-org-120x86.jpeg)