- BTC will explode after the Fed price lower, in line with Kiyosaki.

- The writer believed cash would flee bonds and different belongings to BTC, gold and silver.

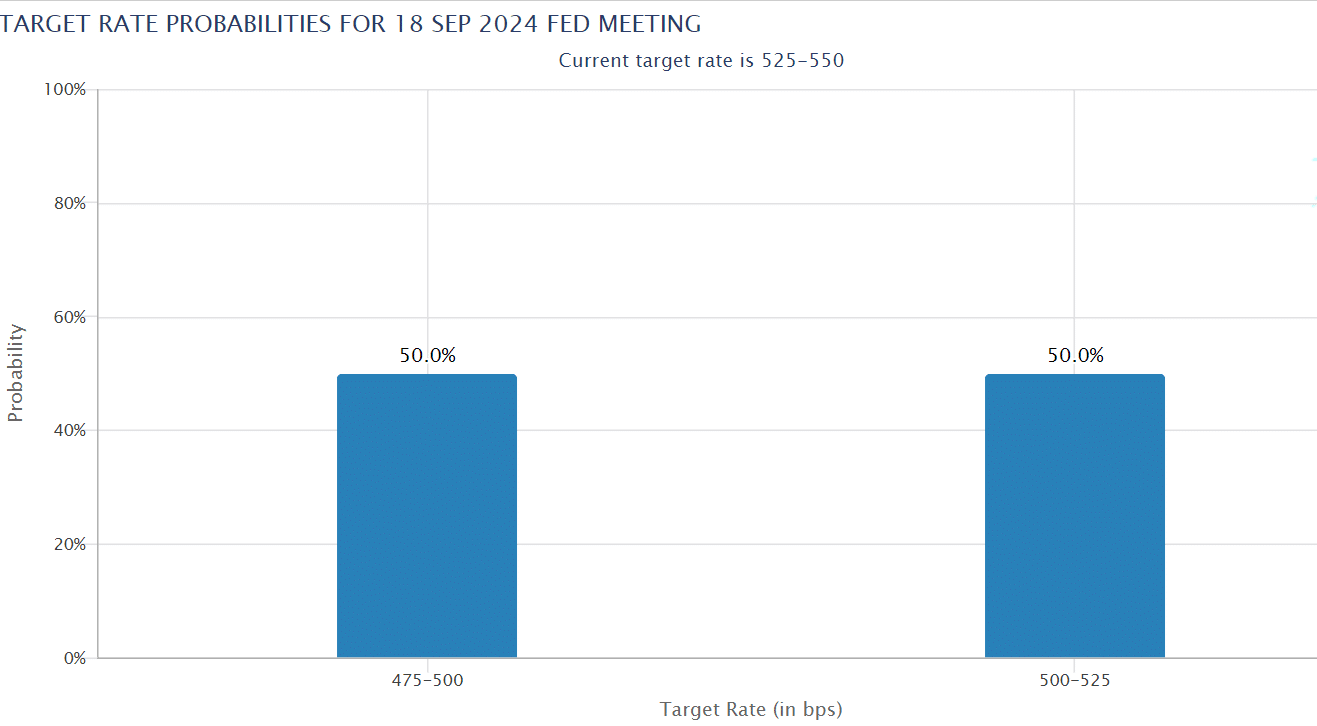

The much-awaited Fed pivot occasion will occur this week, and market pundits have been upbeat currently. The US FOMC (Federal Open Cash Committee) is predicted to start its easing cycle on 18th September.

Based on Robert Kiyosaki, the writer of “Wealthy Dad Poor Dad,” the Fed pivot will profit Bitcoin [BTC] and gold. He said,

‘Bitcoin, gold, silver costs about to EXPLODE…When Fed PIVOTS and actual belongings go up in worth, as faux cash leaves faux belongings equivalent to US bonds, fleeing to actual belongings equivalent to actual property, gold, silver, and Bitcoin.”

Inflation to rally BTC?

Kiyosaki additional urged his followers to purchase extra BTC earlier than the Fed begins its easing cycle.

“Purchase some (extra) gold, silver, or Bitcoin…earlier than the Fed pivots and drops rates of interest.”

This would be the first price lower in 4 years, and market observers may have primed threat belongings for potential wins. Nonetheless, Kiyosaki has beforehand acknowledged BTC and different actual belongings will profit much more due to unsustainable US money owed.

On September thirteenth, Kiyosaki cautioned that the unsustainable US money owed can’t be solved regardless of who wins the US elections. He stated that the greenback was trash and folks have been higher off saving in Bitcoin and gold than the greenback.

“The greenback is trash. Cease saving {dollars}, faux cash….& begin saving gold, silver, & Bitcoin….actual cash.”

Galaxy’s Mike Novogratz echoed an identical sentiment in March. Based on Novogratz, BTC would admire as US money owed proceed to develop at $1 trillion per 100 days.

Briefly, cash inflation will dent the greenback’s worth, forcing customers to hunt alternate options like gold, BTC, or silver. This huge inflation may shortly push BTC to $10 million per coin, noted the writer in a July worth projection.

Within the meantime, BTC was again to $60K after two weeks of struggling under the psychological stage.

After final week’s US financial information, the markets have been pricing a 50/50 probability of a 25/50 bps (foundation level) Fed price lower. How the market will react to the Fed’s pivot within the brief time period stays to be seen.