- Ethereum ETF noticed an outflow of over $20 million.

- ETH has misplaced most of its positive factors from the earlier buying and selling session.

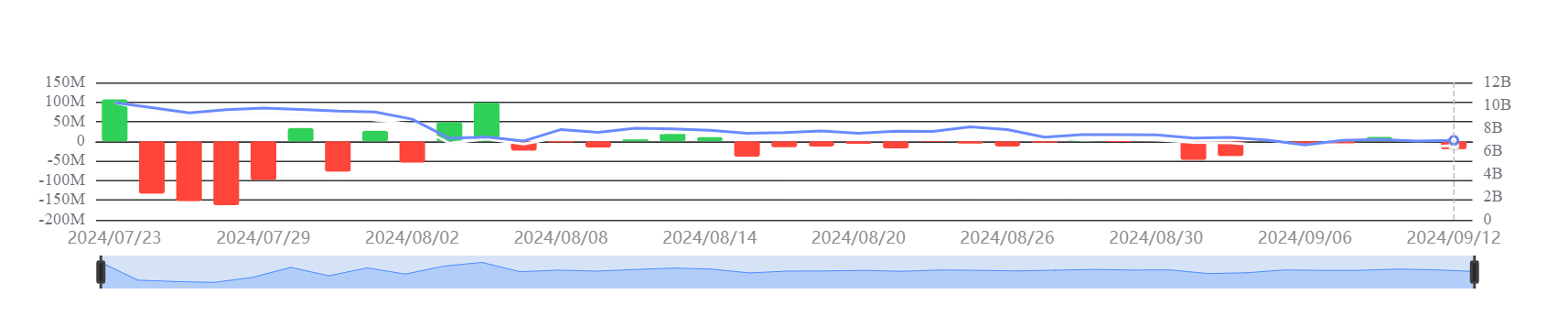

Latest knowledge revealed that the Ethereum ETF skilled a adverse circulation within the final buying and selling session, marking the second consecutive day of outflows.

This occurred regardless of Ethereum’s [ETH] worth displaying a constructive shut, ending its buying and selling session with positive factors.

Ethereum ETF see a consecutive outflow

In line with knowledge from Sosovalue, Ethereum ETF skilled one other day of outflows on the twelfth of September. This marked a continued pattern regardless of ETH closing positively within the earlier buying and selling session.

Moreover, the evaluation revealed that different US-based ETFs recorded zero internet circulation, aside from Grayscale, which noticed an outflow of $20.14 million. As of this writing, the general internet asset worth is round $6.45 billion.

The ETF outflows might point out buyers taking income or reallocating funds, at the same time as Ethereum’s worth trended positively.

This sample urged that whereas there could also be some short-term repositioning amongst institutional buyers, retail and direct market demand for Ethereum may nonetheless be sturdy, permitting for worth stability or progress regardless of the ETF outflows.

ETH caught between revenue and loss

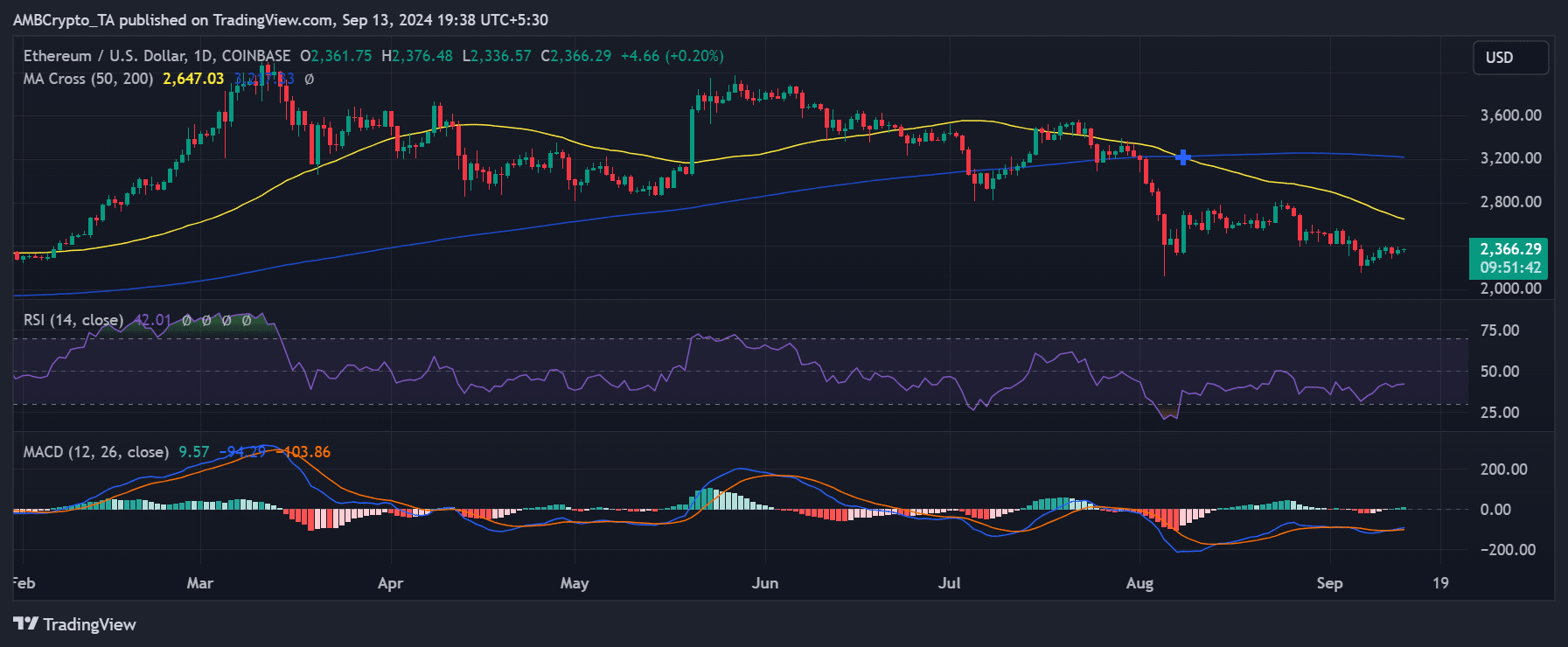

AMBCrypto’s evaluation of Ethereum’s each day worth chart confirmed that ETH closed the final buying and selling session with a virtually 1% improve, bringing its worth to round $2,361.

Nevertheless, as of this writing, the king of altcoins misplaced most of these positive factors, and was buying and selling at roughly $2,350 at press time, reflecting a 0.45% decline.

Additional evaluation indicated that ETH’s worth has been subdued, very similar to the Ethereum ETF circulation tendencies, because it struggled to climb towards the $2,500 worth degree.

The short-moving common (yellow line) has turn out to be a key resistance close to this worth space, with ETH persistently failing to interrupt above it.

This resistance at round $2,500 has held agency, making it a big hurdle for Ethereum’s worth momentum.

Holders proceed accumulation

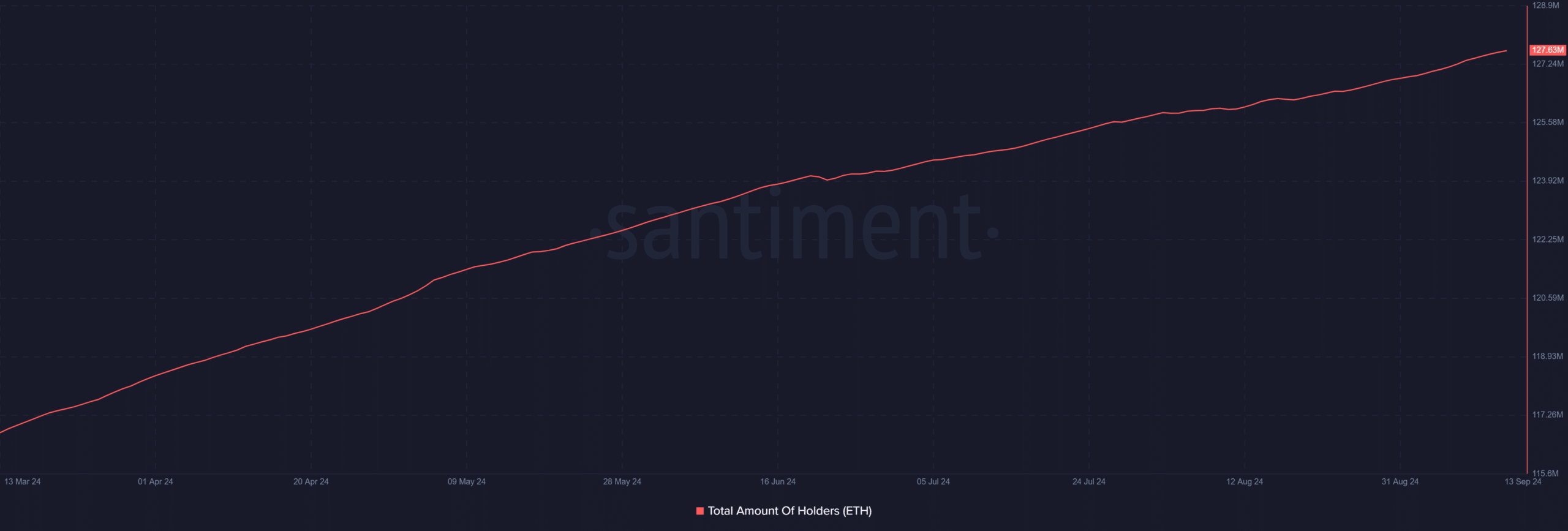

An evaluation of the Ethereum holders’ chart revealed that the variety of ETH holders continued to develop regardless of the latest Ethereum ETF outflow tendencies.

As of this writing, the variety of holders surpassed 127 million, displaying a constant upward pattern.

Learn Ethereum’s [ETH] Price Prediction 2024-25

This indicated that the variety of addresses with non-zero balances have been growing, suggesting that extra addresses are actively shopping for ETH.

This progress within the variety of holders is seen as a constructive pattern, particularly given the present subdued worth actions and Ethereum’s resistance across the $2,500 degree.