- ETH’s RSI fashioned a bullish divergence on the each day timeframe

- 53.88% of high merchants now maintain lengthy positions, whereas 46.12% maintain brief positions

In mild of the bearish market, Ethereum (ETH), the world’s second-largest cryptocurrency, is being constantly dumped by establishments and whales. This has resulted in notable worth drops on the charts.

In truth, in keeping with a publish on X (Beforehand Twitter), establishments dumped a major 55,035 ETH price $123 million to Binance, through the Asian buying and selling hours.

Establishments offload hundreds of thousands price of ETH

The on-chain analytics platform revealed that the establishments concerned have been Wintermute, a number one algorithmic buying and selling agency, and Metalpha a digital asset supervisor.

Collectively, they dumped 46,947 ETH price $104.74 million and eight,088.8 ETH price $18.05 million, respectively, in simply two hours. This important dump has the potential to influence the altcoin’s worth.

Potential motive behind the current dump

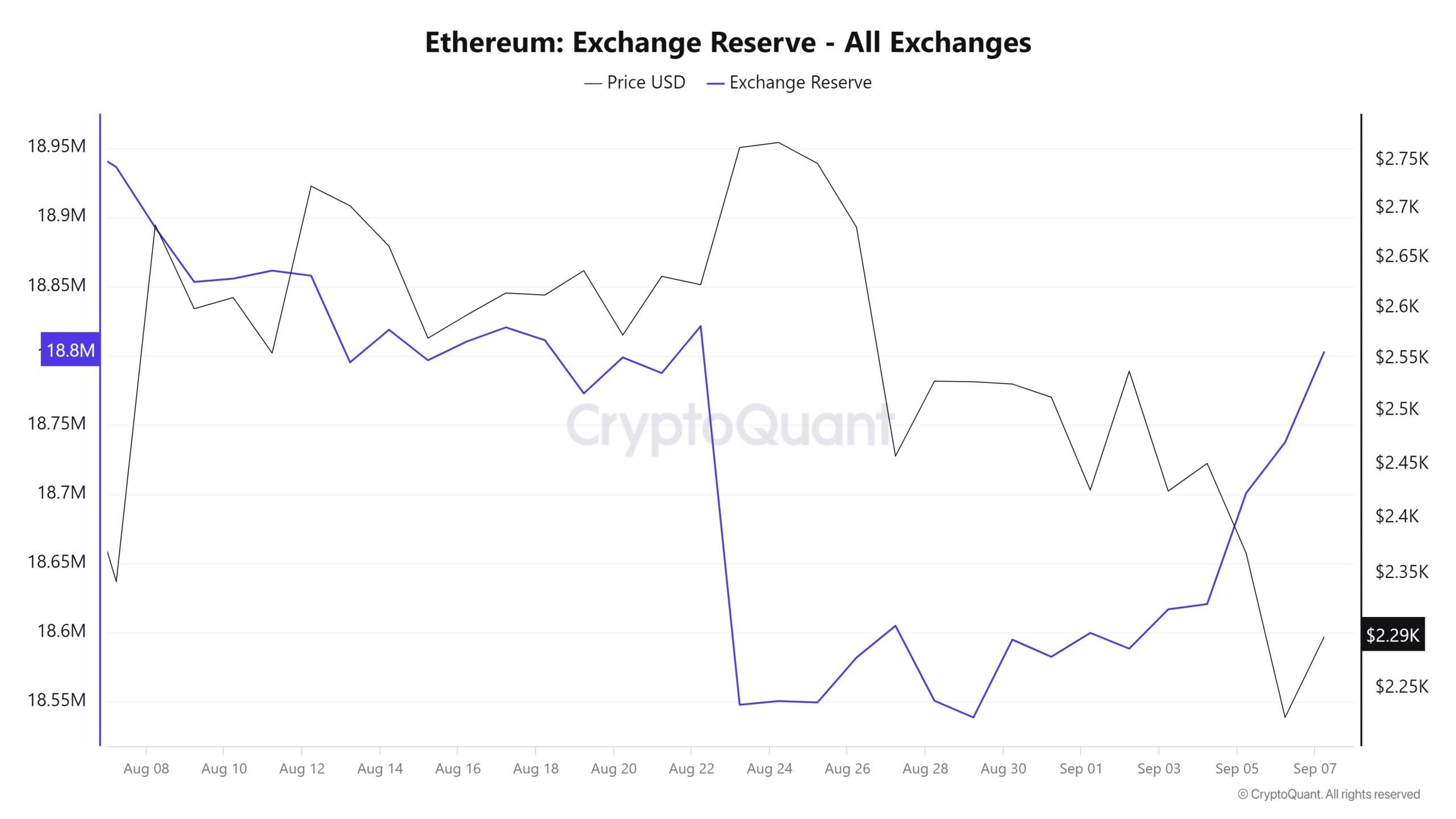

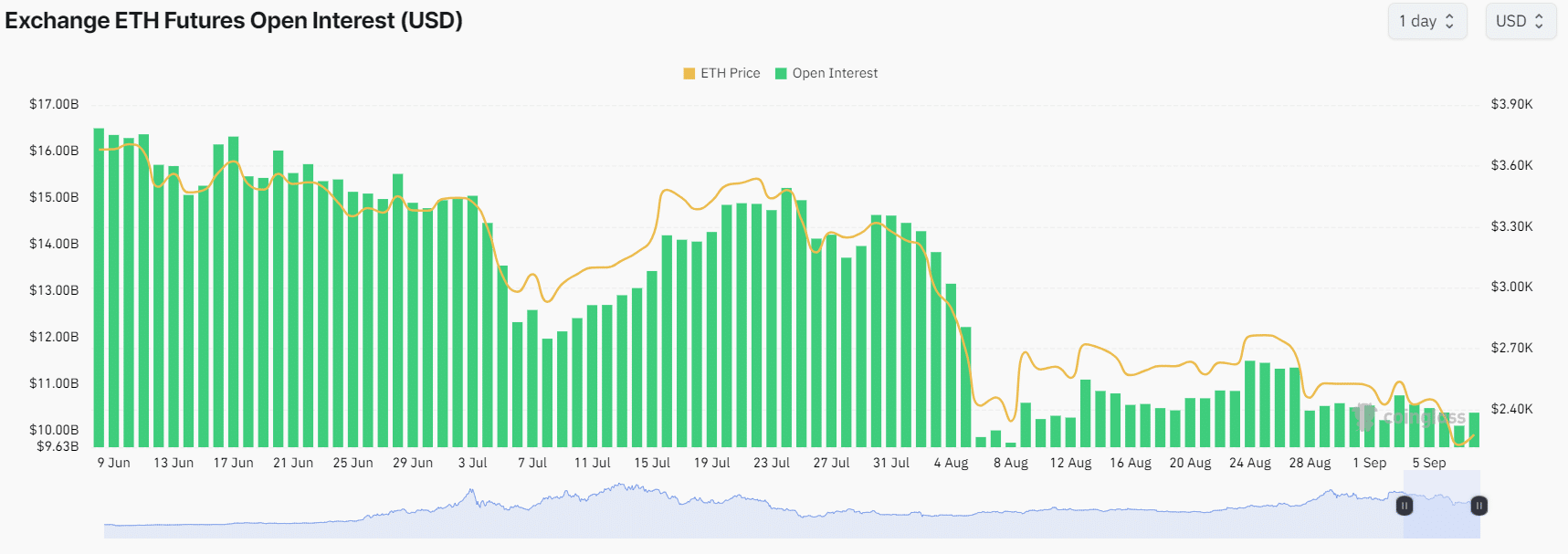

The potential causes behind this dump are the continuing bearish market sentiment, the sustained rise in alternate ETH reserves, and the decline in Futures Open Curiosity for 3 consecutive months.

In response to CryptoQuant, Ethereum alternate reserves have been constantly rising since 28 August. Which means both whales, buyers, or establishments could also be shifting their property to exchanges for a possible sell-off.

CoinGlass’s alternate Futures Open Curiosity has been constantly falling too. This underlined both the liquidation of lengthy positions or the expiry of Futures contracts, with no new positions being constructed.

Right here, it’s price declaring that September is usually thought-about a bearish month or a interval of worth correction for cryptocurrencies, earlier than doubtlessly skyrocketing in October.

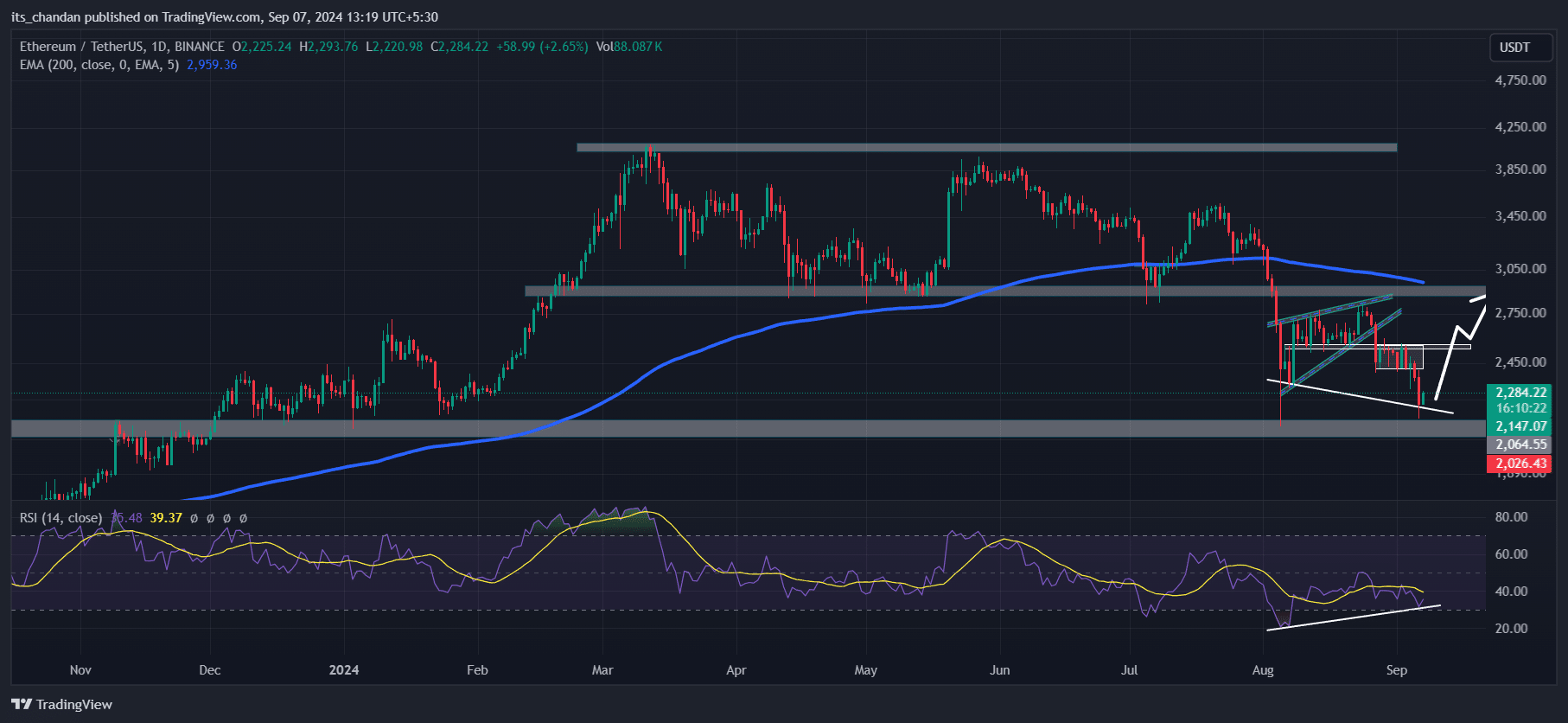

Ethereum technical evaluation and key ranges

In response to a have a look at the worth charts, Ethereum has retested its essential assist degree of $2,140. Since late 2023, this degree has acted as robust assist for ETH.

Nonetheless, ETH’s Relative Power Index (RSI) fashioned a bullish divergence on the each day time-frame, pointing to a development reversal.

Owing to the current retest of assist and the formation of a bullish divergence, there’s now a excessive chance that ETH’s worth may soar by 25% or 30% to $2,500 or $2,550.

Bullish outlook by on-chain metrics

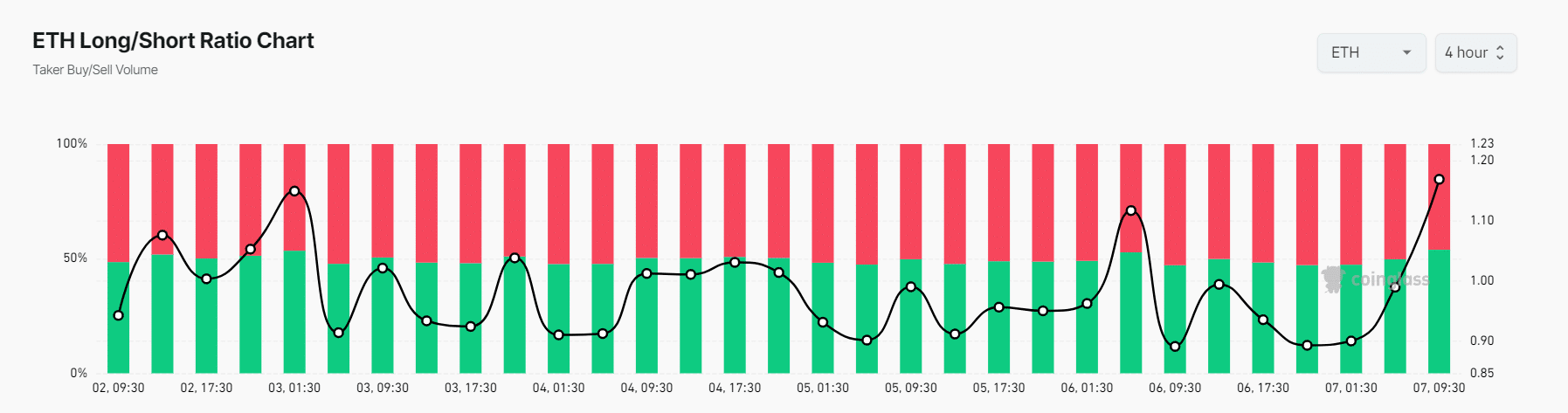

On the shorter timeframe, ETH had some bullish indicators too.

CoinGlass’s ETH Lengthy/Quick ratio, as an example, signaled bullish sentiment. In response to the identical, this ratio on a four-hour time-frame stood at 1.168 at press time (A worth above 1 signifies bullish sentiment).

The info additionally revealed that whereas 53.88% of high merchants held lengthy positions, 46.12% held brief positions.

Additionally, over the identical interval, whole ETH Futures Open Curiosity elevated by 1.80%. This highlighted the participation of merchants as ETH revisited its robust assist degree.

Ethereum’s worth efficiency

At press time, ETH was trading near the $2,280-level, following a decline of two% within the final 24 hours.

In the meantime, its buying and selling quantity over the identical interval skyrocketed by virtually 100%, indicating increased participation from merchants and buyers.