- Bitcoin skilled a notable surge at press time in comparison with earlier day’s shut.

- Are merchants capitalizing on the latest pullback or awaiting an additional worth drop?

Bitcoin [BTC] surged notably up to now 24 hours, but a full worth correction stays elusive because it continues to commerce under the important $60K mark.

As well as, monitoring stablecoin actions is an important barometer for gauging general investor sentiment towards BTC.

With this in thoughts, AMBCrypto analyzed a latest post by CryptoQuant, which indicated a decline in stablecoin inflow.

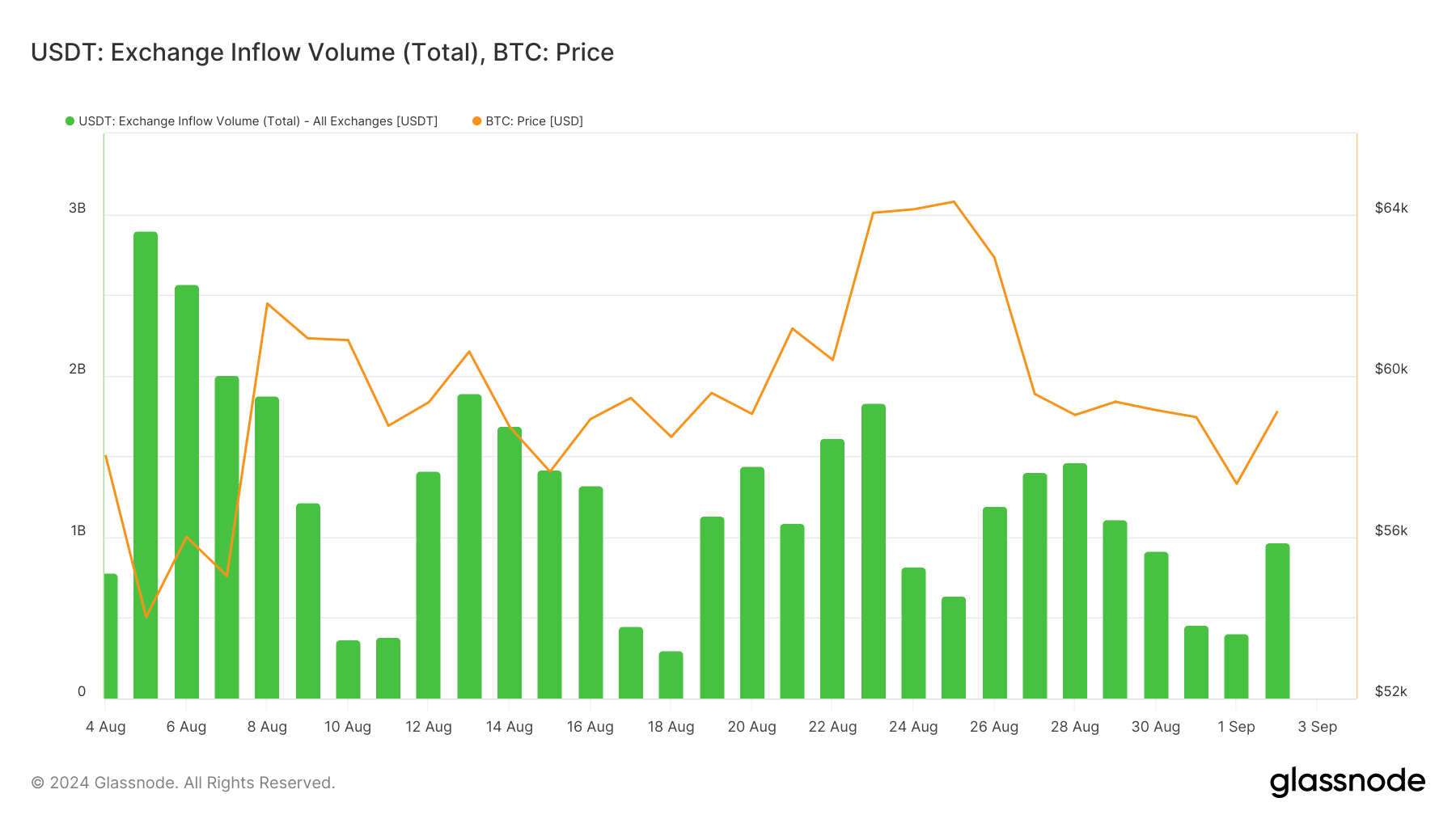

USDT inflow in distinction with BTC’s muted rise

It’s no shock, USDT holds a 70% dominance within the stablecoin market. Consequently, AMBCrypto analyzed latest investor conduct concerning this token.

On the day by day worth chart, Bitcoin began September on a bearish observe, falling about 3% to $57,300 from the day prior to this. Nevertheless, a big upward swing the next day introduced Bitcoin near the $60K threshold.

Surprisingly, the upward swing coincided with USDT inflows doubling from $402 million to $970 million.

Based on AMBCrypto’s evaluation, this indicated renewed optimism amongst stakeholders, as evidenced by the rise in USDT deposits into exchanges.

Furthermore, this inflow might have pushed the latest upward swing, prompting day merchants to purchase the dip.

Usually seen as a bullish sign, this revelation contrasts sharply with the submit talked about earlier.

Consequently, AMBCrypto dug deeper, noting that Bitcoin, regardless of the USDT surge, remained simply 0.21% above the earlier shut of $59,129 at press time.

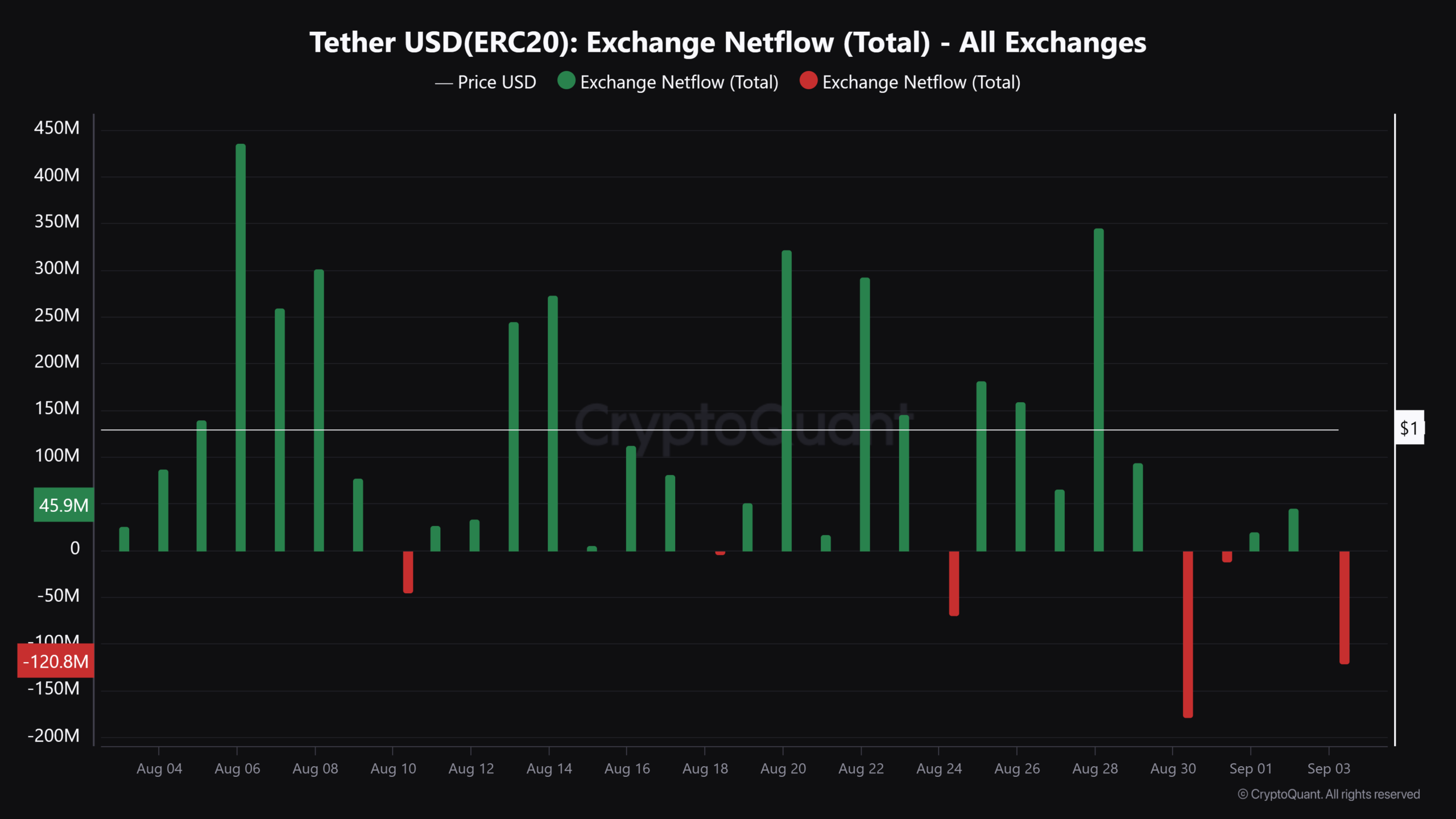

Market warning evident in internet flows

Analyzing internet flows will provide higher perception. Presently, USDT internet move is destructive at $120.8 million, with the buying and selling day nonetheless unfolding.

Actually, this important internet outflow steered rising warning amongst stakeholders.

Based on AMBCrypto’ evaluation of the chart above, 4 days in the past, a considerable $180 million outflow of Tether from exchanges occurred.

Following this, Bitcoin skilled a pointy bearish downturn, with its worth closing at $57,700 – the day’ lowest.

These destructive flows don’t essentially sign outright promoting stress on Bitcoin however do point out warning amongst merchants, who is perhaps utilizing USDT to lock in income or ready for a dip to purchase – So, which one is it?

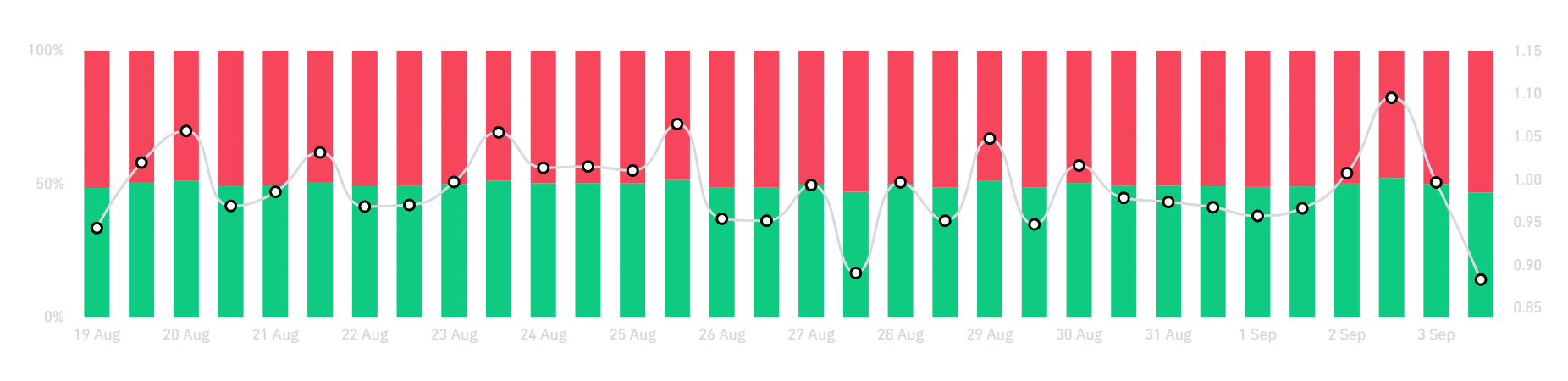

Merchants brace for a deeper drop amid rising BTC warning

AMBCrypto analyzed the chart under to find out if merchants are primarily positioning for a possible decline or holding out for extra revenue.

On the 12-hour chart, a pointy plunge exhibits 46% lengthy versus 54% quick positions.

Merely put, the dominance of quick positions signifies merchants are awaiting a deeper worth drop earlier than contemplating new longs.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Apparently, if the bulls did not intervene, Bitcoin may retrace again to its earlier assist, someplace round $57K, earlier than anticipating a worth correction.

Nevertheless, if the market seems to be extra resilient or if there may be surprising bullish information, this might result in quick squeezes, the place quick sellers are compelled to purchase again their positions, doubtlessly driving Bitcoin previous the $60K ceiling.