- Crypto funding merchandise noticed $305M outflows, with Bitcoin and Ethereum ETFs exhibiting combined tendencies.

- Bitcoin positive aspects post-ETF launch; Ethereum struggles to achieve anticipated value ranges.

Amidst a basic market upswing, with the global crypto market cap rising by 2.79% over the previous 24 hours and most cash gaining over 2%, issues loomed as weekly charts reveal declines exceeded 5%.

Crypto funding merchandise at risk

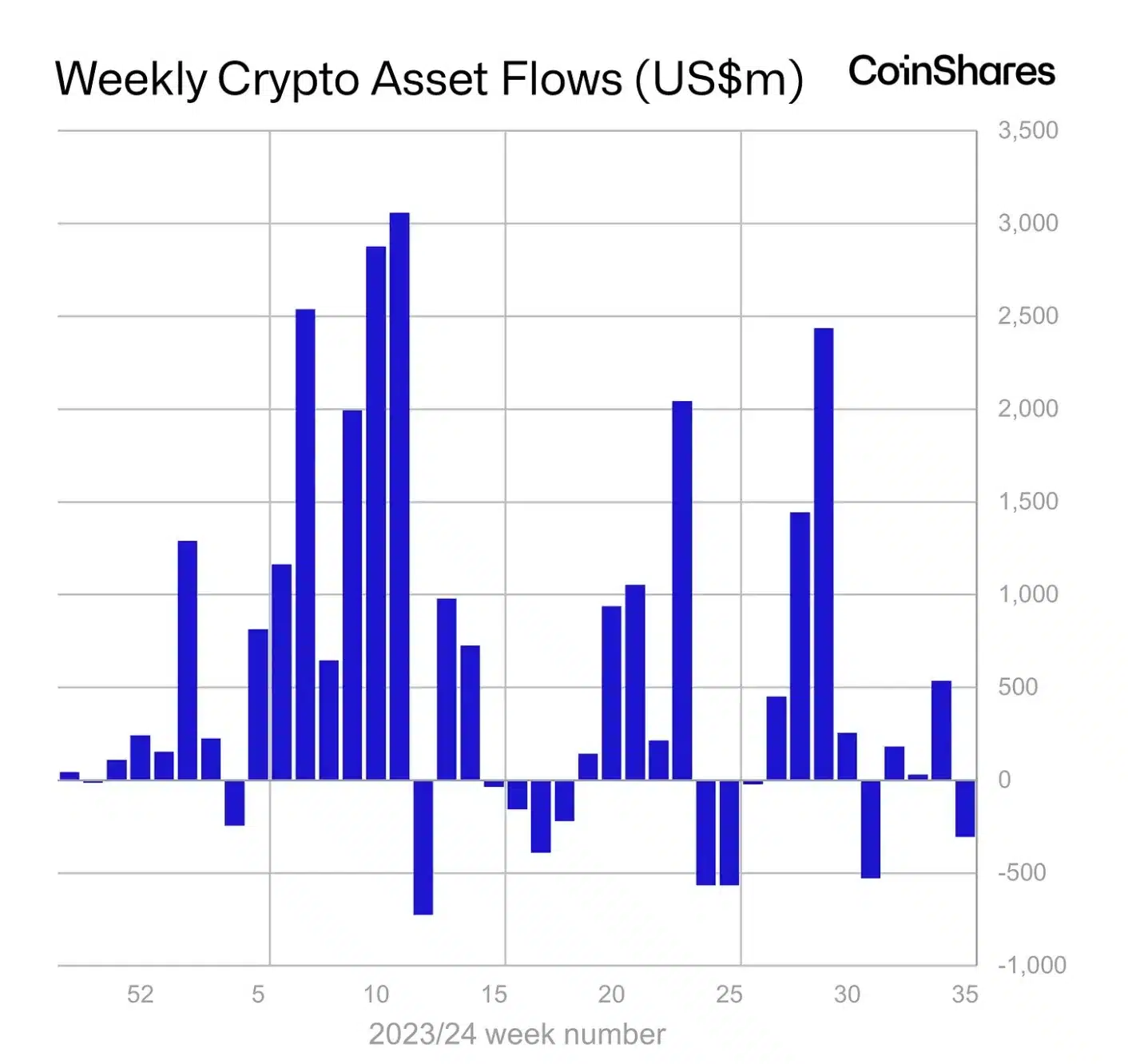

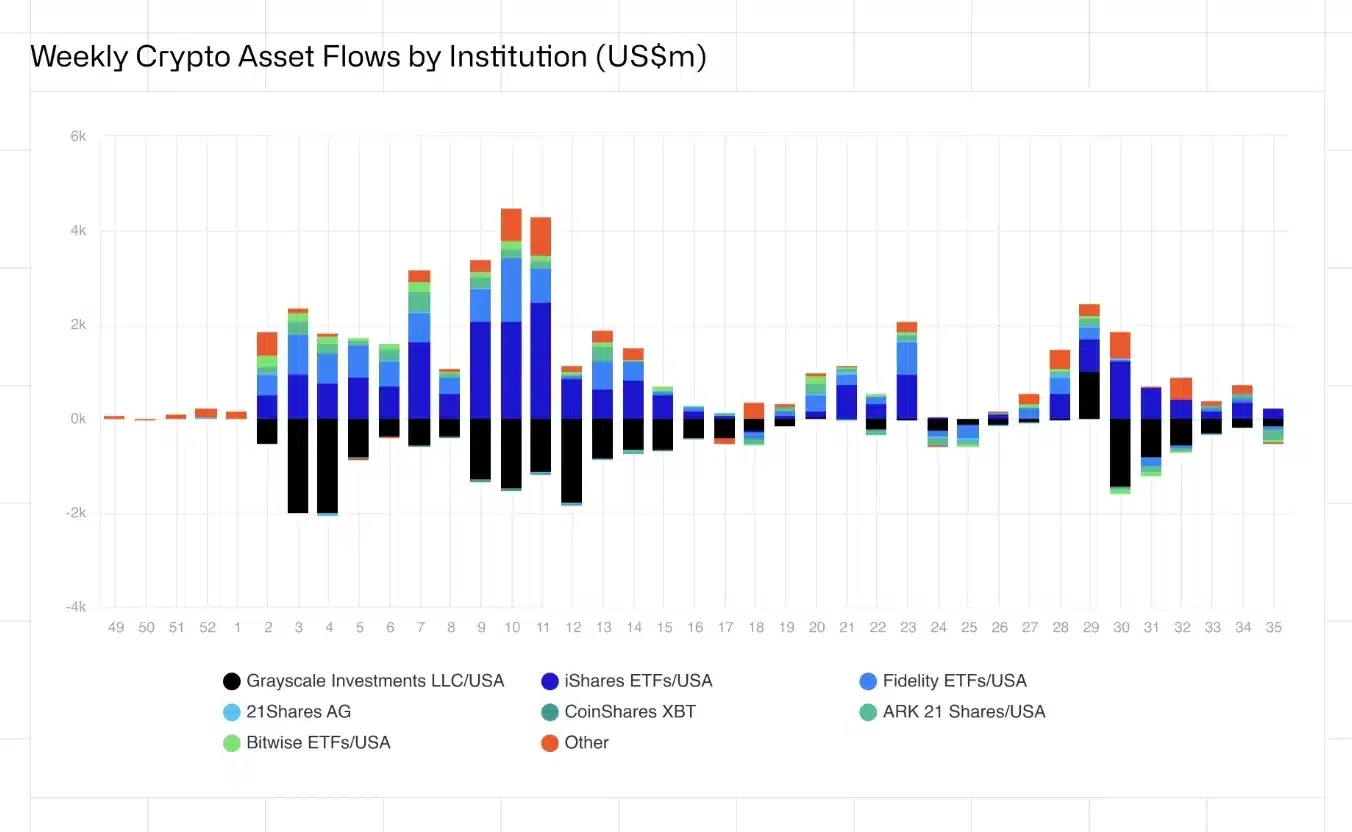

Of larger concern is the numerous outflow from cryptocurrency funding merchandise, with a latest CoinShares report highlighting a complete of $305 million in outflows through the in-between the twenty fourth to the thirty first of August.

This reversal comes after web inflows of $543 million the earlier week, impacting main asset managers like Ark Make investments, Bitwise, BlackRock, Constancy, Grayscale, ProShares, and 21Shares.

As per the report,

“The destructive sentiment was focussed on Bitcoin, seeing US$319m in outflows. Quick bitcoin funding merchandise noticed a second consecutive week of inflows totalling US$4.4m.”

The evaluation additional added,

“Ethereum noticed US$5.7m outflows, whereas buying and selling volumes stagnated, reaching solely 15% of the degrees seen through the US ETF launch week.”

Execs weigh in

Commenting on this sudden streak of outflows, CoinShares’ Head of Analysis, James Butterfill, famous,

“We proceed to count on the asset class to turn into more and more delicate to rate of interest expectations because the Fed will get nearer to a pivot.”

Butterfill defined that the outflows have been triggered by a pervasive destructive sentiment throughout a number of areas and suppliers.

This sentiment was fueled by unexpectedly sturdy financial knowledge from the U.S., which lowered the possibilities of a 50-basis level rate of interest discount.

The disparity between the 2 ETFs

Confirming the identical, the latest knowledge from Farside Investors highlighted a bearish pattern within the Bitcoin [BTC] ETF market, marked by constant outflows from the 26th to the 30th of August.

Conversely, Ethereum [ETH] ETFs have exhibited larger stability.

Regardless of experiencing outflows of $12.6 million throughout the identical interval, ETH ETFs are exhibiting indications of a possible rebound.

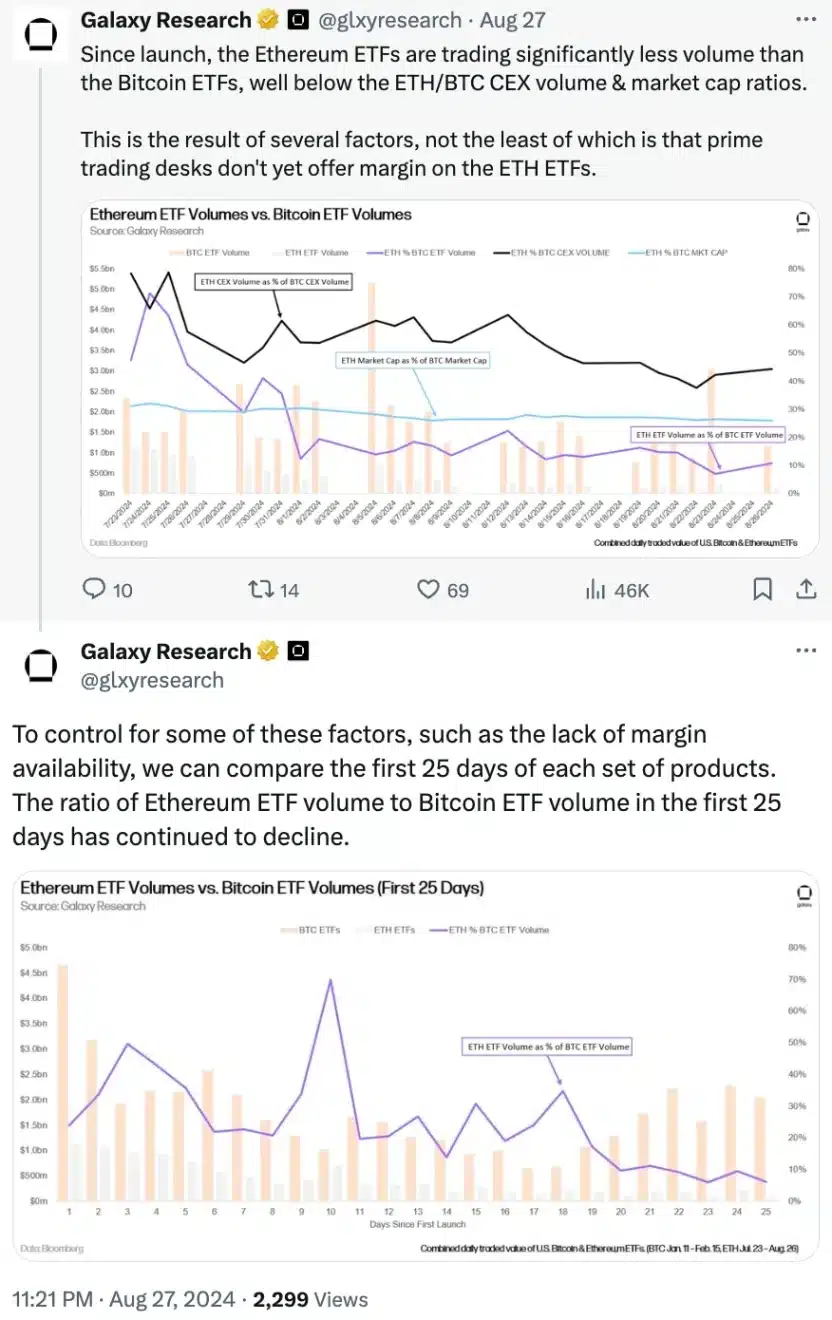

Nevertheless, it nonetheless struggles to compete with Bitcoin ETFs.

Offering insights on the identical, Galaxy Research just lately famous that the decrease buying and selling quantity for Ethereum ETFs in comparison with BTC ETFs is essentially because of the lack of margin buying and selling choices, decreasing their attraction to institutional merchants.

Affect on costs

On the value entrance, each BTC and ETH have been on an upward trajectory, with inexperienced candlesticks showing on the every day chart.

Up to now 24 hours, Bitcoin noticed a rise of 2.22%, whereas Ethereum increased by 2.67%.

Regardless of these positive aspects, BTC and ETH have been buying and selling at $59K and $2.5K, respectively—under expectations following the ETF launch.

It’s vital to notice that after the ETF launch, Bitcoin initially surged previous $70K in March, reflecting a powerful pattern.

Nevertheless, Ethereum has struggled to interrupt the $3K mark, falling wanting the anticipated $4K stage.