Following the Bitcoin worth surge again to $64,000, crypto analyst Rekt Capital is predicting a serious breakout transfer within the coming weeks. In a brand new video evaluation, the analyst forecasts a big market motion round October 2024, based mostly on historic precedents and present chart patterns.

Will October Be Bullish For Bitcoin Once more?

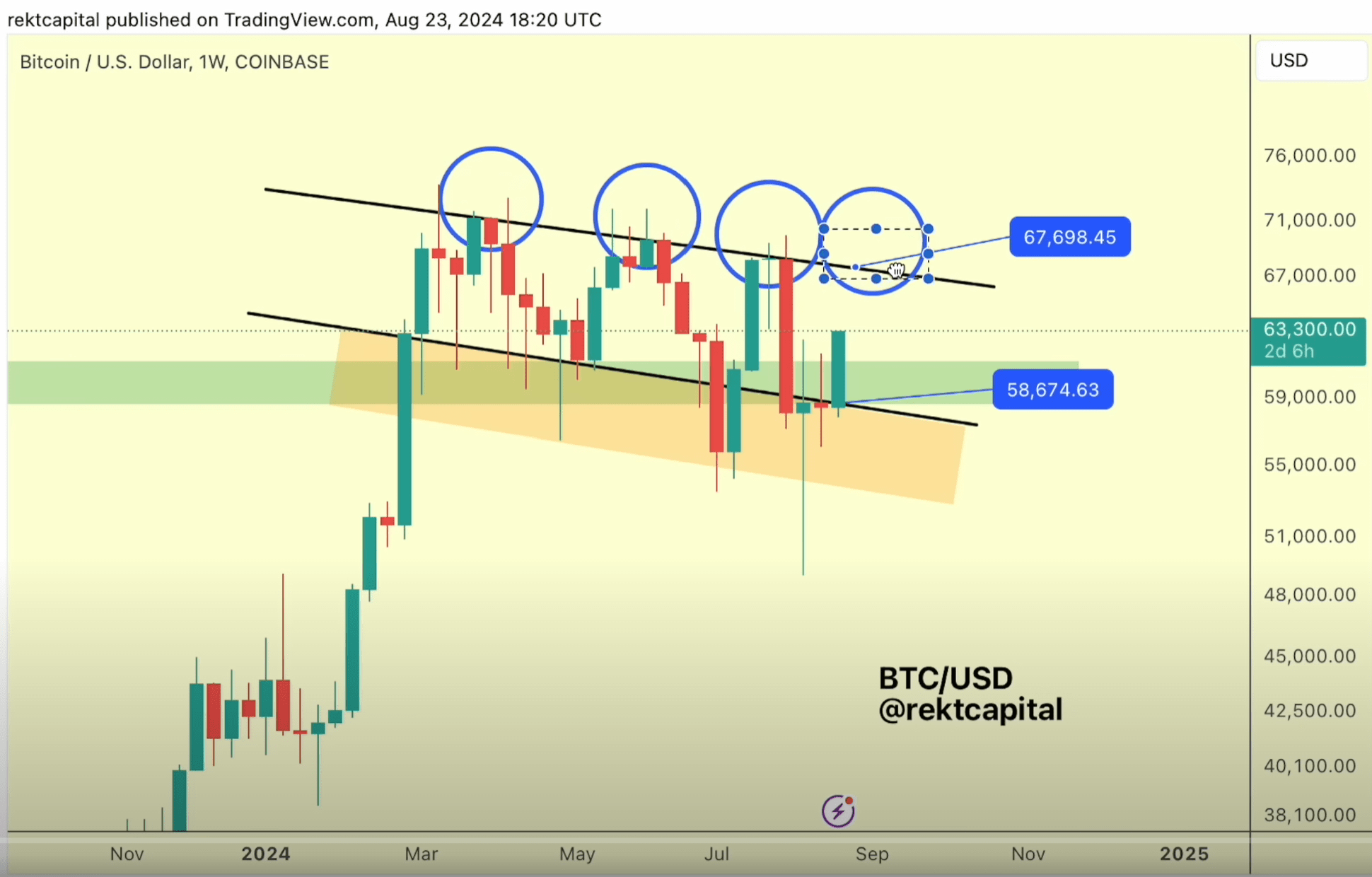

Wanting on the weekly chart, Rekt Capital identifies a downtrending channel. Over the previous 4 weeks, BTC has been deviating under this channel, looking for assist that will allow a worth enlargement above the channel’s backside. This motion has been met with a “incredible restoration,” signaling potential for a return to the channel prime at round $67,000 within the coming weeks.

“The channel backside rebound is essential because it has traditionally taken worth from the channel backside to the highest in roughly two weeks on common,” Rekt Capital defined. He highlighted the significance of weekly candle closes above particular ranges, significantly at $67,500 and finally at $71,500, which might mark a break from the reaccumulation vary excessive established post-halving.

Associated Studying

“The constant sample of bouncing from the channel backside to the highest sometimes spans a median of two weeks, however within the present context, we’re observing a probably elongated consolidation section at these decrease ranges,” defined Rekt Capital. This remark means that whereas the rebound trajectory follows historical patterns, the consolidation at decrease costs may afford buyers cut price shopping for alternatives.

Specializing in the technical thresholds, Rekt Capital emphasised the criticality of a number of weekly candle closes above pivotal worth factors. Firstly, a detailed above $66,000 would reconfirm the reaccumulation range’s decrease boundary as a newfound assist, setting the stage for additional upward motion. Extra importantly, a decisive weekly shut above $67,500 would signify a breach of the persistent decrease highs pattern that has dominated since March of this yr.

Associated Studying

“The weekly shut above these particular ranges is just not merely a technical achievement however a psychological victory for market individuals, indicating a weakening of sell-side strain and a regain of bullish momentum,” famous Rekt Capital.

Traditionally, Bitcoin exhibits a bent to provoke main rallies roughly 150 to 160 days following a halving occasion. Drawing parallels from the post-halving periods of 2016 and 2020, the analyst recommended that comparable circumstances are presently forming, with Bitcoin being round 133 days publish the newest halving.

“This cyclical remark aligns nicely with the present market dynamics, the place Bitcoin is methodically testing and, in some circumstances, breaching necessary technical limitations,” he remarked. This comparability is just not solely based mostly on temporal patterns but additionally on the qualitative nature of market conduct throughout these intervals.

A big level of research was the 21-week EMA, a key indicator typically considered the bull market barometer. Rekt Capital highlighted its historic significance, noting, “Deviations under the 21-week EMA in bull markets sometimes supply profitable shopping for alternatives, as seen within the 2021 cycle. Presently, Bitcoin is oscillating round this EMA, offering blended indicators that require vigilant interpretation.”

Wanting forward, the analyst initiatives that for Bitcoin to embark on a brand new parabolic section main to cost discovery and probably new all-time highs, it should first consolidate above the $71,500 degree—representing the reaccumulation vary excessive. This degree has beforehand acted as a formidable resistance, and a weekly shut above it could possible catalyze a serious bullish section.

“Within the coming weeks, the market’s means to uphold these vital helps and break by resistance ranges with conviction will probably be paramount. This can decide the feasibility of a breakout aligning with historic patterns noticed post-halving,” Rekt Capital concluded, suggesting that October might be pivotal for Bitcoin’s trajectory.

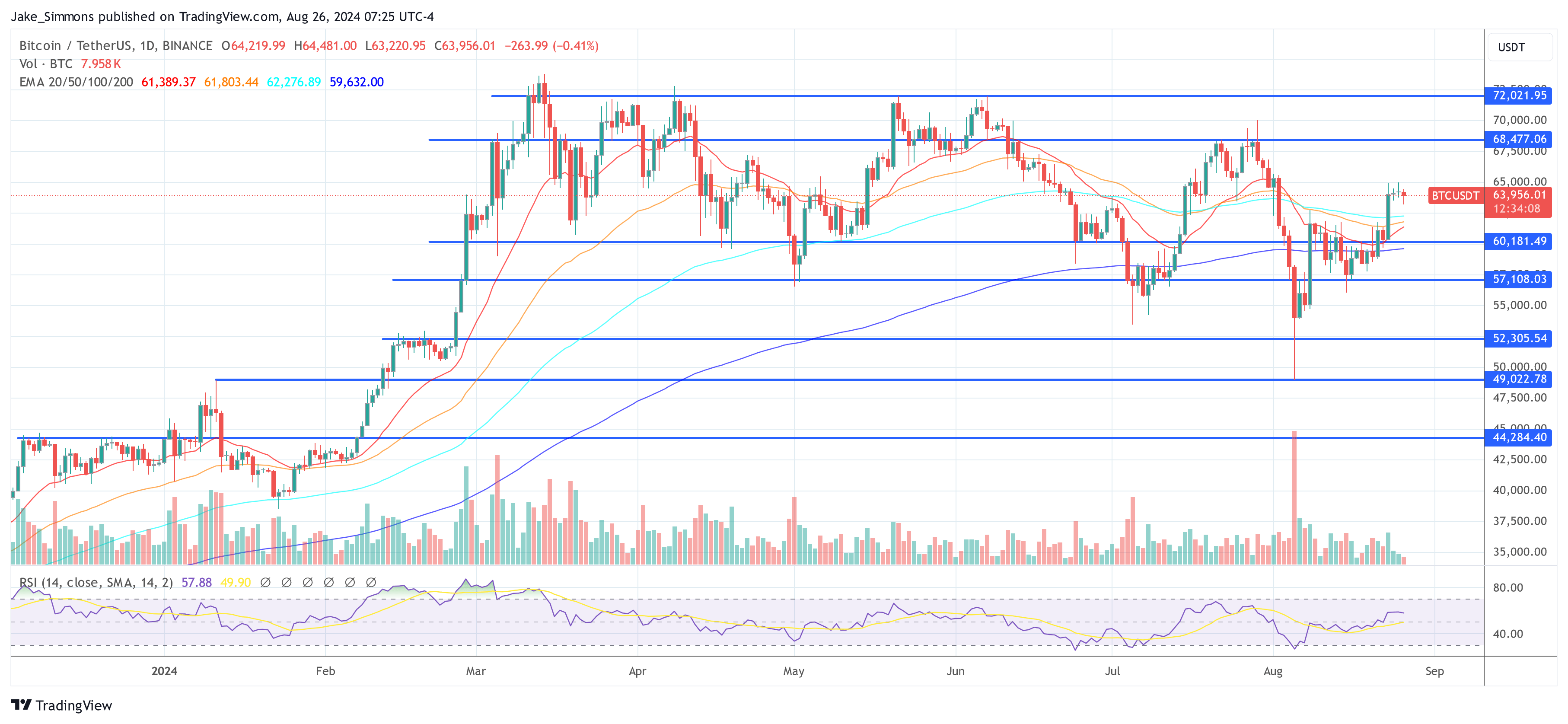

At press time, BTC traded at $63,956.

Featured picture created with DALL.E, chart from TradingView.com