- Bitcoin millionaires surged by 111% in 2024, pushed by new ETFs and Bitcoin highs

- Prime crypto hubs like Singapore and Hong Kong benefited from favorable tax insurance policies

Regardless of the latest dip within the cryptocurrency market, a dip accelerated by Bitcoin [BTC] falling below $60k on 28 August, there stays a silver lining. This, due to Bitcoin’s stellar efficiency for many of 2024.

Crypto wealth report analyzed

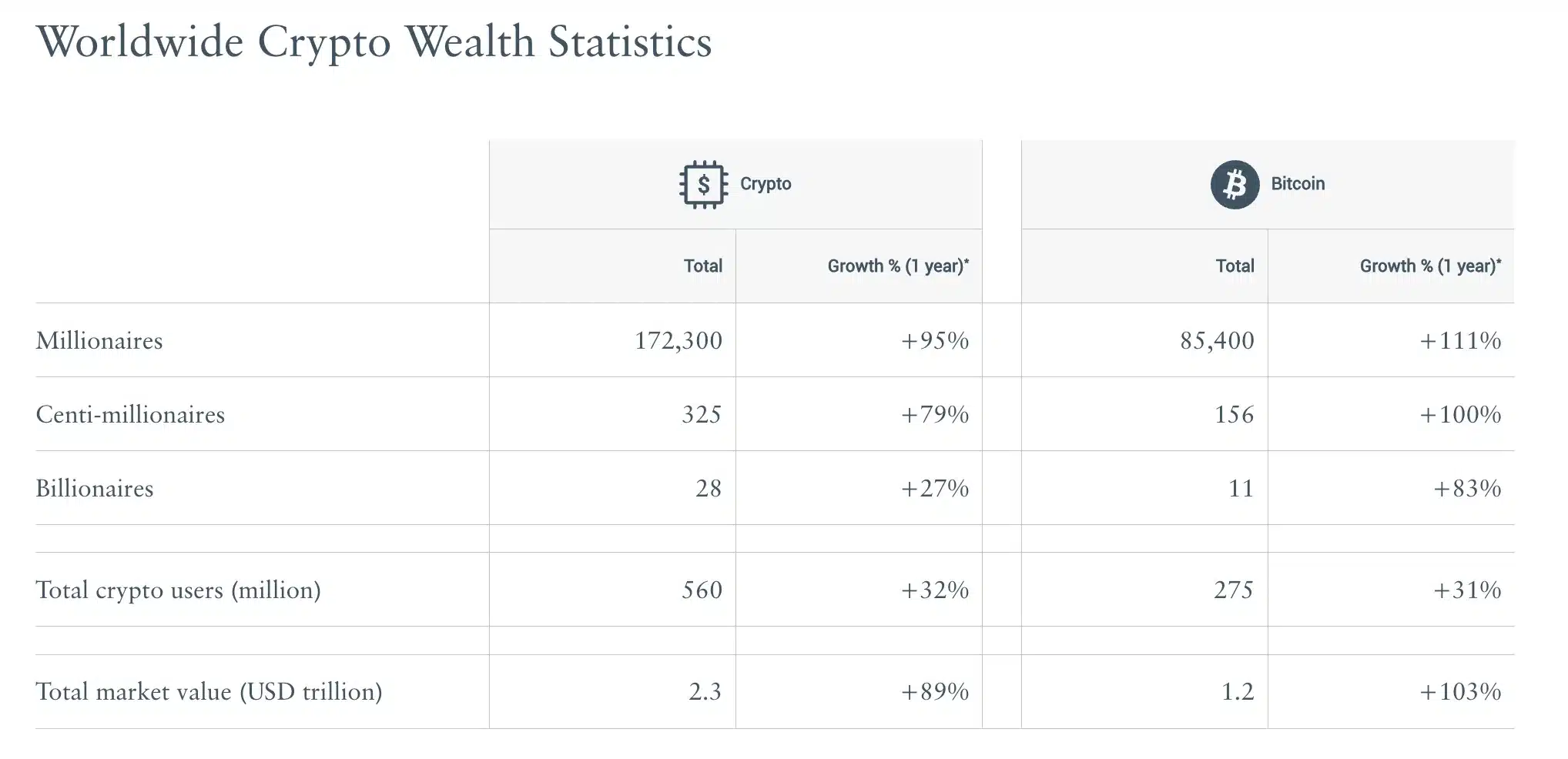

In response to “The Crypto Wealth Report 2024” by New World Wealth and Henley & Companions, the variety of BTC millionaires climbed by 111% over the previous 12 months. In truth, figures for a similar are actually as excessive as 85,400.

In tandem, the general variety of crypto millionaires has additionally seen a big uptick, climbing to 172,300, up from 88,200 final 12 months.

The hike in crypto millionaires might be attributed to the introduction of newly accredited spot ETFs within the U.S., which propelled Bitcoin to new heights in 2024.

After reaching an all-time excessive of over $73,000 in March, Bitcoin quickly settled round $64,000 – Marking a forty five% improve regardless of some retracement. Later nonetheless, BTC would fall even additional on the charts.

Over the previous 12 months, BTC’s worth has soared by 138%. The launch of those ETFs has been significantly impactful, amassing over $50 billion in property since January, following a prolonged battle for approval from the Securities and Change Fee.

Execs weigh in…

Remarking on the identical, Dominic Volek, Group Head of Non-public Shoppers at Henley & Companions mentioned,

“The cryptocurrency panorama of 2024 bears little resemblance to its predecessors. Bitcoin’s rise to over USD 73,000 in March set a brand new all-time excessive, whereas the long-awaited approval of spot Bitcoin and Ethereum ETFs within the USA unleashed a torrent of institutional capital. Anticipation now builds for potential Solana ETFs becoming a member of the Wall Avenue occasion.”

He added,

“These milestones have seeded a brand new period of crypto adoption, one the place digital property more and more cross-pollinate with conventional finance and international mobility.”

António Henriques, CEO of Bison Financial institution and Chairman of Bison Digital Property, additionally identified,

“Within the quickly evolving world of finance, cryptocurrencies are difficult the dominance of conventional fiat currencies. As these two monetary realms intersect, we’re witnessing the daybreak of a brand new period in international finance, the place the progressive potential of digital property meets the steadiness of conventional cash.”

What this implies is that regardless of short-term fluctuations, many nonetheless strongly consider within the potential of Bitcoin and different crypto property.

As Michael Saylor, former CEO of MicroStrategy, aptly put it,

“#Bitcoin is Guidelines With out Rulers.”

Nation-states step up their crypto recreation

Lastly, the report additionally revealed that Singapore tops the worldwide cryptocurrency hub index with a rating of 45.7 out of 60, adopted by Hong Kong and the UAE.

All three excel resulting from their favorable tax insurance policies, notably their exemption from capital positive aspects tax. This advantages crypto traders and high-net-worth people.

That’s not all although. Only recently, El Salvador’s Bitcoin reserves grew to five,851 BTC, price about $356.4 million.

In the meantime, Russia has shared plans that it’s going to begin trials for crypto exchanges and cross-border transactions from 1st September 2024.

This can be a signal of the persistent perception in Bitcoin’s potential, regardless of short-term market fluctuations.