- BTC’s long-term MVRV was under 6% at press time.

- BTC would possibly see capitulation or accumulation quickly, primarily based on the response of holders.

Regardless of Bitcoin’s [BTC] comparatively secure worth in current months, key on-chain metrics recommended underlying challenges that would influence the market.

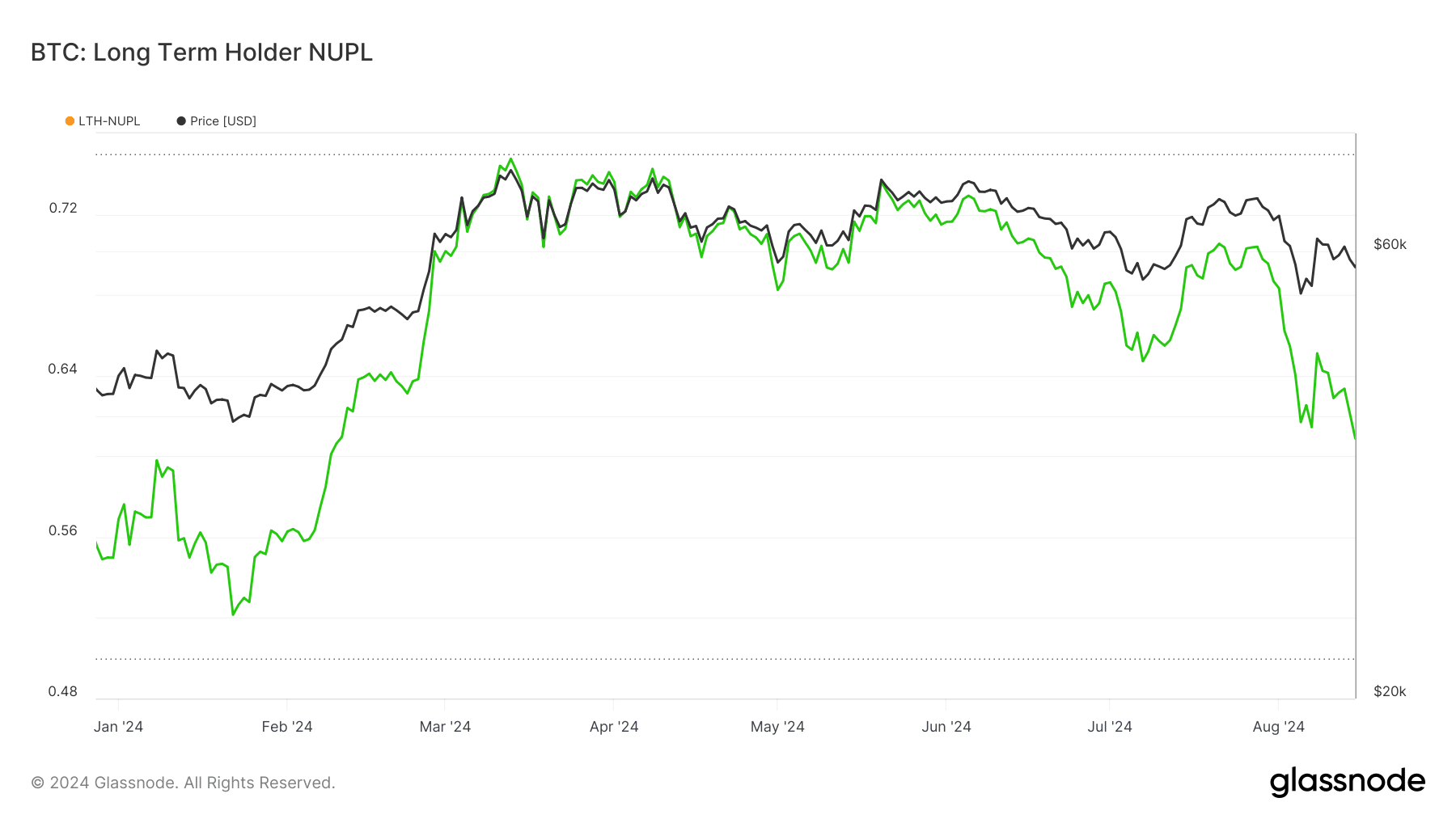

One regarding indicator is the Lengthy Time period Holder Internet Unrealized Revenue/Loss (LTH-NUPL).

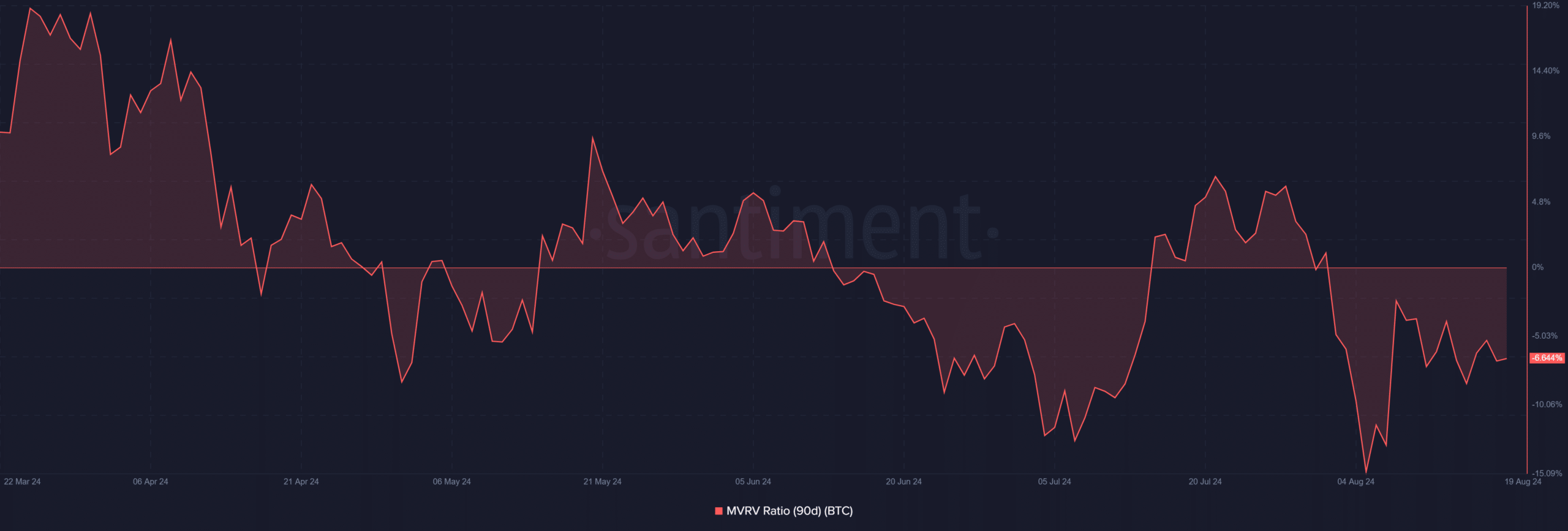

Moreover, the long-term Market Worth to Realized Worth (MVRV) ratio has remained under zero for the previous a number of weeks.

Declining Bitcoin profitability

An evaluation of the Lengthy-Time period Holder Internet Unrealized Revenue/Loss (LTH-NUPL) on Glassnode revealed that long-term Bitcoin holders have been experiencing a big decline in profitability at press time.

This development may very well be a vital indicator of the market’s future path.

Round March 2024, Bitcoin’s worth and the LTH-NUPL peaked, signaling that many long-term holders have been sitting on substantial unrealized income.

Nonetheless, following this peak, each the value and LTH-NUPL started to say no, suggesting that the market could have seen appreciable profit-taking.

From June to August 2024, the LTH-NUPL continued to say no, intently mirroring BTC’s downward worth development.

As of August 2024, the LTH-NUPL is positioned on the decrease finish of the spectrum, indicating that many long-term holders’ income have considerably diminished.

What this might imply for Bitcoin

This example might recommend that the market is approaching a vital juncture. It may very well be nearing a degree of capitulation, the place holders could begin promoting off their holdings to keep away from additional losses.

Additionally, it may very well be approaching a possible backside, the place new accumulation might happen as buyers search shopping for alternatives.

The LTH-NUPL particularly measures the unrealized revenue or lack of long-term Bitcoin holders.

A excessive NUPL worth signifies that almost all of the cash held by this group are in revenue, probably resulting in profit-taking and a market correction.

Conversely, a low or destructive NUPL worth implies that extra cash are held at a loss, which might result in capitulation or current a shopping for alternative for buyers.

LTH’s income sinks

AMBCrypto’s evaluation of Bitcoin’s 90-day Market Worth to Realized Worth (MVRV) revealed that long-term holders have been holding at a loss on the time of writing.

The development reinforces the findings from the Lengthy-Time period Holder Internet Unrealized Revenue/Loss (LTH-NUPL) evaluation.

Additionally, the 90-day MVRV has been under zero since 1st August, and as of this writing, it stood at roughly -6.6%.

This indicated that buyers who purchased Bitcoin throughout this era have been holding a mean lack of over 6%.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The persistent destructive MVRV means that long-term holders have been experiencing monetary strain, which might affect their decision-making within the close to time period.

This development is essential as a result of how these holders react—whether or not by promoting off their holdings to attenuate losses or by holding on in anticipation of a market restoration—will considerably influence Bitcoin’s worth path.