- Is China ready for US FED’s charges resolution earlier than pumping the liquidity machine?

- Liquidity to drive market rallies for BTC and altcoins

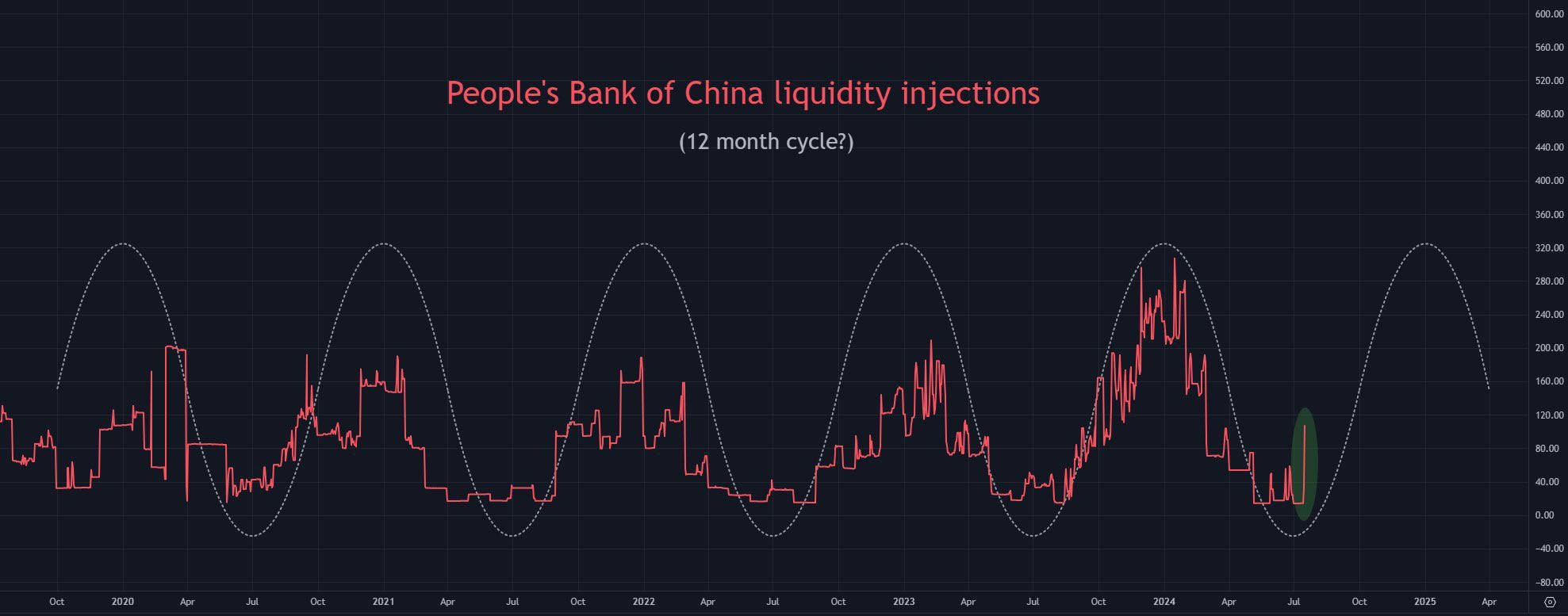

China is poised to inject important liquidity into its financial system, which may increase Bitcoin [BTC] and different cryptocurrencies as cited by X consumer and market analyst Quinten.

Historic patterns present that the Individuals’s Financial institution of China typically will increase liquidity in August, with earlier injections occurring on eleventh August in 2020, thirty first August in 2021, and 2022, and twenty eighth August in 2023.

Though there was a quick liquidity increase in June, there was little exercise since.

China is likely to be ready for the Federal Reserve to chop charges, presumably on 18th September, earlier than ramping up its liquidity efforts. This transfer may elevate world liquidity.

Historic post-halving BTC consolidation in play

The crypto market stays bullish regardless of latest dips, proving flawed those that predicted a bear market.

Bitcoin is at the moment in its typical post-halving consolidation section, which regularly precedes a big bull run. Mixed with China’s anticipated liquidity injection, the market is poised for a possible explosion.

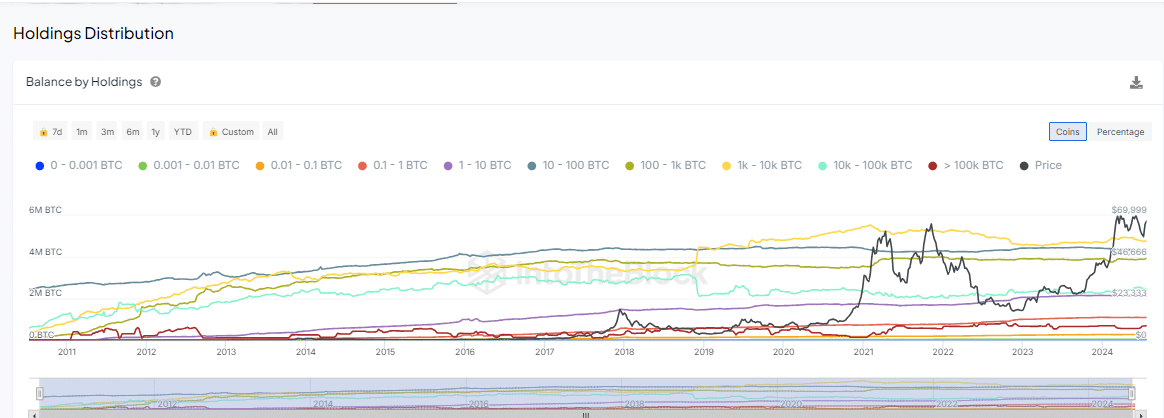

Analyzing BTC handle holdings on IntoTheBlock exhibits little motion, suggesting accumulation.

This section sometimes comes earlier than important market surges, because it displays a interval the place merchants and traders are inserting orders.

The present accumulation hints at a possible rise in BTC and different cryptocurrency costs, pushed by anticipated enhance in liquidity.

BTC’s double backside types under the day by day 200 EMA

The BTC value chart exhibits a double backside under the day by day 200 EMA, a sample typically signaling a market rally.

That is bolstered by a retest of the decrease Gaussian channel band, coinciding with the day by day 200 EMA.

These sturdy indicators recommend BTC is poised to rise quickly, particularly with the added increase from China’s liquidity injections.

Huge weekly candle for your complete market

Moreover, anticipated liquidity increase has created a powerful bullish sign with a big weekly candle and a big rejection wick.

This implies a possible surge in Bitcoin, Ethereum and altcoins within the coming weeks. Help ranges on larger time-frames are additionally displaying sturdy shopping for curiosity, reinforcing the expectation of a market rise.