Blur, a decentralized non-fungible token (NFT) market, and OpenSea competitor is below stress, tumbling by over 30% from its November peaks. Whereas BLUR retreats, on-chain information reveals that BLUR whales have been shifting their tokens to main crypto exchanges, presumably to liquidate.

Whales On A Potential Promoting Spree

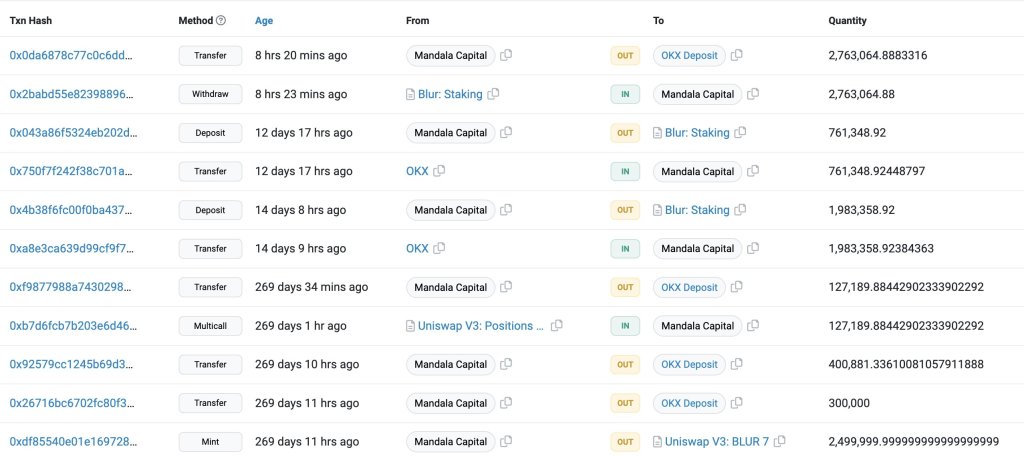

In line with Lookonchain data on December 7, a number of whales have been offloading massive quantities of BLUR. For example, 16.85 million BLUR, price roughly $8.43 million, had been deposited to exchanges previously 24 hours.

Notably, one whale deposited 2.54 million BLUR, price $1.26 million, acquired from the airdrop to Binance. On the similar time, Mandala Capital transferred 2.76 million BLUR, price $1.4 million, to OKX.

The deluge continued as one other whale, solely marked by the related “0x68b5” deal with, withdrew 3.31 million BLUR price $1.79 million from Binance between November 25 and 29 earlier than shifting them to the identical change on December 1. The token had fallen, which means the whale was down by roughly $65,000.

Associated Studying

It’s unclear whether or not the identical addresses are bought for USDT or different tokens. Nevertheless, what’s recognized is that any whale transfers to a centralized change is related to liquidation. Accordingly, sentiment is impacted when whales transfer cash in massive batches to exchanges, and retailers may interpret their transfers as incoming promoting stress.

BLUR Is Up 220% From October Lows

Up to now, value motion, patrons have the lead from a top-down preview. The coin is already up 220% from October lows. Most significantly, patrons have the higher hand, trying on the candlestick association within the day by day chart.

Despite the fact that the token is down 30% from November peaks, the failure of bears to power the coin beneath the 20-day shifting common (MA) within the day by day chart means that the uptrend continues to be legitimate. Losses beneath $0.46, or the bottom of the present bull flag, may set off a sell-off. Conversely, any upswing above $0.58 and even $0.69–or November highs, may drive extra demand, lifting BLUR to $0.84 or increased within the coming classes.

Associated Studying: Binance CEO Disputes JPMorgan Chief’s Critique Of Crypto

Whether or not the uptrend will resume additionally stays to be seen. What’s clear, although, is that the broader neighborhood is intently monitoring the NFT scene and Blur, {the marketplace}. The latest upswing was because of the activation of Season 2 Airdrop, which ended on November 20.

Forward of this, the token was already up 150%, solely to increase good points briefly earlier than cooling off within the first week of December.

Characteristic picture from Canva, chart from TradingView