The Bitcoin (BTC) market was extremely bullish within the final week, with costs leaping by over 10%. Amidst this constructive growth, there was notable investor exercise, which factors to an unyielding demand that would assist a sustained value uptrend.

BTC Provide Shake-Up: Lengthy-Time period Holders Enhance, New Consumers Step In Above $92K

In a latest X post, common crypto pundit Axel Adler Jr. shared some attention-grabbing on-chain insights on the Bitcoin market.

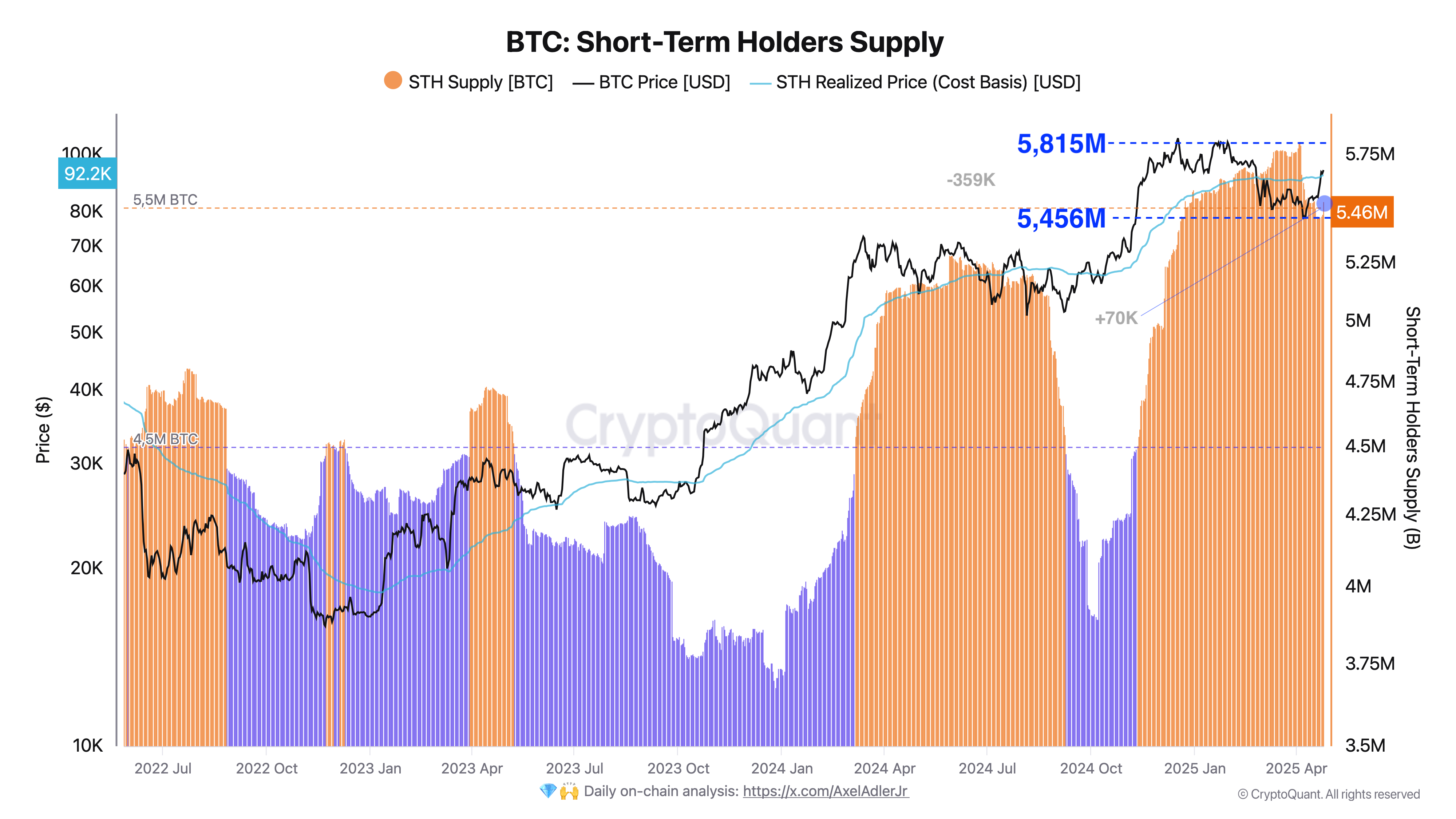

Utilizing knowledge from CryptoQuant, Adler studies that the market provide of short-term holders decreased by 359,000 BTC, valued at $33.84 billion, over 16 days between April 4-21. Apparently, this decline was not because of promoting strain however somewhat coin maturation, leading to a transition to the long-term holders class.

This can be a constructive market sign indicating that holders are assured in Bitcoin’s long-term prospects. By opting towards promoting, holders are strengthening the underlying market demand, offering a strong basis for future value rallies.

In one other attention-grabbing growth, Axel Adler Jr additionally famous that BTC short-term holders’ provide grew by 70,000 BTC, valued at $6.59 billion, within the final two days following Bitcoin’s newest value rally.

The analyst explains that this enhance resulted from profit-taking by long-term holders by way of redistribution as costs climbed. Importantly, short-term holders have successfully absorbed this new provide, signaling robust demand within the Bitcoin market.

This demand is extremely mirrored in Bitcoin’s potential to stay above $92,200, the short-term holders’ price foundation, representing the typical acquisition value for his or her holdings. This means a sturdy market confidence as new consumers are aggressively getting into the market, increasing the STH cohort.

General, the mix of serious coin maturation, wholesome redistribution, and Bitcoin’s resilience above the short-term holders’ price foundation highlights a structurally robust market demand. With long-term holders demonstrating confidence and new demand successfully absorbing provide, BTC seems well-positioned for sustained upward momentum within the close to to mid-term.

Bitcoin Value Overview

On the time of writing, Bitcoin trades at $94,408, reflecting a 0.78% decline within the final day. Nonetheless, every day asset buying and selling quantity is down by 55.53%, suggesting a waning market participation.

Nonetheless, BTC seems set to take care of its value uptrend, having moved previous the major resistance level at $91,000, supported by different bullish developments, together with a revival in ETF inflows totaling roughly $3.06 billion over the previous week.

The subsequent resistance lies at $96,000, shifting previous which may pave the way in which for an extra value rise to round $100,000. Nonetheless, a value rejection may pressure a return to round $92,000, successfully making a range-bound motion.

Featured picture from The Financial Instances, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.